Pottery Barn 2012 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2012 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In the direct-to-customer channel, cost of goods sold as a percentage of direct-to-customer net revenues increased

approximately 70 basis points during fiscal 2012 compared to fiscal 2011. This increase as a percentage of net

revenues was primarily driven by lower selling margins, partially offset by the leverage of fixed occupancy

expenses due to increasing net revenues.

In the retail channel, cost of goods sold as a percentage of net revenues decreased 30 basis points during fiscal

2012 compared to fiscal 2011. This decrease as a percentage of net revenues was primarily driven by the leverage

of fixed occupancy expenses.

Fiscal 2011 vs. Fiscal 2010

Cost of goods sold increased by $130,740,000, or 6.1%, in fiscal 2011 compared to fiscal 2010. Cost of goods

sold as a percentage of net revenues remained flat at 60.8% in fiscal 2011 compared to fiscal 2010. The leverage

of fixed occupancy expenses due to increasing net revenues and a decrease in occupancy expense dollars was

offset by lower selling margins due to higher promotional activity (including shipping fees).

In the direct-to-customer channel, cost of goods sold as a percentage of direct-to-customer net revenues increased

approximately 70 basis points during fiscal 2011 compared to fiscal 2010. This increase as a percentage of net

revenues was primarily driven by lower selling margins due to higher promotional activity (including shipping

fees), partially offset by the leverage of fixed occupancy expenses due to increasing net revenues.

In the retail channel, cost of goods sold as a percentage of retail net revenues remained relatively flat during

fiscal 2011 compared to fiscal 2010. A decrease in occupancy expense dollars and the leverage of fixed

occupancy expenses due to increasing net revenues was offset by lower selling margins due to higher

promotional activity.

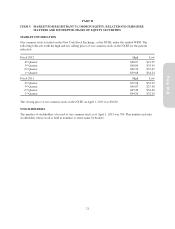

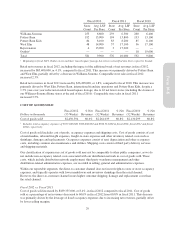

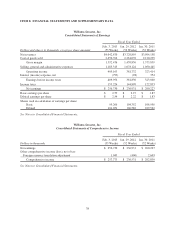

SELLING, GENERAL AND ADMINISTRATIVE EXPENSES

Dollars in thousands

Fiscal 2012

(53 Weeks)

% Net

Revenues

Fiscal 2011

(52 Weeks)

% Net

Revenues

Fiscal 2010

(52 Weeks)

% Net

Revenues

Selling, general and administrative expenses $1,183,313 29.3% $1,078,124 29.0% $1,050,445 30.0%

Selling, general and administrative expenses consist of non-occupancy related costs associated with our retail

stores, distribution warehouses, customer care centers, supply chain operations (buying, receiving and inspection)

and corporate administrative functions. These costs include employment, advertising, third party credit card

processing and other general expenses.

We experience differing employment and advertising costs as a percentage of net revenues within the retail and

direct-to-customer channels due to their distinct distribution and marketing strategies. Store employment costs

represent a greater percentage of retail net revenues than employment costs as a percentage of net revenues

within the direct-to-customer channel. However, advertising expenses are higher within the direct-to-customer

channel than in the retail channel.

Fiscal 2012 vs. Fiscal 2011

Selling, general and administrative expenses increased by $105,189,000, or 9.8%, in fiscal 2012 compared to

fiscal 2011. Including employee separation charges of $6,935,000 primarily related to the retirement of our

former Executive Vice President, Chief Operating and Chief Financial Officer, and expense of approximately

$6,071,000 from asset impairment charges, selling, general and administrative expenses as a percentage of net

revenues increased to 29.3% during fiscal 2012 from 29.0% during fiscal 2011 (which included expense of

$2,819,000 from asset impairment and early lease termination charges). This increase was primarily driven by

higher employment costs, including employee separation charges, and increases in other expenses resulting from

planned incremental investments to support e-commerce, global expansion and business development growth

strategies, partially offset by greater advertising efficiency.

In the direct-to-customer channel, selling, general and administrative expenses as a percentage of net revenues

decreased 110 basis points during fiscal 2012 compared to fiscal 2011. This decrease was primarily driven by

greater advertising efficiency.

30