PG&E 2008 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2008 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.117

• Level 3: “Unobservable inputs for the asset or liability.”

These are inputs for which there is no market data avail-

able, or observable inputs that are adjusted using Level 3

assumptions. Instruments classifi ed as Level 3 consist

primarily of fi nancial and physical instruments such

as options, non-exchange-traded derivatives valued using

broker quotes, and new and/or complex instruments

that have immature or limited markets.

SFAS No. 157 is applied prospectively with limited

exceptions. One such exception relates to SFAS No. 157’s

nullifi cation of a portion of EITF No. 02-3, “Issues Involved

in Accounting for Derivative Contracts Held for Trading

Purposes and Contracts Involved in Energy Trading and

Risk Management Activities” (“EITF 02-3”). Prior to the

issuance of SFAS No. 157, EITF 02-3 prohibited an entity

from recognizing a day-one gain or loss on derivative con-

tracts based on the use of unobservable inputs. A day-one

gain or loss is the difference between the transaction price

and the fair value of the contract on the day the derivative

contract is executed (i.e., at inception). Prior to the adoption

of SFAS No. 157, the Utility did not record any day-one

gains associated with Congestion Revenue Rights (“CRRs”)

as the fair value was based primarily on unobservable market

data. (CRRs allow market participants, including load serv-

ing entities, to hedge the fi nancial risk of congestion charges

imposed by the CAISO in the day-ahead market to be estab-

lished when the CAISO’s Market Redesign and Technology

Upgrade (“MRTU”) becomes effective.) The costs associated

with procuring CRRs are currently being recovered in rates

or are probable of recovery in future rates. The adoption of

SFAS No. 157 permitted the Utility to record day-one gains

associated with CRRs resulting in a $48 million increase

in price risk management assets and the related regulatory

liabilities as of January 1, 2008.

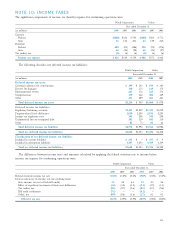

NOTE 12: FAIR VALUE

MEASUREMENTS

On January 1, 2008, PG&E Corporation and the Utility

adopted the provisions of SFAS No. 157, which defi nes fair

value measurements and implements a hierarchical disclosure

requirement. SFAS No. 157 deferred the disclosure of the

hierarchy for certain non-fi nancial instruments to fi scal years

beginning after November 15, 2008.

SFAS No. 157 defi nes fair value as “the price that would

be received to sell an asset or paid to transfer a liability in

an orderly transaction between market participants at the

measurement date,” or the “exit price.” Accordingly, an entity

must determine the fair value of an asset or liability based

on the assumptions that market participants would use in

pricing the asset or liability, not those of the reporting entity

itself. The identifi cation of market participant assumptions

provides a basis for determining what inputs are to be used

for pricing each asset or liability. Additionally, SFAS No. 157

establishes a fair value hierarchy that gives precedence to fair

value measurements calculated using observable inputs over

those using unobservable inputs. Accordingly, the following

levels were established for each input:

• Level 1: “Inputs that are quoted prices (unadjusted)

in active markets for identical assets or liabilities that

the reporting entity has the ability to access at the

measurement date.” Active markets are those in which

transactions for the asset or liability occur with suffi cient

frequency and volume to provide pricing information on

an ongoing basis. Instruments classifi ed as Level 1 consist

of fi nancial instruments such as exchange-traded derivatives

(other than options), listed equities, and U.S. government

treasury securities.

• Level 2: “Inputs other than quoted prices included in

Level 1 that are observable for the asset or liability, either

directly or indirectly.” Instruments classifi ed as Level 2 con-

sist of fi nancial instruments such as non-exchange-traded

derivatives (other than options) valued using exchange

inputs and exchange-traded derivatives (other than options)

for which the market is not active.