PG&E 2008 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2008 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

between market participants at the measurement date, or

the “exit price.” The hierarchy gives the highest priority

to unadjusted quoted prices in active markets for identical

assets or liabilities (Level 1 measurements) and the lowest

priority to unobservable inputs (Level 3 measurements). Assets

and liabilities are classifi ed based on the lowest level of

input that is signifi cant to the fair value measurement. (See

Notes 2 and 12 of the Notes to the Consolidated Financial

Statements for further discussion on SFAS No. 157.)

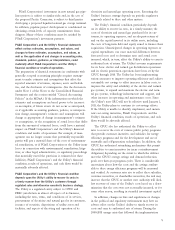

Level 3 Instruments at Fair Value

As Level 3 measurements are based on unobservable inputs,

signifi cant judgment may be used in the valuation of these

instruments. Accordingly, the following table sets forth the

fair values of instruments classifi ed as Level 3 within the fair

value hierarchy, along with a description of the valuation

technique for each type of instrument:

Value as of

December 31, January 1,

(in millions) 2008 2008

Money market investments

(held by PG&E Corporation) $ 12 $ —

Nuclear decommissioning trusts 5 8

Price risk management instruments (156) 115

Long-term disability trust 78 87

Dividend participation rights (42) (68)

Other (2) (4)

Total Level 3 Instruments $(105) $138

Level 3 fair value measurements represent approximately

5% of the total net value of all fair value measurements

of PG&E Corporation. During the twelve months ended

December 31, 2008, there were no material increases or

decreases in Level 3 assets or liabilities resulting from a

transfer of assets or liabilities from, or into, Level 1 or

Level 2. The majority of these instruments are accounted

for in accordance with SFAS No. 71, as amended, as they

are expected to be recovered or refunded through regulated

rates. Therefore, changes in the aggregate fair value of these

assets and liabilities (including realized and unrealized

gains and losses) are recorded within regulatory accounts

in the accompanying Consolidated Balance Sheets with the

exception of the dividend participation rights associated

with PG&E Corporation’s Convertible Subordinated Notes.

The changes in the fair value of the dividend participation

rights are refl ected in Other income (expense), net in PG&E

Corporation’s Consolidated Statements of Income. Changes

in the fair value of the Level 3 instruments did not have

a material effect on liquidity and capital resources as of

December 31, 2008.

Fixed income returns were projected based on real matu-

rity and credit spreads added to a long-term infl ation rate.

Equity returns were estimated based on estimates of dividend

yield and real earnings growth added to a long-term rate of

infl ation. For the Utility’s defi ned benefi t pension plan, the

assumed return of 7.3% compares to a ten-year actual return

of 4.6%.

The rate used to discount pension and other post-

retirement benefi t plan liabilities was based on a yield curve

developed from market data of approximately 300 Aa-grade

non-callable bonds at December 31, 2008. This yield curve

has discount rates that vary based on the duration of the

obligations. The estimated future cash fl ows for the pension

and other postretirement obligations were matched to the

corresponding rates on the yield curve to derive a weighted

average discount rate.

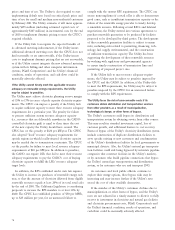

The following refl ects the sensitivity of pension costs and

projected benefi t obligation to changes in certain actuarial

assumptions:

Increase in

Projected

Increase Benefi t

Increase in 2008 Obligation at

(decrease) in Pension December 31,

(in millions) Assumption Costs 2008

Discount rate (0.5)% $15 $667

Rate of return on

plan assets (0.5)% 47 —

Rate of increase in

compensation 0.5% 17 162

The following refl ects the sensitivity of other post-

retirement benefi t costs and accumulated benefi t obligation

to changes in certain actuarial assumptions:

Increase Increase in

in 2008 Accumulated

Other Benefi t

Increase Post- Obligation at

(decrease) in retirement December 31,

(in millions) Assumption Benefi t Costs 2008

Health care cost trend rate 0.5% $6 $33

Discount rate (0.5)% 6 75

NEW ACCOUNTING POLICIES

FAIR VALUE MEASUREMENTS

On January 1, 2008, PG&E Corporation and the Utility

adopted the provisions of SFAS No. 157. SFAS No. 157

establishes a fair value hierarchy that prioritizes inputs to

valuation techniques used to measure the fair value of an

asset or liability. The objective of a fair value measurement

is to determine the price that would be received to sell an

asset or paid to transfer a liability in an orderly transaction