PG&E 2008 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2008 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

118

available, such as credit default swap spreads. When such

information is not available, internal models may be used.

As of December 31, 2008, the nonperformance and credit

risk adjustment represents approximately 5% of the net price

risk management value. As permitted under SFAS No. 157,

PG&E Corporation and the Utility utilize a mid-market

pricing convention (the mid-point between bid and ask

prices) as a practical expedient in valuing the majority

of its derivative assets and liabilities at fair value.

PG&E Corporation’s and the Utility’s fair value

measurements incorporate various factors required under

SFAS No. 157 such as the credit standing of the counter-

parties involved, nonperformance risk including the risk of

non performance by PG&E Corporation and the Utility on

their liabilities, the applicable exit market, and specifi c risks

inherent in the instrument. Nonperformance and credit

risk adjustments on the Utility’s price risk management

instruments are based on current market inputs when

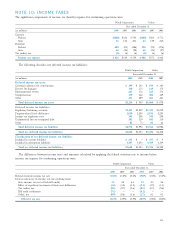

The following table sets forth the fair value hierarchy by level of PG&E Corporation’s and the Utility’s recurring fair

value fi nancial instruments as of December 31, 2008. The instruments are classifi ed based on the lowest level of input that is

signifi cant to the fair value measurement. PG&E Corporation’s and the Utility’s assessment of the signifi cance of a particular

input to the fair value measurement requires judgment, and may affect the valuation of fair value assets and liabilities and

their placement within the fair value hierarchy levels.

PG&E Corporation

Fair Value Measurements as of December 31, 2008

(in millions) Level 1 Level 2 Level 3 Total

Assets:

Money market investments (held by PG&E Corporation) $ 164 $ — $ 12 $ 176

Nuclear decommissioning trusts(1) 1,505 289 5 1,799

Rabbi trusts 66 — — 66

Long-term disability trust 99 — 78 177

Assets Total $1,834 $289 $ 95 $2,218

Liabilities:

Dividend participation rights $

— $ — $ 42 $ 42

Price risk management instruments(2) (49) 123 156 230

Other — — 2 2

Liabilities Total $

(49) $123 $200 $ 274

(1) Excludes taxes on appreciation of investment value.

(2) Balances include the impact of netting adjustments in accordance with the requirements of FIN 39-1 of $159 million to Level 1, $32 million to Level 2,

and $76 million to Level 3.

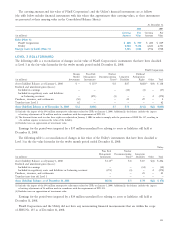

Utility

Fair Value Measurements as of December 31, 2008

(in millions) Level 1 Level 2 Level 3 Total

Assets:

Nuclear decommissioning trusts(1) $1,505 $289 $ 5 $1,799

Long-term disability trust 99 — 78 177

Assets Total $1,604 $289 $ 83 $1,976

Liabilities:

Price risk management instruments(2) $ (49) $123 $156 $ 230

Other — — 2 2

Liabilities Total $

(49) $123 $158 $ 232

(1) Excludes taxes on appreciation of investment value.

(2) Balances include the impact of netting adjustments in accordance with the requirements of FIN 39-1 of $159 million to Level 1, $32 million to Level 2,

and $76 million to Level 3.