Pottery Barn 2012 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2012 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

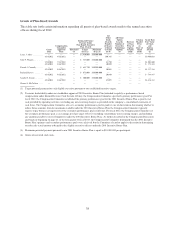

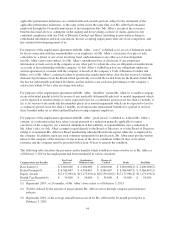

(7) Represents restricted stock units granted on March 25, 2010. The restricted stock units vest in full four years

following the date of grant on March 25, 2014 subject to continued service. In addition, upon vesting, the

executive receives a cash payment equal to dividends declared between the grant date and the vesting date.

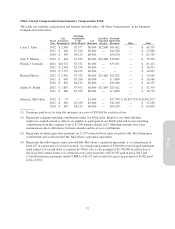

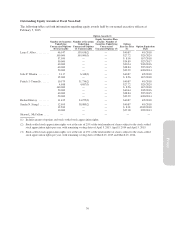

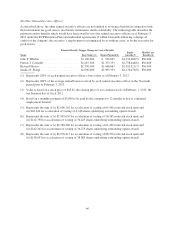

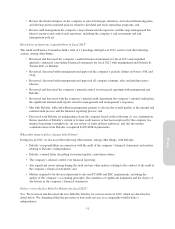

Option Exercises and Stock Vested

The following table sets forth information regarding exercises and vesting of equity awards held by our named

executive officers during fiscal 2012.

Option Awards Stock Awards

Number of Shares

Acquired on Exercise (#)

Value Realized on

Exercise ($)(1)

Number of Shares

Acquired on Vesting (#)

Value Realized on

Vesting ($)(2)

Laura J. Alber ............ 102,500 $ 2,819,775 17,579 $682,944

Julie P. Whalen ........... — — 6,081 $233,385

Patrick J. Connolly ......... 20,000 $ 468,400 14,078 $546,930

Richard Harvey ........... 25,000 $ 937,250 13,246 $509,500

Sandra N. Stangl .......... 44,700 $ 1,450,684 15,472 $591,751

Sharon L. McCollam ....... 625,000 $10,115,055 17,579 $658,861

(1) The value realized upon exercise is calculated as the difference between the closing price of our stock on the

day prior to the exercise date multiplied by the number of shares exercised and the applicable exercise price

of the options.

(2) The value realized upon vesting is calculated as the closing price of our stock on the day prior to the vesting

date multiplied by the number of units vested.

Pension Benefits

None of our named executive officers received any pension benefits during fiscal 2012.

Nonqualified Deferred Compensation

None of our named executive officers contributed to or received earnings from a company nonqualified deferred

compensation plan during fiscal 2012.

Employment Contracts and Termination of Employment and Change-of-Control Arrangements

We have entered into a management retention agreement with each of our named executive officers. As noted

above, however, Ms. McCollam retired effective March 6, 2012 and is no longer covered by a management

retention agreement. Mr. Harvey will also no longer be covered by a management retention agreement due to his

departure from the company.

The retention agreement with each of Ms. Whalen, Mr. Connolly and Ms. Stangl has an initial two-year term and

will be automatically extended for one year following the initial term unless either party provides notice of non-

extension. If we enter into a definitive agreement with a third party providing for a “change of control,” each

retention agreement will be automatically extended for 18 months following the change of control. In addition,

effective November 1, 2012, we adopted the 2012 EVP Level Management Retention Plan, or the EVP Retention

Plan. The EVP Retention Plan will replace the individual management retention agreements that we previously

entered into with each named executive officer, other than the agreement entered into with Ms. Alber, which

remains in effect. The EVP Retention Plan provides that the executives will automatically become participants in

the plan upon the later of (i) the effective date of the EVP Retention Plan or (ii) the lapse of the term of such

executive’s management retention agreement with the Company in existence on the effective date of the EVP

Retention Plan. The EVP Retention Plan will remain in effect through November 15, 2015, unless earlier

terminated by the company in accordance with the plan. The EVP Retention Plan provides for substantially the

same severance benefits as the individual agreements.

41

Proxy