PG&E 2008 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2008 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

140

CONTINGENCIES

PG&E CORPORATION

PG&E Corporation retains a guarantee related to certain

indemnity obligations of its former subsidiary, NEGT, that

were issued to the purchaser of an NEGT subsidiary company.

PG&E Corporation’s sole remaining exposure relates to any

potential environmental obligations that were known to

NEGT at the time of the sale but not disclosed to the pur-

chaser, and is limited to $150 million. PG&E Corporation

has not received any claims nor does it consider it probable

that any claims will be made under the guarantee. PG&E

Corporation believes its potential exposure under this guar-

antee would not have a material impact on its fi nancial

condition or results of operations.

UTILITY

Application to Recover Hydroelectric

Facility Divestiture Costs

On April 14, 2008, the Utility fi led an application with the

CPUC requesting authorization to recover approximately

$47 million, including $12.2 million of interest, of the

costs it incurred in connection with the Utility’s efforts to

determine the market value of its hydroelectric generation

facilities in 2000 and 2001. These efforts were undertaken at

the direction of the CPUC in preparation for the proposed

divestiture of the facilities to further the development of

a competitive generation market in California. The Utility

continues to own its hydroelectric generation assets. On

February 18, 2009, a proposed decision was issued by the

administrative law judge, which if adopted by the CPUC,

would allow the Utility to recover these costs. It is expected

that the CPUC will issue a fi nal decision in 2009.

California Department of Water Resources Contracts

Electricity purchased under the DWR-allocated power

purchase contracts with various generators provided

approximately 15.1% of the electricity delivered to the

Utility’s customers for the year ended December 31, 2008.

The DWR remains legally and fi nancially responsible for

its power purchase contracts. The Utility acts as a billing

and collection agent of the DWR’s revenue requirements

from the Utility’s customers.

provide security of supply. Pricing terms also are diversifi ed,

ranging from market-based prices to base prices that are esca-

lated using published indices. New agreements are primarily

based on forward market pricing and will begin to impact

nuclear fuel costs starting in 2010.

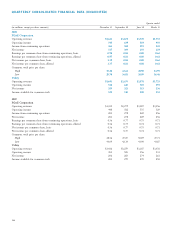

At December 31, 2008, the undiscounted obligations

under nuclear fuel agreements were as follows:

(in millions)

2009 $ 95

2010 108

2011 92

2012 79

2013 81

Thereafter 495

Total $950

Payments for nuclear fuel amounted to approximately

$157 million in 2008, $102 million in 2007, and $106 mil-

lion in 2006.

Other Commitments and Operating Leases

The Utility has other commitments relating to operating

leases, vehicle leasing, and telecommunication and infor-

mation system contracts. At December 31, 2008, the future

minimum payments related to other commitments were

as follows:

(in millions)

2009 $ 45

2010 18

2011 17

2012 17

2013 16

Thereafter 34

Total $147

Payments for other commitments and operating leases

amounted to approximately $41 million in 2008, $38 million

in 2007, and $100 million in 2006.

Underground Electric Facilities

At December 31, 2008, the Utility was committed to spending

approximately $228 million for the conversion of existing

overhead electric facilities to underground electric facilities.

These funds are conditionally committed depending on the

timing of the work, including the schedules of the respective

cities, counties, and telephone utilities involved. The Utility

expects to spend approximately $40 million to $60 million

each year in connection with these projects. Consistent with

past practice, the Utility expects that these capital expendi-

tures will be included in rate base as each individual project

is completed and recoverable in rates charged to customers.