PG&E 2008 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2008 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

139

Capacity payments, which allow QFs to recover

investment costs, are based on the QF’s total available

capacity and contractual capacity commitment. Capacity

payments may be adjusted if the QF exceeds or fails to

meet performance requirements specifi ed in the applicable

power purchase agreement.

Natural Gas Supply and Transportation Commitments

The Utility purchases natural gas directly from producers

and marketers in both Canada and the United States to

serve its core customers. The contract lengths and natural

gas sources of the Utility’s portfolio of natural gas procure-

ment contracts have fl uctuated generally based on market

conditions. At December 31, 2008, the Utility’s undiscounted

obligations for natural gas purchases and gas transportation

services were as follows:

(in millions)

2009 $ 898

2010 183

2011 115

2012 49

2013 42

Thereafter 157

Total $1,444

Payments for natural gas purchases and gas transportation

services amounted to approximately $2.7 billion in 2008,

$2.2 billion in 2007, and $2.2 billion in 2006.

Nuclear Fuel Agreements

The Utility has entered into several purchase agreements

for nuclear fuel. These agreements have terms ranging from

1 to 16 years and are intended to ensure long-term fuel sup-

ply. The contracts for uranium, conversion, and enrichment

services provide for 100% coverage of reactor requirements

through 2010, while contracts for fuel fabrication services

provide for 100% coverage of reactor requirements through

2011. The Utility relies on a number of international pro-

ducers of nuclear fuel in order to diversify its sources and

The following table shows the future fi xed capacity

payments due under the QF contracts that are accounted

for as capital leases. These amounts are also included in the

table above. The fi xed capacity payments are discounted to

the present value shown in the table below using the Utility’s

incremental borrowing rate at the inception of the leases.

The amount of this discount is shown in the table below

as the amount representing interest:

(in millions)

2009 $ 50

2010 50

2011 50

2012 50

2013 50

Thereafter 204

Total fi xed capacity payments 454

Amount representing interest 110

Present value of fi xed capacity payments $344

Minimum lease payments associated with the lease

obligation are included in Cost of electricity on PG&E

Corporation’s and the Utility’s Consolidated Statements

of Income. In accordance with SFAS No. 71, the timing of

the Utility’s recognition of the lease expense conforms to the

ratemaking treatment for the Utility’s recovery of the cost of

electricity. The QF contracts that are accounted for as capital

leases expire between April 2014 and September 2021.

At December 31, 2008, the Utility had approximately

$30 million included in Current Liabilities — Other

and $314 million included in Noncurrent Liabilities — Other

representing the present value of the fi xed capacity payments

due under these contracts recorded on the Utility’s Consoli-

dated Balance Sheets. The corresponding assets of $344 mil-

lion, including amortization of $64 million, are included in

Property, Plant, and Equipment on the Utility’s Consolidated

Balance Sheets at December 31, 2008.

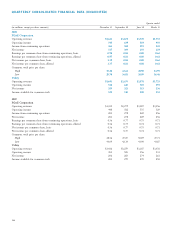

At December 31, 2008, the undiscounted future expected power purchase agreement payments were as follows:

Irrigation District &

Qualifying Facility Water Agency Renewable Other

Operations & Debt Total

(in millions) Energy Capacity Maintenance Service Energy Capacity Energy Capacity Payments

2009 $ 949 $ 412 $ 38 $ 26 $ 427 $12 $ 5 $ 270 $ 2,139

2010 960 378 45 23 460 7 6 281 2,160

2011 947 364 46 21 602 7 7 164 2,158

2012 808 334 32 21 688 7 7 86 1,983

2013 755 324 21 15 583 — 7 71 1,776

Thereafter 4,882 1,866 46 38 6,986 — 3 1,038 14,859

Total $9,301 $3,678 $228 $144 $9,746 $33 $35 $1,910 $25,075