PG&E 2008 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2008 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

“PG&E’s strategy is

simple: continue to

learn better than ever

what customers need

and value, and run

our operations to

consistently deliver it.”

energy solutions — and then run our operations to consistently

deliver it with impeccable discipline, e ciency, and precision.

is letter covers 2008 nancial results, examples of ways

we are putting our strategy into action, and insights into our

plans for the current year and beyond.

Delivering for Investors

Returns on new capital investments in PG&E’s asset base were

the predominant force behind last year’s core earnings growth.

Additional contributions came from incentives we earned by

helping customers achieve energy e ciency savings, as well as

from internal cost savings and operational e ciencies.

In total, we grew net income by 33 percent compared

with 2007, to $1.34 billion or $3.63 per share, as reported

under generally accepted accounting principles (GAAP). is

increase included the substantial one-time bene ts of a

multiyear tax settlement.

Earnings per share from operations, a non-GAAP measure

adjusted to exclude the $257 million from the tax settlement

and re ect normal operations, were $2.95 per share, up

6 percent over 2007 levels. ( e “Financial Highlights” table on

page 31 reconciles GAAP total net income with non-GAAP

earnings from operations.)

ese results met our targets for the year and exceeded the

nancial community’s consensus forecast.

Also important, in 2008 we raised PG&E Corporation’s

common stock dividend by 8 percent, following through

on a commitment to shadow earnings growth over time with

higher dividends.

Despite solid earnings and dividend growth, however,

total shareholder return — stock price appreciation plus

dividends — declined with the falling share price, as it did for

virtually every large company. Although it may be cold

comfort, we take some con dence from the fact that PG&E

Corporation’s shares held their value better than most others

in the sector or the S&P 500.

Looking ahead, we continue to see attractive opportunities

to grow earnings. e earnings trajectory we recently

shared with Wall Street analysts for the next three years projects

growth rates that put us in the top 25 percent among

comparable utilities. We also recently increased our common

stock dividend by almost another 8 percent, an expression of

con dence in the health and stability of the business.

Ultimately, we believe PG&E’s outlook represents exactly

the kind of potential for solid returns that will be rewarded

and once again re ected in the value of our stock as markets

eventually recover.

Investing in Our System

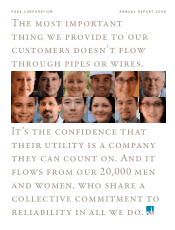

Our most basic, yet most demanding, everyday responsibility

will always be providing dependable service. Nothing is more

crucial to meeting this challenge than continuously making

smart, timely investments in the utility’s basic infrastructure.

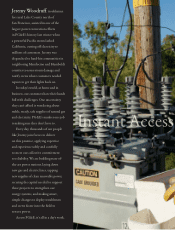

PG&E’s total capital spending last year was $3.7 billion,

consistent with our plans to invest an average of $3.5 to

$4 billion per year over the 2008 through 2011 timeframe.

e majority of these investments continue to go toward

our electric and natural gas distribution networks. For example,

last year we installed more than 5,000 pieces of new protective

equipment and control devices to strengthen our system and

enhance power restoration capabilities.

Another major accomplishment was ramping up our

SmartMeterTM initiative. We put in 1.4 million high-tech gas

and electric meters in 2008, 1.3 million of which were being

remotely read and billed by year’s end.

We also presented regulators with designs for a large

set of strategic, integrated investments in new equipment and

technology to strengthen reliability over the next six years.