PG&E 2008 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2008 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

137

At December 31, 2008 and December 31, 2007, the Utility

had a receivable of approximately $29 million from PG&E

Corporation included in Accounts receivable — Related

parties and Other Noncurrent Assets — Related parties

receivable on the Utility’s Consolidated Balance Sheets and

a payable of approximately $25 million and $28 million,

respectively, to PG&E Corporation included in Accounts

payable — Related parties on the Utility’s Consolidated

Balance Sheets.

NOTE 17: COMMITMENTS

AND CONTINGENCIES

PG&E Corporation and the Utility have substantial fi nancial

commitments in connection with agreements entered into to

support the Utility’s operating activities. PG&E Corporation

and the Utility also have signifi cant contingencies arising from

their operations, including contingencies related to guarantees,

regulatory proceedings, nuclear operations, employee matters,

environmental compliance and remediation, tax matters,

and legal matters.

COMMITMENTS

UTILITY

Third-Party Power Purchase Agreements

As part of the ordinary course of business, the Utility

enters into various agreements to purchase electric energy

and capacity and makes payments under existing power

purchase agreements. The price of purchased power may

be fi xed or variable. Variable pricing is generally based on

either the current market price of gas or electricity at the

date of purchase.

Qualifying Facility Power Purchase Agreements — Under

the Public Utility Regulatory Policies Act of 1978 (“PURPA”),

electric utilities were required to purchase energy and capacity

from independent power producers that are qualifying

co-generation facilities and qualifying small power production

facilities (“QFs”). To implement the purchase requirements

of PURPA, the CPUC required California investor-owned

electric utilities to enter into long-term power purchase agree-

ments with QFs and approved the applicable terms, condi-

tions, prices, and eligibility requirements. These agreements

require the Utility to pay for energy and capacity. Energy

payments are based on the QF’s actual electrical output and

CPUC-approved energy prices, while capacity payments are

based on the QF’s total available capacity and contractual

capacity commitment. Capacity payments may be adjusted

if the QF exceeds or fails to meet performance requirements

specifi ed in the applicable power purchase agreement.

PG&E Corporation and the Utility are unable to predict

when the FERC or judicial proceedings will be resolved, and

the amount of any potential refunds that the Utility may

receive or the amount of disputed claims, including interest,

the Utility will be required to pay.

NOTE 16: RELATED

PARTY AGREEMENTS

AND TRANSACTIONS

In accordance with various agreements, the Utility and other

subsidiaries provide and receive various services to and from

their parent, PG&E Corporation, and among themselves.

The Utility and PG&E Corporation exchange administrative

and professional services in support of operations. Services

provided directly to PG&E Corporation by the Utility are

priced at the higher of fully loaded cost (i.e., direct cost of

good or service and allocation of overhead costs) or fair mar-

ket value, depending on the nature of the services. Services

provided directly to the Utility by PG&E Corporation are

priced at the lower of fully loaded cost or fair market value,

depending on the nature and value of the services. PG&E

Corporation also allocates various corporate administrative

and general costs to the Utility and other subsidiaries using

agreed-upon allocation factors, including the number of

employees, operating expenses excluding fuel purchases, total

assets, and other cost allocation methodologies. Management

believes that the methods used to allocate expenses are rea-

sonable and meet the reporting and accounting requirements

of its regulatory agencies.

The Utility’s signifi cant related party transactions were

as follows:

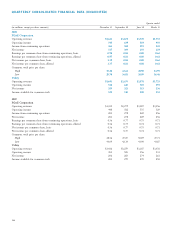

Year ended December 31,

(in millions) 2008 2007 2006

Utility revenues from:

Administrative services provided

to PG&E Corporation $ 4 $ 4 $ 5

Interest from PG&E Corporation

on employee benefi t assets — 1 1

Utility expenses from:

Administrative services received

from PG&E Corporation $122 $107 $108

Utility employee benefi t payments

provided to PG&E Corporation 2 4 3