Pottery Barn 2012 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2012 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

relating to any non-business related benefits or perquisites, other than a tax gross-up payment made to

Ms. McCollam with respect to health insurance premiums paid pursuant to her separation agreement.

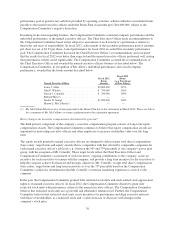

Does the Compensation Committee evaluate the risk of our compensation programs?

In 2012, the Compensation Committee retained Cook & Co to evaluate the risk inherent in the company’s

executive and non-executive programs. Accordingly, Cook & Co. evaluated the company’s executive and non-

executive programs and provided a report to the Compensation Committee. The report concluded that, among

other things:

• The company’s executive compensation program is designed to encourage behaviors aligned with the

long-term interests of stockholders;

• There is appropriate balance in short-term versus long-term pay, cash and equity, recognition of corporate

versus business unit performance, financial and non-financial goals, and formulas and discretion; and

• Policies are in place and being implemented to mitigate compensation risk such as stock ownership

guidelines, insider-trading prohibitions, and independent Compensation Committee oversight.

How does the Compensation Committee address Internal Revenue Code Section 162(m)?

Under Section 162(m) of the Internal Revenue Code of 1986, as amended, and regulations adopted under it by

the Internal Revenue Service, publicly held companies may be precluded from deducting certain compensation

paid to certain executive officers in excess of $1,000,000 per taxable year. The regulations exclude from this

limit various forms of performance-based compensation, stock-settled stock appreciation rights and stock

options, provided certain requirements, such as stockholder approval, are satisfied. The company believes that

awards granted under the company’s equity incentive plans qualify as performance-based compensation and can

therefore be excluded from the $1,000,000 limit, with the exception of restricted stock units that vest solely based

on continued service. The company believes that bonuses awarded to date under the Bonus Plan also qualify as

performance-based compensation and are excluded from calculating the limit. Bonuses awarded outside of the

Bonus Plan do not qualify as performance-based compensation for purposes of Section 162(m) and therefore

count toward the $1,000,000 limit. While the Compensation Committee cannot predict how the deductibility

limit may impact its compensation program in future years, the Compensation Committee intends to maintain an

approach to executive compensation that links pay to performance.

35

Proxy