PG&E 2008 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2008 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

Cost of Electricity

The Utility’s cost of electricity includes the cost of purchased

power and the cost of fuel used by its generation facilities

or supplied to other facilities under tolling agreements. The

Utility’s cost of electricity also includes realized gains and

losses on price risk management activities. (See Notes 11 and

12 of the Notes to the Consolidated Financial Statements for

further information.) The cost of electricity excludes non-fuel

costs associated with the Utility’s own generation facilities,

which are included in Operating and maintenance expense

in the Consolidated Statements of Income. The Utility’s

cost of purchased power and the cost of fuel used in Utility-

owned generation are passed through to customers.

The Utility is required to dispatch, or schedule, all of

the electricity resources within its portfolio in the most

cost-effective way. This requirement, in certain cases, requires

the Utility to schedule more electricity than is necessary

to meet its load and sell the excess electricity on the open

market. The Utility typically schedules excess electricity

when the expected sales proceeds exceed the variable costs

to operate a generation facility or buy electricity under

an optional contract. The Utility’s net proceeds from the

sale of surplus electricity are recorded as a reduction to

the cost of electricity.

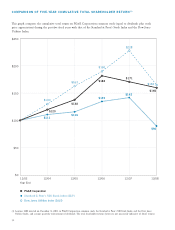

The following table provides a summary of the Utility’s

cost of electricity and the total amount and average cost of

purchased power:

(in millions) 2008 2007 2006

Cost of purchased power $ 4,516 $ 3,443 $ 3,114

Proceeds from surplus sales

allocated to the Utility (255) (155) (343)

Fuel used in own generation 164 149 151

Total cost of electricity $ 4,425 $ 3,437 $ 2,922

Average cost of purchased power

per kWh $ 0.088 $ 0.089 $ 0.084

Total purchased power

(in millions of kWh) 51,100 38,828 36,913

The Utility’s total cost of electricity increased by approxi-

mately $988 million, or 29%, in 2008 compared to 2007.

This increase was primarily driven by increases in the total

volume of purchased power of 12,272 million kilowatt-hours

(“kWh”), or 32%. Following the DWR’s termination of its

power purchase agreement with Calpine Corporation in

December 2007, the volume of power provided by the DWR

to the Utility’s customers decreased by 8,784 million kWh.

As a result, the Utility was required to increase its purchases

of power from third parties to meet customer load. In addi-

tion, the Utility increased the volume of power it purchased

in 2008 from third parties during the scheduled extended

outage at Diablo Canyon Unit 2 to replace the four steam

These increases were partially offset by the following:

• Transmission revenues decreased by approximately $200 mil-

lion, primarily due to a decrease in revenues received under

the Utility’s reliability must run (“RMR”) agreements with

the CAISO. During 2006, the CPUC adopted rules to

implement state law requirements for California investor-

owned utilities to meet resource adequacy requirements,

including rules to address local transmission system reli-

ability issues. As the utilities fulfi ll their responsibilities to

meet these requirements, the number of RMR agreements

with the CAISO and the associated revenues and costs will

decline. (See “Cost of Electricity” below.)

• Revenues in 2006 included approximately $136 million for

recovery of scheduling coordinator costs that the Utility

incurred from April 1998 through December 2005, as

ordered by the FERC. No similar amount was recognized

in 2007.

• Revenues in 2006 included approximately $65 million

for recovery of net interest related to disputed claims for

the period between the effective date of the Utility’s plan

of reorganization under Chapter 11 in April 2004 and the

fi rst issuance of the ERBs in February 2005, and for certain

energy supplier refund litigation costs upon completion

of the CPUC’s 2005 Annual Electric True-up verifi cation

audit. No similar amount was recognized in 2007.

• Other electric operating revenues decreased by approximately

$58 million, refl ecting a pension revenue requirement that

was recovered in 2006 but not in 2007.

The Utility’s electric operating revenues for 2009 and

2010 are expected to increase as authorized by the CPUC

in the 2007 GRC. The Utility’s electric operating revenues

for future years are also expected to increase as authorized

by the FERC in the TO rate cases. In addition, the Utility

expects to continue to collect revenue requirements related

to CPUC-approved capital expenditures outside the GRC,

including capital expenditures for the new Utility-owned

generation projects and the SmartMeter™ advanced metering

project. Revenues would also increase to the extent the CPUC

approves the Utility’s proposal for other capital projects.

(See “Capital Expenditures” below.) Revenue requirements

associated with new or expanded public purpose, energy

effi ciency, and demand response programs will also result

in increased electric operating revenues. Future electric

operating revenues are impacted by changes in the Utility’s

electricity procurement costs as discussed under “Cost

of Electricity” below. Finally, the Utility may recognize

additional incentive revenues to the extent it achieves the

CPUC’s energy effi ciency goals.