PG&E 2008 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2008 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

97

As further discussed in Note 17 of the Notes to the

Consolidated Financial Statements, in January 2001,

the California Department of Water Resources (“DWR”)

began purchasing electricity to meet the portion of demand

of the California investor-owned electric utilities that was

not being satisfi ed from their own generation facilities

and existing electricity contracts. Under California law, the

DWR is deemed to sell the electricity directly to the Utility’s

retail customers, not to the Utility. The Utility acts as a

pass-through entity for electricity purchased by the DWR

on behalf of its customers. Although charges for electricity

provided by the DWR are included in the amounts the

Utility bills its customers, the Utility deducts the amounts

passed through to the DWR from its electricity revenues.

The pass-through amounts are based on the quantities of

electricity provided by the DWR that are consumed by

customers at the CPUC-approved remittance rate. These

pass-through amounts are excluded from the Utility’s

electricity revenues and from the cost of electricity in its

Consolidated Statements of Income.

There was no material difference between PG&E

Corporation’s and the Utility’s accumulated other compre-

hensive income (loss) for the periods presented above.

REVENUE RECOGNITION

The Utility’s operating revenues are composed of revenue

from electric and natural gas distribution and transmission

services and electric generation services. Amounts recorded

for these services are billed to the Utility’s customers at the

CPUC-approved and FERC-approved rates, which provide

an authorized rate of return, and recovery of operation and

maintenance and capital-related carrying costs. The Utility’s

revenues are recognized as electricity and natural gas are

delivered, and include amounts for services rendered but

not yet billed at the end of each year.

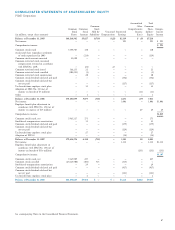

ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS)

Accumulated other comprehensive income (loss) reports a measure for accumulated changes in equity of an enterprise that

result from transactions and other economic events, other than transactions with shareholders. The following table sets forth

the after-tax changes in each component of accumulated other comprehensive income (loss):

Minimum Employee Benefi t Accumulated

Pension Plan Adjustment in Other

Liability Adoption of Accordance with Comprehensive

(in millions) Adjustment SFAS No. 158 SFAS No. 158 Income (Loss)

Balance at December 31, 2005 $(8) $ — $ — $ (8)

Period change in:

Adoption of SFAS No. 158 (net of income tax benefi t of $8 million) 8 (19) — (11)

Balance at December 31, 2006 — (19) — (19)

Period change in pension benefi ts and other benefi ts:

Unrecognized prior service cost (net of income tax expense

of $18 million) — — 26 26

Unrecognized net gain (net of income tax expense of $195 million) — — 289 289

Unrecognized net transition obligation (net of income tax expense

of $11 million) — — 16 16

Transfer to regulatory account (net of income tax benefi t

of $207 million)(1) — — (302) (302)

Balance at December 31, 2007 — (19) 29 10

Period change in pension benefi ts and other benefi ts:

Unrecognized prior service cost (net of income tax expense

of $27 million) — — 37 37

Unrecognized net loss (net of income tax benefi t of $1,088 million) — — (1,583) (1,583)

Unrecognized net transition obligation (net of income tax expense

of $11 million) — — 15 15

Transfer to regulatory account (net of income tax expense

of $894 million)(1) — — 1,300 1,300

Balance at December 31, 2008 $ — $(19) $

(202) $ (221)

(1) The Utility recorded approximately $2,259 million in 2008 and $109 million in 2007, pre-tax, as a reduction to the existing pension regulatory liability in

accordance with the provisions of SFAS No. 71. The adjustment resulted in a regulatory asset balance at December 31, 2008. The Utility recorded approxi-

mately $44 million in 2007, pre-tax, as an addition to the existing pension regulatory liability in accordance with SFAS No. 71. See Note 14 of the Notes

to the Consolidated Financial Statements for further information on pre-tax transfer amounts to the regulatory account.