PG&E 2008 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2008 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

116

The dividend participation rights of PG&E Corporation’s

Convertible Subordinated Notes, considered to be derivative

instruments, are recorded at fair value in PG&E Corporation’s

Consolidated Financial Statements in accordance with SFAS

No. 133. The dividend participation rights are not consid-

ered price risk management instruments, and thus are not

included in the tables above. (See Note 4 of the Notes to

the Consolidated Financial Statements for discussion of the

Convertible Subordinated Notes.)

As of December 31, 2008, PG&E Corporation and the

Utility had cash fl ow hedges with expiration dates through

December 2012 for energy contract derivative instruments.

Upon settlement of derivative instruments, including

those derivative instruments for which the normal purchase

and sales exception has been elected and derivative instru-

ments designated as cash fl ow hedges, any gains or losses

are recorded in the cost of electricity and the cost of natural

gas. All costs of electricity and natural gas are passed through

to customers. Cash infl ows and outfl ows associated with

the settlement of price risk management transactions are

recognized in operating cash fl ows on PG&E Corporation’s

and the Utility’s Consolidated Statements of Cash Flows.

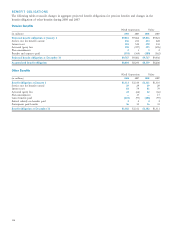

In PG&E Corporation’s and the Utility’s Consolidated Balance Sheets, price risk management assets and liabilities

associated with the Utility’s electricity and gas procurement activities are presented on a net basis by counterparty where

the right of offset exists. As PG&E Corporation and the Utility adopted the provisions of FIN 39-1 on January 1, 2008,

the net balances include outstanding cash collateral associated with derivative positions. (See Note 2 of the Notes to the

Consolidated Financial Statements for discussion of the adoption of FIN 39-1.) The table below shows the total price risk

management derivative balances and the portions that are designated as cash fl ow hedges as of December 31, 2008:

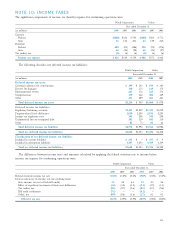

Price Risk Management Derivatives Balance at December 31, 2008

Derivatives with Designated as Total Price Risk

No Hedge Cash Flow Cash Management

(in millions) Designation Hedges Collateral Derivatives

Current Assets — Prepaid expenses and other $ 55 $ — $ 55 $110

Other Noncurrent Assets — Other 81 — 67 148

Current Liabilities — Other 132 139 (75) 196

Noncurrent Liabilities — Other 150 211 (69) 292

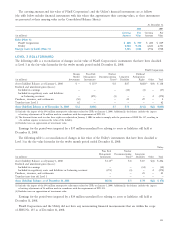

The table below shows the total price risk management derivative balances and the portions that are designated as cash

fl ow hedges as of December 31, 2007:

Price Risk Management Derivatives Balance at December 31, 2007

Derivatives with Designated as Total Price Risk

No Hedge Cash Flow Cash Management

(in millions) Designation Hedges Collateral(2) Derivatives

Current Assets — Prepaid expenses and other $54 $ (2)(1) $ 3 $ 55

Other Noncurrent Assets — Other 83 42 46 171

Current Liabilities — Other 71 12 (16) 67

Noncurrent Liabilities — Other 17 3 — 20

(1) $2 million of the cash fl ow hedges in a liability position at December 31, 2007 related to counterparties for which the total net derivatives position is

a current asset.

(2) The net cash collateral receivable balance was classifi ed as Current Assets — Prepaid expenses and other in the 2007 Annual Report. Amounts have been

reclassifi ed in accordance with FIN 39-1.