Pottery Barn 2012 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2012 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

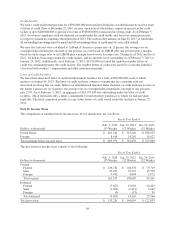

Except where required by U.S. tax law, we have historically elected not to provide for U.S. income taxes with

respect to the undistributed earnings of our foreign subsidiaries as we intended to utilize those earnings in our

foreign operations for an indefinite period of time. As of February 3, 2013, the accumulated undistributed

earnings of all foreign subsidiaries were approximately $35,600,000 and are sufficient to support our anticipated

future cash needs for our foreign operations. We currently intend to utilize the remainder of those undistributed

earnings for an indefinite period of time and will only repatriate such earnings when it is tax effective to do so. It

is currently not practical to estimate the tax liability that might be payable if these foreign earnings were to be

repatriated.

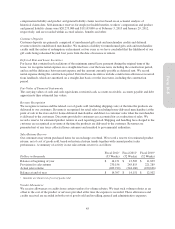

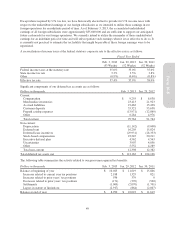

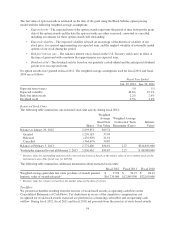

A reconciliation of income taxes at the federal statutory corporate rate to the effective rate is as follows:

Fiscal Year Ended

Feb. 3, 2013

(53 Weeks)

Jan. 29, 2012

(52 Weeks)

Jan. 30, 2011

(52 Weeks)

Federal income taxes at the statutory rate 35.0% 35.0% 35.0%

State income tax rate 3.3% 3.5% 3.8%

Other (0.9%) (0.6%) (0.8%)

Effective tax rate 37.4% 37.9% 38.0%

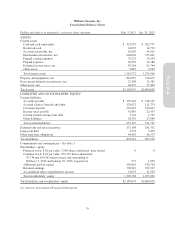

Significant components of our deferred tax accounts are as follows:

Dollars in thousands Feb. 3, 2013 Jan. 29, 2012

Current:

Compensation $ 9,255 $ 8,638

Merchandise inventories 23,413 21,923

Accrued liabilities 19,462 15,438

Customer deposits 55,321 53,638

Prepaid catalog expenses (13,971) (12,869)

Other 6,284 4,976

Total current 99,764 91,744

Non-current:

Depreciation (11,142) (9,008)

Deferred rent 16,205 15,824

Deferred lease incentives (29,931) (28,353)

Stock-based compensation 23,245 20,211

Executive deferral plan 4,562 4,563

Uncertainties 3,907 4,856

Other 5,552 4,289

Total non-current 12,398 12,382

Total deferred tax assets, net $ 112,162 $ 104,126

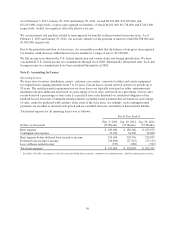

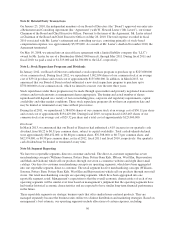

The following table summarizes the activity related to our gross unrecognized tax benefits:

Dollars in thousands Feb. 3, 2013 Jan. 29, 2012 Jan. 30, 2011

Balance at beginning of year $ 10,023 $ 11,619 $ 15,866

Increases related to current year tax positions 2,188 1,329 821

Increases related to prior years’ tax positions 936 379 0

Decreases related to prior years’ tax positions (171) (370) (560)

Settlements (1,069) (2,070) (1,701)

Lapses in statute of limitations (2,917) (864) (2,807)

Balance at end of year $ 8,990 $ 10,023 $ 11,619

49

Form 10-K