PG&E 2008 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2008 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

114

$2 million, respectively, at December 31, 2008, and $55 mil-

lion and $22 million, respectively, at December 31, 2007.

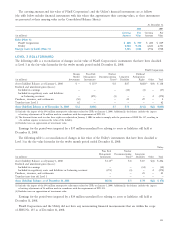

PG&E Corporation and the Utility do not expect the

company’s total amount of unrecognized tax benefi ts to

change signifi cantly within the next 12 months.

On July 9, 2008, PG&E Corporation was notifi ed

that the U.S. Congress’ Joint Committee on Taxation

(“Joint Committee”) had approved a settlement reached

with the IRS appellate division in the fi rst quarter of 2007

for tax years 1997 through 2000. As a result of the settlement,

PG&E Corporation received a $16 million refund from

the IRS in October 2008. This settlement did not result in

material changes to the amount of unrecognized tax benefi ts

that PG&E Corporation recorded under FIN 48.

On June 20, 2008, PG&E Corporation reached an agree-

ment with the IRS regarding a change in accounting method

related to the capitalization of indirect service costs for

tax years 2001 through 2004. This agreement resulted in

a $29 million benefi t from a reduction in interest expense

accrued on unrecognized tax benefi ts partially offset by a

$15 million liability associated with unrecognized state tax

benefi ts, for a net tax benefi t of approximately $14 million.

In addition, on June 27, 2008, PG&E Corporation agreed

to the revenue agent reports (“RARs”) from the IRS that

refl ected this agreement and resolved 2001 through 2004

audit issues. The RARs for the 2001 through 2004 audit

years were submitted to the Joint Committee for approval.

On October 28, 2008, the IRS executed a closing

agreement for the 2001 through 2004 audit years after

the Joint Committee indicated it took no exception to the

settlement. As a result of the settlement, PG&E Corporation

recognized after-tax income of approximately $257 million,

including interest, in the fourth quarter of 2008, of which

approximately $154 million was related to NEGT and recorded

as income from discontinued operations, and approximately

$60 million was attributable to the Utility. PG&E Corporation

expects to receive a tax refund from the IRS of approximately

$310 million, plus interest, as a result of the settlement,

of which approximately $170 million will be allocated to

the Utility. The after-tax income of $257 million includes

approximately $204 million, primarily related to a reduction

in PG&E Corporation’s unrecognized tax benefi ts and

additional claims allowed, and approximately $53 million

related to the utilization of federal capital loss carry forwards.

On January 1, 2007, PG&E Corporation and the Utility

adopted the provisions of FASB Interpretation No. 48,

“Accounting for Uncertainty in Income Taxes” (“FIN 48”).

Under FIN 48, a tax benefi t can be recognized only if it is

more likely than not that a tax position taken or expected to

be taken in a tax return will be sustained upon examination

by taxing authorities based on the merits of the position. The

tax benefi t recognized in the fi nancial statements is measured

based on the largest amount of benefi t that is greater than

50% likely of being realized upon settlement. The difference

between a tax position taken or expected to be taken in a

tax return and the benefi t recognized and measured pursuant

to FIN 48 represents an unrecognized tax benefi t. An unrec-

ognized tax benefi t is a liability that represents a potential

future obligation to the taxing authority.

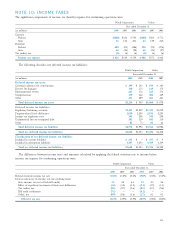

The following table reconciles the changes in unrecognized

tax benefi ts during 2008 and 2007:

PG&E

(in millions) Corporation Utility

Balance at January 1, 2007 $ 212 $ 90

Additions for tax position of prior years 15 4

Reductions for tax position of prior years (18) —

Balance at December 31, 2007 209 94

Additions for tax position of prior years 43 20

Decreases as a result of settlements

with the IRS (177) (77)

Balance at December 31, 2008 $ 75 $ 37

The component of unrecognized tax benefi ts that, if recog-

nized, would affect the effective tax rate at December 31, 2008

for PG&E Corporation and the Utility is $46 million and

$24 million, respectively.

PG&E Corporation and the Utility recognized a reduc-

tion in interest and penalties expense on unrecognized tax

benefi ts by $44 million and $21 million, respectively, as

of December 31, 2008. PG&E Corporation and the Utility

recognized interest and penalties expense on unrecognized

tax benefi ts of $7 million and $2 million, respectively, as of

December 31, 2007. Interest and penalties expense is classifi ed

as Income tax provision in the Consolidated Statements

of Income. Interest and penalties expense included in the

liability for uncertain tax position was $11 million and