Pottery Barn 2012 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2012 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

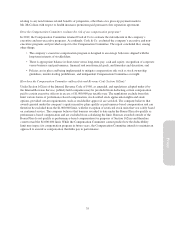

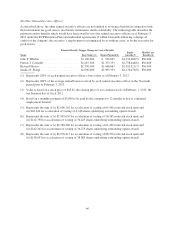

(4) Represents the sum of (i) $15,056,759 for acceleration of vesting of 334,446 restricted stock units and

(ii) $2,116,332 for acceleration of vesting of 193,092 shares underlying outstanding option awards. Value is

based on a stock price of $45.02, the closing price of our common stock on February 1, 2013, the last

business day of fiscal 2012.

(5) Represents the sum of (i) $22,841,122 for acceleration of vesting of 507,355 restricted stock units and

(ii) $2,309,498 for acceleration of vesting of 239,638 shares underlying outstanding option awards. Value is

based on a stock price of $45.02, the closing price of our common stock on February 1, 2013, the last

business day of fiscal 2012.

(6) Based on a monthly payment of $3,000 to be paid by the company for 18 months or 12 months, as

applicable, in lieu of continued employment benefits.

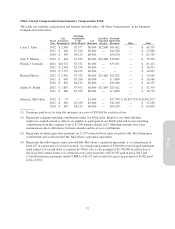

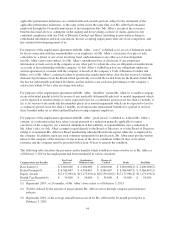

Sharon L. McCollam

In connection with Ms. McCollam’s retirement effective March 6, 2012, we entered into a Separation Agreement

and General Release with Ms. McCollam. Pursuant to the agreement, Ms. McCollam continued to receive her

base salary of $875,000 for a period of one year, an additional lump sum amount equal to 80% of base salary (or

$700,000), a cash payment of $1,300,000 in satisfaction of Ms. McCollam’s annual bonus, health care coverage

for up to 18 months, and outplacement services. We also agreed to accelerate the vesting of 131,060 stock-settled

stock appreciation rights scheduled to vest during March, April and November 2012, and 17,579 restricted stock

units scheduled to vest in May 2012 in exchange for a general release of claims in favor of the company.

The following table describes the payments and/or benefits that were payable to Ms. McCollam as of March 6,

2012, the effective date of Ms. McCollam’s retirement.

Compensation and Benefits Amount

Base Salary(1) ................................... $ 875,000

Lump Sum Payment(2) ............................ $ 700,000

Bonus Payment(3) ................................ $1,300,000

Equity Awards(4) ................................ $3,018,698

Dividend Equivalent Payments(5) ................... $ 37,795

Health Care Benefits(6) ............................ $ 8,838

Other Perquisites(7) ............................... $ 150,000

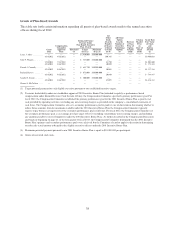

(1) Represents one year of Ms. McCollam’s base salary as of March 6, 2012.

(2) Represents 80% of Ms. McCollam’s base salary as of March 6, 2012.

(3) Represents satisfaction of Ms. McCollam’s annual bonus.

(4) Represents the sum of (i) $2,367,923 for the acceleration of vesting of 131,060 stock-settled stock

appreciation rights and (ii) $650,775 for the acceleration of vesting of 17,579 restricted stock units, which

represents the fair value of these awards as of March 15, 2012, the effective date of the acceleration in

connection with Ms. McCollam’s separation agreement.

(5) Represents dividend equivalent payments on 17,579 restricted stock units awarded to Ms. McCollam prior

to retirement and accelerated pursuant to the separation agreement.

(6) Based on a monthly health insurance premium of $491 payable by the company for up to 18 months, which

is the period provided under COBRA.

(7) Value of outplacement services made available to Ms. McCollam.

45

Proxy