PG&E 2008 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2008 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.119

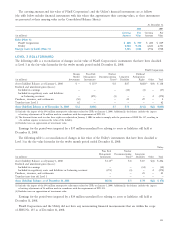

The Consolidated Balance Sheets of PG&E Corporation

and the Utility contain assets held in trust for the PG&E

Retirement Plan Master Trust, the Postretirement Life

Insurance Trust, and the Postretirement Medical Trusts

presented on a net basis. The assets held in these trusts

are fair valued annually and are included in the scope of

SFAS No. 157, but the pension liabilities are not considered

fair value instruments under SFAS No. 157. As the assets

are presented net of a non-fair value measure in PG&E

Corporation’s and the Utility’s Consolidated Financial

Statements, the fair value hierarchy disclosure in the table

above does not require the inclusion of pension assets.

The pension assets include equities, debt securities, swaps,

commingled funds, futures, cash equivalents, and insurance

policies. The pension assets are presented net of pension

obligations as Noncurrent Liabilities — Other in PG&E

Corporation’s and the Utility’s Consolidated Balance Sheets.

PRICE RISK MANAGEMENT INSTRUMENTS

Price risk management instruments comprise physical and

fi nancial derivative contracts including futures, forwards,

options, and swaps that are both exchange-traded and over-

the-counter (“OTC”) traded contracts. PG&E Corporation

and the Utility consistently apply valuation methodology

among their instruments. SFAS No. 71 allows the Utility to

defer the unrealized gains and losses associated with these

derivatives, as they are expected to be refunded or recovered

in future rates.

All energy options (exchange-traded and OTC) are valued

using the Black’s Option Pricing Model and classifi ed as

Level 3 measurements primarily due to volatility inputs.

MONEY MARKET INVESTMENTS

PG&E Corporation invests in AAA-rated money market

funds that seek to maintain a stable net asset value. These

funds invest in high quality, short-term, diversifi ed money

market instruments, such as treasury bills, federal agency

securities, certifi cates of deposit, and commercial paper with

a maximum weighted average maturity of 60 days or less.

PG&E Corporation’s investments in these money market

funds are generally valued based on observable inputs such

as expected yield and credit quality and are thus classifi ed

as Level 1 instruments. Approximately $164 million held in

money market funds are recorded as Cash and cash equiva-

lents in PG&E Corporation’s Consolidated Balance Sheets.

As of December 31, 2008, PG&E Corporation classifi ed

approximately $12 million invested in one money market

fund as a Level 3 instrument because the fund manager

imposed restrictions on fund participants’ redemption

requests. PG&E Corporation’s investment in this money

market fund, previously recorded as Cash and cash equiva-

lents, is recorded as Prepaid expenses and other in PG&E

Corporation’s Consolidated Balance Sheets.

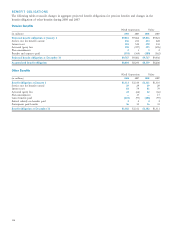

TRUST ASSETS

The nuclear decommissioning trusts, the rabbi trusts related

to the non-qualifi ed deferred compensation plans, and the

long-term disability trust hold primarily equities, debt securi-

ties, mutual funds, and life insurance policies. These instru-

ments are generally valued based on unadjusted prices in

active markets for identical transactions or unadjusted prices

in active markets for similar transactions. The rabbi trusts

are classifi ed as Current Assets-Prepaid expenses and other

and Other Noncurrent Assets-Other in PG&E Corporation’s

Consolidated Balance Sheets. The long-term disability trust is

classifi ed as Current Liabilities-Other in PG&E Corporation’s

and the Utility’s Consolidated Balance Sheets, representing a

net obligation as the projected obligation exceeds plan assets.