Pottery Barn 2012 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2012 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

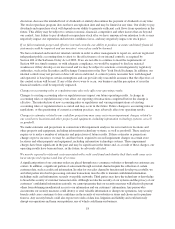

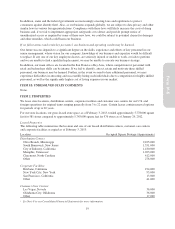

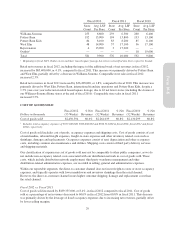

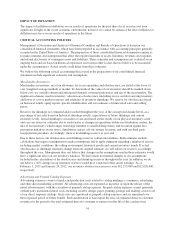

ITEM 6. SELECTED FINANCIAL DATA

Five-Year Selected Financial Data

Dollars and amounts in thousands, except percentages,

per share amounts and retail stores data

Fiscal 2012

(53 Weeks)

Fiscal 2011

(52 Weeks)

Fiscal 2010

(52 Weeks)

Fiscal 2009

(52 Weeks)

Fiscal 2008

(52 Weeks)

Results of Operations

Net revenues $4,042,870 $3,720,895 $3,504,158 $3,102,704 $3,361,472

Net revenue growth (decline) 8.7% 6.2% 12.9% (7.7%) (14.8%)

Comparable brand revenue growth (decline)16.1% 7.3% 13.9% (9.3%) (15.6%)

Gross margin $1,592,476 $1,459,856 $1,373,859 $1,103,237 $1,135,172

Gross margin as a percent of net revenues 39.4% 39.2% 39.2% 35.6% 33.8%

Operating income2$ 409,163 $ 381,732 $ 323,414 $ 121,442 $ 42,153

Operating margin310.1% 10.3% 9.2% 3.9% 1.3%

Net earnings $ 256,730 $ 236,931 $ 200,227 $ 77,442 $ 30,024

Basic earnings per share $ 2.59 $ 2.27 $ 1.87 $ 0.73 $ 0.28

Diluted earnings per share $ 2.54 $ 2.22 $ 1.83 $ 0.72 $ 0.28

Weighted average basic shares outstanding during

the period 99,266 104,352 106,956 105,763 105,530

Weighted average diluted shares outstanding during

the period 101,051 106,582 109,522 107,373 106,880

Financial Position

Working capital $ 659,645 $ 704,567 $ 735,878 $ 616,711 $ 479,936

Total assets $2,187,679 $2,060,838 $2,131,762 $2,079,169 $1,935,464

Return on assets 12.0% 11.3% 9.5% 3.9% 1.5%

Net cash provided by operating activities $ 364,127 $ 291,334 $ 355,989 $ 490,718 $ 230,163

Capital expenditures $ 205,404 $ 130,353 $ 61,906 $ 72,263 $ 191,789

Long-term debt and other long-term obligations $ 50,216 $ 52,015 $ 59,048 $ 62,792 $ 62,071

Stockholders’ equity $1,309,138 $1,255,262 $1,258,863 $1,211,595 $1,147,984

Stockholders’ equity per share (book value) $ 13.39 $ 12.50 $ 12.00 $ 11.33 $ 10.86

Return on equity 20.0% 18.8% 16.2% 6.6% 2.6%

Annual dividends declared per share $ 0.88 $ 0.73 $ 0.58 $ 0.48 $ 0.48

Direct-to-Customer Net Revenues

Direct-to-customer net revenue growth (decline) 14.5% 12.4% 18.6% (12.5%) (15.9%)

Direct-to-customer net revenues as a percent of net

revenues 46.2% 43.9% 41.5% 39.5% 41.6%

E-commerce net revenue growth (decline) 17.4% 17.9% 26.9% (8.7%) (6.4%)

E-commerce net revenues as a percent of direct-to-

customer net revenues 88.6% 86.4% 82.4% 77.0% 73.9%

Retail Net Revenues

Retail net revenue growth (decline) 4.1% 1.8% 9.2% (4.3%) (14.0%)

Retail net revenues as a percent of net revenues 53.8% 56.1% 58.5% 60.5% 58.4%

Comparable store sales growth (decline)12.3% 3.5% 9.8% (5.1%) (17.2%)

Number of stores at year-end 581 576 592 610 627

Store selling square footage at year-end 3,548,000 3,535,000 3,609,000 3,763,000 3,828,000

Store leased square footage at year-end 5,778,000 5,743,000 5,831,000 6,081,000 6,148,000

1Comparable brand revenue and comparable store sales are calculated on a 52-week to 52-week basis, with the exception of fiscal 2012

which was calculated on a 53-week to 53-week basis. See definition of comparable brand revenue and comparable stores within

“Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

2Operating income is defined as earnings before net interest income or expense and income taxes.

3Operating margin is defined as operating income as a percentage of net revenues.

The information set forth above is not necessarily indicative of future operations and should be read in

conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and

the Consolidated Financial Statements and notes thereto in this Annual Report on Form 10-K.

24