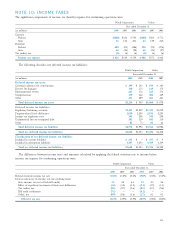

PG&E 2008 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2008 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

109

NEGT and its subsidiaries in its consolidated income tax

returns beginning October 29, 2004. PG&E Corporation

will continue to report resolution of NEGT matters in

discontinued operations.

On the effective date, PG&E Corporation recorded

a net of tax gain on disposal of NEGT of $684 million.

On October 28, 2008, PG&E Corporation resolved 2001-2004

audits with the Internal Revenue Service (“IRS”) and recog-

nized after-tax income of approximately $257 million in the

fourth quarter of 2008, of which $154 million was related

to NEGT and recorded as income from discontinued

operations. See Note 10 of the Notes to the Consolidated

Financial Statements for further discussion of the resolution

of the 2001-2004 audits.

At December 31, 2008 and 2007, PG&E Corporation’s

Consolidated Balance Sheets included the following assets

and liabilities related to NEGT:

(in millions) 2008 2007

Current Assets

Income taxes receivable $137 $33

Current Liabilities

Income taxes payable — —

Other 10 11

Noncurrent Liabilities

Income taxes payable 3 74

Deferred income taxes 7 34

Other 12 14

While PERF is a wholly owned consolidated subsidiary

of the Utility, it is legally separate from the Utility. The

assets (including the recovery property) of PERF are not

available to creditors of the Utility or PG&E Corporation,

and the recovery property is not legally an asset of the

Utility or PG&E Corporation.

RATE REDUCTION BONDS

In December 1997, PG&E Funding LLC, a limited liability

corporation wholly owned by and consolidated with the

Utility, issued $2.9 billion of rate reduction bonds (“RRBs”).

The proceeds of the RRBs were used by PG&E Funding

LLC to purchase from the Utility the right, known as

“transition property,” to be paid a specifi ed amount from

a non-bypassable charge levied on residential and small

commercial customers. The RRBs were paid in full when

they matured on December 26, 2007 and there are no

future principal or interest payments.

NOTE 6: DISCONTINUED

OPERATIONS

National Energy & Gas Transmission, Inc. (“NEGT”) was

incorporated on December 18, 1998 as a wholly owned

subsidiary of PG&E Corporation. NEGT fi led a voluntary

petition for relief under Chapter 11 on July 8, 2003. On

October 29, 2004, NEGT’s plan of reorganization became

effective (“effective date”), at which time NEGT emerged

from Chapter 11 and PG&E Corporation’s equity ownership

in NEGT was cancelled. PG&E Corporation ceased including

The fi rst series of ERBs issued on February 10, 2005 included fi ve classes aggregating approximately $1.9 billion principal

amount with scheduled maturities ranging from September 25, 2006 to December 25, 2012. Interest rates on the remaining

four outstanding classes range from 3.87% for the earliest maturing class to 4.47% for the latest maturing class. The proceeds

of the fi rst series of ERBs were paid by PERF to the Utility and were used by the Utility to refi nance the remaining unam-

ortized after-tax balance of the settlement regulatory asset. The second series of ERBs, issued on November 9, 2005, included

three classes aggregating approximately $844 million principal amount, with scheduled maturities ranging from June 25, 2009

to December 25, 2012. Interest rates on the three classes range from 4.85% for the earliest maturing class to 5.12% for the

latest maturing class. The proceeds of the second series of ERBs were paid by PERF to the Utility to pre-fund the Utility’s

tax liability that will be due as the Utility collects the DRC charges from customers.

The total amount of ERB principal outstanding was $1.6 billion at December 31, 2008 and $1.9 billion at December 31,

2007. The scheduled principal repayments for ERBs are refl ected in the table below:

(in millions) 2009 2010 2011 2012 Total

Utility

Average fi xed interest rate 4.36% 4.49% 4.59% 4.66% 4.53%

Energy recovery bonds $ 370 $ 386 $ 404 $ 423 $1,583