PG&E 2008 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2008 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.115

NOTE 11: DERIVATIVES

AND HEDGING ACTIVITIES

The Utility enters into contracts to procure electricity,

natural gas, nuclear fuel, and fi rm transmission rights,

some of which meet the defi nition of a derivative under

SFAS No. 133. These contracts include physical and fi nan-

cial instruments, such as forwards, futures, swaps, options,

and other instruments and agreements, and are primarily

intended to reduce the volatility in the cost of electricity,

natural gas, nuclear fuel, and fi rm transmission rights. The

Utility uses derivative instruments only for non-trading pur-

poses (i.e., risk mitigation) and not for speculative purposes.

The Utility also has derivative instruments for the physical

delivery of commodities transacted in the normal course

of business. These derivative instruments are eligible for the

normal purchase and sales exception under SFAS No. 133,

where physical delivery is probable, in quantities that are

expected to be used by the Utility over a reasonable period

in the normal course of business, and where the price is not

tied to an unrelated underlying. Instruments that are eligible

for the normal purchase and sales exception are not refl ected

in the Consolidated Balance Sheets.

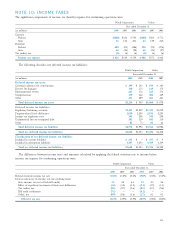

All such derivative instruments, including instruments

designated as cash fl ow hedges, are recorded at fair value

and presented as price risk management assets and liabilities

in the Consolidated Balance Sheets (see table below). As a

result of applying the provisions of SFAS No. 71, unrealized

changes in the fair value of derivative instruments are

deferred and recorded to regulatory assets or liabilities.

Under the same regulatory accounting treatment, changes

in the fair value of cash fl ow hedges are also recorded to

regulatory assets or liabilities, rather than being deferred

in accumulated other comprehensive income.

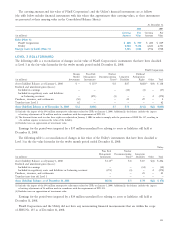

On December 24, 2008, PG&E Corporation fi led claims

with the California Franchise Tax Board to reduce tax on

income related to generator settlements from 2004 through

2007. As a result of the claims, the Utility recorded a tax

benefi t of $16 million in the fourth quarter 2008.

On January 30, 2009, PG&E Corporation reached a

tentative agreement with the IRS to resolve refund claims

related to the 1998 and 1999 tax years that, if approved

by the Joint Committee, would result in a cash refund of

approximately $200 million, plus interest. The refund would

result in net income of approximately $50 million. Because

the agreement is subject to Joint Committee approval, PG&E

Corporation has not recognized any benefi t associated with

the potential refund.

As of December 31, 2008, PG&E Corporation had

$68 million of federal capital loss carry forwards based

on tax returns as fi led, of which approximately $30 million

will expire if not used by tax year 2009.

The IRS is currently auditing tax years 2005 through

2007. For tax year 2008, PG&E Corporation has been

participating in the IRS’s Compliance Assurance Process

(“CAP”), a real-time audit process intended to expedite the

resolution of issues raised during audits. To date, no material

adjustments have been proposed for either the 2005 through

2007 audit or for the 2008 CAP, except for adjustments to

refl ect rollover impact of items settled from prior audits.

The California Franchise Tax Board is currently auditing

PG&E Corporation’s 2004 and 2005 combined California

income tax returns. To date, no material adjustments have

been proposed. In addition to the federal capital loss carry

forwards, PG&E Corporation has $2.1 billion of California

capital loss carry forwards based on tax returns as fi led,

the majority of which expired in tax year 2008.