Pottery Barn 2012 Annual Report Download - page 102

Download and view the complete annual report

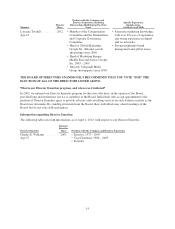

Please find page 102 of the 2012 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.number of restricted stock units granted is determined by dividing the total monetary value of each award,

equal to the annual equity grant as identified in the preceding table, by the closing price of our common

stock on the trading day prior to the grant date, rounding down to the nearest whole share.

(2) Represents the fair market value associated with a restricted stock unit award of 7,244 shares of common

stock made on May 24, 2012, with a fair value as of the grant date of $35.20 per share for an aggregate

grant date fair value of $254,989.

(3) Includes (i) taxable value of discount on merchandise of $26,304 and (ii) dividend equivalent payments

made with respect to outstanding stock unit awards of $8,943.

(4) Represents the fair market value associated with a restricted stock unit award of 2,627 shares of common

stock made on May 24, 2012, with a fair value as of the grant date of $35.20 per share for an aggregate

grant date fair value of $92,470.

(5) Includes (i) taxable value of discount on merchandise of $6,403 and (ii) dividend equivalent payments

made with respect to an outstanding restricted stock unit award of $2,308.

(6) Includes (i) taxable value of discount on merchandise of $1,761 and (ii) dividend equivalent payments

made with respect to an outstanding restricted stock unit award of $2,313.

(7) Represents the fair market value associated with a restricted stock unit award of 3,352 shares of common

stock made on May 24, 2012, with a fair value as of the grant date of $35.20 per share for an aggregate

grant date fair value of $117,990.

(8) Includes (i) taxable value of discount on merchandise of $4,471 and (ii) dividend equivalent payments

made with respect to an outstanding restricted stock unit award of $2,750.

(9) Includes (i) taxable value of discount on merchandise of $7,369 and (ii) dividend equivalent payments

made with respect to an outstanding restricted stock unit award of $2,200.

(10) Includes (i) taxable value of discount on merchandise of $1,067 and (ii) dividend equivalent payments

made with respect to outstanding restricted stock unit awards of $2,200.

(11) Represents the fair market value associated with a restricted stock unit award of 2,862 shares of common

stock made on May 24, 2012, with a fair value as of the grant date of $35.20 per share for an aggregate

grant date fair value of $100,742.

(12) Includes (i) taxable value of discount on merchandise of $2,978 and (ii) dividend equivalent payments

made with respect to outstanding restricted stock unit awards of $17,928.

(13) Includes (i) taxable value of discount on merchandise of $10,682 and (ii) dividend equivalent payments

made with respect to outstanding restricted stock unit awards of $2,313.

Are the Directors required to own stock in the company?

Yes. The Board has approved a share ownership policy. Each non-employee director must hold at least $400,000

worth of shares of company stock by the fifth anniversary of such director’s initial election to the Board. In the

event a director holds at least $400,000 worth of shares of company stock during the required time period, but the

value of such director’s shares decreases below $400,000 due to a drop in the company’s stock price, the director

shall be deemed to have complied with this policy so long as the director does not sell shares of company stock.

If a director has not complied with this policy during the required time period, then the director may not sell any

shares until such director holds at least $400,000 worth of shares of company stock.

What is our Board leadership structure?

We currently separate the positions of Chief Executive Officer and Chairman of the Board. Adrian D.P. Bellamy,

an independent director, has served as our Chairman of the Board since May 2010.

8