Pottery Barn 2012 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2012 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.None of the executive officers is provided with any type of golden parachute excise tax gross-up. In addition, our

equity compensation plans do not provide for automatic “single trigger” vesting acceleration upon or following a

change of control. We have considered the total potential cost of the change of control protection afforded to our

executive officers and have determined that it is reasonable given the importance of the objectives described

above.

Do our named executive officers have severance protection?

As described in the section titled “Employment Contracts and Termination of Employment and Change-of-

Control Arrangements” beginning on page 41, as of the last day of the company’s 2012 fiscal year, the company

had entered into a severance arrangement with Ms. Alber providing for certain severance benefits upon her

termination without cause or voluntary termination for good reason following a change of control. The company

had also previously entered into a severance arrangement with Ms. McCollam, who retired from the company

effective March 6, 2012, as described in the section titled “Employment Contracts and Termination of

Employment and Change-of-Control Arrangements—Sharon L. McCollam” beginning on page 45. The

Compensation Committee implemented these arrangements to ensure that these two senior executive focus on the

company’s goals and objectives, as well as the best interests of stockholders, rather than potential personal

economic exposure under these particular circumstances.

Grants of restricted stock units made in fiscal 2012 to company employees, including the restricted stock units

granted to the named executive officers, include an acceleration feature that provides for the full acceleration of

vesting of such awards in the event of a qualifying retirement, which is defined as leaving the company’s

employment at age 70 or later, with at least fifteen years of service.

Otherwise, except as described above, the named executive officers do not have arrangements that provide them

with specific benefits upon their termination. The Compensation Committee has considered the total potential

cost of the severance benefits to the executive officers and determined them to be reasonable.

Do we provide perquisites to the executive officers?

The company provides executive officers, including the named executive officers, with perquisites and other

personal benefits that the company and the Compensation Committee believe are reasonable and enable the

company to attract and retain superior employees for key positions. The company provides certain perquisites to

its named executive officers, including premiums for term life insurance in excess of $50,000, a matching

contribution for investments in our 401(k) plan up to $7,500 in any calendar year, and a $500 monthly car

allowance. Some of these perquisites are also provided to other employees.

In fiscal 2012, the Compensation Committee authorized and approved the reimbursement of expenses for

financial counseling services of up to $12,000 annually for certain executive officers, including each of the

named executive officers, other than Pat Connolly (who is eligible to receive such services commencing in fiscal

2013) and Ms. McCollam, who retired in March 2012. The financial counseling services may include services

related to financial planning, tax planning and preparation, and estate planning. The Compensation Committee

believes it is in the company’s best interest to provide senior executives with financial counseling services as an

effective executive retention tool. These executives have complex financial planning requirements that require

significant time and attention. The Committee believes that providing company-subsidized financial services will

give the executives appropriate support to plan for their financial security and maximize the net financial reward

to the executive from the company’s compensation and benefits programs. In addition, reducing the amount of

time and attention the executives may spend on these matters should enable the executives to devote more time to

the company’s business needs.

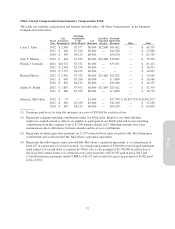

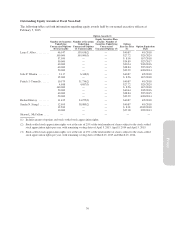

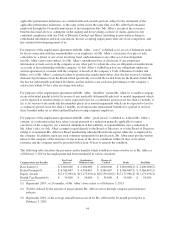

The value of all of these benefits to each of the named executive officers is detailed in the “Other Annual

Compensation from Summary Compensation Table” table on page 36. The Compensation Committee believes

these perquisites to be customary for comparable professionals in our industry with comparable management and

retail industry experience. There are no tax gross-ups to named executive officers on any imputed income

34