PG&E 2008 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2008 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

113

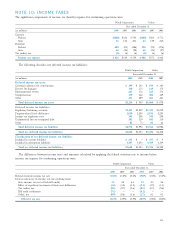

NOTE 10: INCOME TAXES

The signifi cant components of income tax (benefi t) expense for continuing operations were:

PG&E Corporation Utility

Year ended December 31,

(in millions) 2008 2007 2006 2008 2007 2006

Current:

Federal $(268) $526 $ 743 $(188) $563 $ 771

State 33 140 201 24 149 210

Deferred:

Federal 604 (81) (286) 596 (92) (276)

State

62 (40) (98) 62 (43) (97)

Tax credits, net (6) (6) (6) (6) (6) (6)

Income tax expense $ 425 $539 $ 554 $ 488 $571 $ 602

The following describes net deferred income tax liabilities:

PG&E Corporation Utility

Year ended December 31,

(in millions) 2008 2007 2008 2007

Deferred income tax assets:

Customer advances for construction $ 199 $ 143 $ 199 $ 143

Reserve for damages 130 173 129 173

Environmental reserve 225 172 225 172

Compensation 339 162 306 129

Other 231 289 201 261

Total deferred income tax assets $1,124 $ 939 $1,060 $ 878

Deferred income tax liabilities:

Regulatory balancing accounts $1,425 $1,219 $1,425 $1,219

Property-related basis differences 2,819 2,290 2,813 2,293

Income tax regulatory asset 345 298 345 298

Unamortized loss on reacquired debt 102 110 102 110

Other 81 75 81 66

Total deferred income tax liabilities $4,772 $3,992 $4,766 $3,986

Total net deferred income tax liabilities $3,648 $3,053 $3,706 $3,108

Classifi cation of net deferred income tax liabilities:

Included in current liabilities $

251 $ — $ 257 $ 4

Included in noncurrent liabilities 3,397 3,053 3,449 3,104

Total net deferred income tax liabilities $3,648 $3,053 $3,706 $3,108

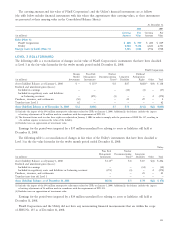

The differences between income taxes and amounts calculated by applying the federal statutory rate to income before

income tax expense for continuing operations were:

PG&E Corporation Utility

Year ended December 31,

2008 2007 2006 2008 2007 2006

Federal statutory income tax rate 35.0% 35.0% 35.0% 35.0% 35.0% 35.0%

Increase (decrease) in income tax rate resulting from:

State income tax (net of federal benefi t) 3.1 4.2 4.3 3.3 4.3 4.6

Effect of regulatory treatment of fi xed asset differences (3.2) (3.0) (1.2) (3.1) (2.9) (1.1)

Tax credits, net (0.5) (0.7) (0.6) (0.5) (0.7) (0.6)

IRS audit settlements (7.1) — —

(4.1) — —

Other, net (0.9) (0.6) (1.6) (1.7) 0.1 0.1

Effective tax rate 26.4% 34.9% 35.9% 28.9% 35.8% 38.0%