Pottery Barn 2012 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2012 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

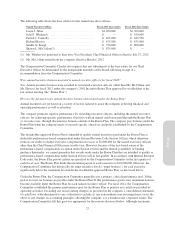

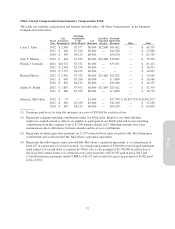

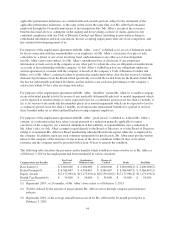

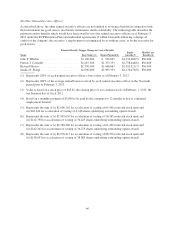

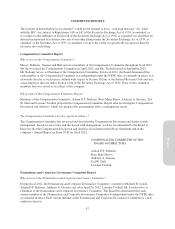

Other Annual Compensation from Summary Compensation Table

This table sets forth the compensation and benefits included under “All Other Compensation” in the Summary

Compensation table above.

Fiscal

Year

Life

Insurance

Premiums(1)

Matching

Contribution

to the

401(k) Plan(2)

Car

Allowance

Executive

Financial

Services

Dividend

Equivalent

Payments Other Total

Laura J. Alber .......2012 $ 2,340 $7,577 $6,000 $12,000 $41,662 — $ 69,579

2011 $ 420 $7,350 $6,000 — $11,250 — $ 25,020

2010 $ 420 $6,125 $6,000 — $50,250 — $ 62,795

Julie P. Whalen ......2012 $ 416 $7,679 $6,000 $12,000 $10,843 — $ 36,938

Patrick J. Connolly . . . 2012 $18,715 $7,331 $6,000 — $33,365 — $ 65,411

2011 $ 2,969 $7,350 $6,000 — — — $ 16,319

2010 $ 2,772 $6,125 $6,000 — — — $ 14,897

Richard Harvey ......2012 $ 2,342 $7,332 $6,000 $12,000 $25,022 — $ 52,696

2011 $ 630 $7,350 $6,000 — $ 3,000 — $ 16,980

2010 $ 630 $6,125 $6,000 — $13,400 — $ 26,155

Sandra N. Stangl .....2012 $ 1,829 $7,452 $6,000 $12,000 $25,022 — $ 52,303

2011 $ 420 $7,350 $6,000 — $ 3,000 — $ 16,770

—

Sharon L. McCollam . . 2012 $ 97 — $1,000 — $37,795(3) $2,853,725(4) $2,892,617

2011 $ 630 $7,350 $6,000 — $11,250 — $ 25,230

2010 $ 630 $6,125 $6,000 — $50,250 — $ 63,005

(1) Premiums paid by us for term life insurance in excess of $50,000 for each fiscal year.

(2) Represents company matching contributions under our 401(k) plan. Similar to our other full-time

employees, named executive officers are eligible to participate in our 401(k) plan and receive matching

contributions from the company of up to $7,500 during calendar 2012. Matching amounts above this

maximum are due to differences between calendar and fiscal year contributions.

(3) Represents dividend equivalent payments on 17,579 restricted stock units awarded to Ms. McCollam prior

to retirement and accelerated per Ms. McCollam’s separation agreement.

(4) Represents the following in connection with Ms. McCollam’s separation agreement: (i) a cash payment of

$104,327 in satisfaction of accrued vacation, (ii) a lump sum payment of $700,000 received upon retirement

(paid subject to 6-month delay as required by 409A), (iii) a cash payment of $1,300,000 in satisfaction of

her fiscal 2011 annual bonus, (iv) continuation of salary payments of $740,385 paid in fiscal 2012 and

(v) health insurance premiums under COBRA of $5,131 and a related tax gross-up payment of $3,882 paid

in fiscal 2012.

37

Proxy