Pottery Barn 2012 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2012 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

All Other Fees

Deloitte billed a total of approximately $24,000 for fiscal 2012 and $35,000 for fiscal 2011 for all other fees. All

other fees consisted primarily of sustainability consulting fees and license fees related to the use of Deloitte’s on-

line accounting research tool.

What is our policy regarding pre-approval of audit and non-audit services performed by Deloitte?

All services performed by Deloitte, whether audit or non-audit services, must be pre-approved by us or a

designated member of the Audit and Finance Committee, whose decisions must be reported to us at our next

meeting. Pre-approval must be obtained before Deloitte performs the services but cannot be obtained more than

one year before performance begins. Approval can be for general classes of permitted services such as annual

audit services or tax consulting services. The permitted services, the dates of the engagement and the estimated

fees for such services, must be approved by the Audit and Finance Committee in accordance with these

procedures before performance begins.

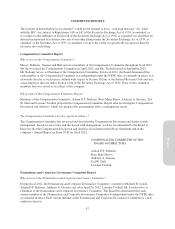

CORPORATE GOVERNANCE GUIDELINES AND CODE OF BUSINESS CONDUCT AND ETHICS

Our Corporate Governance Guidelines and our Code of Business Conduct and Ethics, both of which apply to all

of our employees, including our Chief Executive Officer, Chief Financial Officer and Controller, are available on

our website at www.williams-sonomainc.com. Copies of our Corporate Governance Guidelines and our Code of

Business Conduct and Ethics are also available upon written request and without charge to any stockholder by

writing to: Williams-Sonoma, Inc., Attention: Corporate Secretary, 3250 Van Ness Avenue, San Francisco,

California 94109. To date, there have been no waivers that apply to our Chief Executive Officer, Chief Financial

Officer, Controller or persons performing similar functions under our Code of Business Conduct and Ethics. We

intend to disclose any amendment to, or waivers of, the provisions of our Code of Business Conduct and Ethics

that affect our Chief Executive Officer, Chief Financial Officer, Controller or persons performing similar

functions by posting such information on our website at www.williams-sonomainc.com.

CERTIFICATIONS

The certification of our Chief Executive Officer required by the NYSE Listing Standards, Section 303A.12(a),

relating to our compliance with the NYSE Corporate Governance Listing Standards, was submitted to the NYSE

on June 21, 2012. The certifications of our Chief Executive Officer and Chief Financial Officer required by the

SEC in connection with our Annual Report on Form 10-K for the year ended February 3, 2013 were submitted to

the SEC on April 4, 2013 with our Annual Report on Form 10-K.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

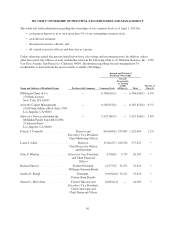

We have in place policies in our Code of Business Conduct and Ethics that provide that associates must not

engage in any transaction when an associate may face a real or perceived conflict of interest with the company.

Our Code of Business Conduct and Ethics is distributed to all employees on an annual basis and made available

throughout the year in our internal document database. It is also available on our website and in print to any

stockholder who requests it. In addition, we have in place policies and procedures with respect to related person

transactions that provide that our executive officers, directors, director nominees and principal stockholders, as

well as their immediate family members and affiliates, are not permitted to enter into a related party transaction

with us unless (i) the transaction is approved or ratified by our Audit and Finance Committee or the disinterested

members of our Board or (ii) the transaction involves the service of one of our executive officers or directors or

any related compensation, is reportable under Item 402 of Regulation S-K and is approved by our Compensation

Committee.

For the purposes of our related party transaction policy, “related party transaction” means any transaction in

which the amount involved exceeds $120,000 in any calendar year and in which any of our executive officers,

53

Proxy