PG&E 2008 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2008 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

127

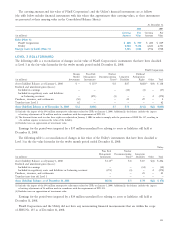

CHANGE IN PLAN ASSETS

To determine the fair value of the plan assets, PG&E Corporation and the Utility use publicly quoted market values and

independent pricing services depending on the nature of the assets, as reported by the trustee.

The following tables reconcile aggregate changes in plan assets during 2008 and 2007:

Pension Benefi ts

PG&E Corporation Utility

(in millions) 2008 2007 2008 2007

Fair value of plan assets at January 1 $ 9,540 $9,028 $ 9,540 $9,028

Actual return on plan assets (1,232) 766 (1,232) 766

Company contributions 182 139 179 137

Benefi ts and expenses paid (424) (393) (421) (391)

Fair value of plan assets at December 31 $ 8,066 $9,540 $ 8,066 $9,540

Other Benefi ts

PG&E Corporation Utility

(in millions) 2008 2007 2008 2007

Fair value of plan assets at January 1 $1,331 $1,256 $1,331 $1,256

Actual return on plan assets (316) 107 (316) 107

Company contributions 48 38 48 38

Plan participant contribution 36 36 36 36

Benefi ts and expenses paid (109) (106) (109) (106)

Fair value of plan assets at December 31 $ 990 $1,331 $ 990 $1,331

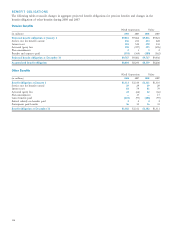

FUNDED STATUS

The following schedule shows the plans’ aggregate funded status on a plan sponsor basis. The funded status is the difference

between the fair value of plan assets and projected benefi t obligations.

Pension Benefi ts

PG&E Corporation Utility

December 31, December 31,

(in millions) 2008 2007 2008 2007

Fair value of plan assets at December 31 $ 8,066 $ 9,540 $ 8,066 $ 9,540

Projected benefi t obligation at December 31 (9,767) (9,081) (9,717) (9,036)

Prepaid/(accrued) benefi t cost $(1,701) $ 459 $(1,651) $ 504

Noncurrent asset $ — $ 532 $

— $ 532

Current liability (5) (2) (3) (3)

Noncurrent liability (1,696) (71) (1,648) (25)

Prepaid/(accrued) benefi t cost $(1,701) $ 459 $(1,651) $ 504

Other Benefi ts

PG&E Corporation Utility

December 31, December 31,

(in millions) 2008 2007 2008 2007

Fair value of plan assets at December 31 $ 990 $ 1,331 $ 990 $ 1,331

Benefi t obligation at December 31 (1,382) (1,311) (1,382) (1,311)

Prepaid/(accrued) benefi t cost $

(392) $ 20 $ (392) $ 20

Noncurrent asset $ — $ 54 $

— $ 5 4

Noncurrent liability (392) (34) (392) (34)

Prepaid/(accrued) benefi t cost $

(392) $ 20 $ (392) $ 20