PG&E 2008 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2008 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

129

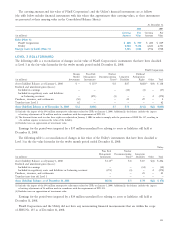

COMPONENTS OF ACCUMULATED OTHER COMPREHENSIVE INCOME

Since December 31, 2006, the effective date of SFAS No. 158, PG&E Corporation and the Utility have recorded unrecognized

prior service costs, unrecognized gains and losses, and unrecognized net transition obligations as components of accumulated

other comprehensive income, net of tax. In subsequent years, PG&E Corporation and the Utility recognize these amounts

as components of net periodic benefi t cost in accordance with SFAS No. 87, “Employers’ Accounting for Pensions,” and

SFAS No. 106.

Pre-tax amounts recognized in accumulated other comprehensive income consist of:

PG&E Corporation Utility

(in millions) 2008 2007 2008 2007

Pension Benefi ts:

Beginning unrecognized prior service cost $ (222) $(268) $ (226) $(275)

Current year unrecognized prior service cost (2) (3) (3) (2)

Amortization of unrecognized prior service cost 49 49 48 51

Unrecognized prior service cost (175) (222) (181) (226)

Beginning unrecognized net gain (loss) 105 (318) 117 (306)

Current year unrecognized net gain (loss) (2,219) 421 (2,217) 423

Amortization of unrecognized net gain 1 2 — —

Unrecognized net gain (loss) (2,113) 105 (2,100) 117

Beginning unrecognized net transition obligation — (1) — (1)

Amortization of unrecognized net transition obligation — 1 — 1

Unrecognized net transition obligation — — — —

Less: transfer to regulatory account(1) 2,259 109 2,259 109

Total $ (29) $ (8) $ (22) $ —

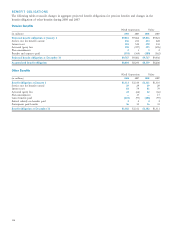

Other Benefi ts:

Beginning unrecognized prior service cost $ (116) $(114) $ (116) $(114)

Current year unrecognized prior service cost — (18) — (18)

Amortization of unrecognized prior service cost 17 16 17 16

Unrecognized prior service cost (99) (116) (99) (116)

Beginning unrecognized net gain 311 250 311 250

Current year unrecognized net gain (loss) (438) 71 (438) 71

Amortization of unrecognized net loss (15) (10) (15) (10)

Unrecognized net gain (loss) (142) 311 (142) 311

Beginning unrecognized net transition obligation (128) (154) (128) (154)

Amortization of unrecognized net transition obligation 26 26 26 26

Unrecognized net transition obligation (102) (128) (102) (128)

Less: transfer to regulatory account(2) — (44) — (44)

Total $ (343) $ 23 $ (343) $ 23

(1) The Utility recorded approximately $2,259 million in 2008 and $109 million in 2007 as a reduction to the existing pension regulatory liability in

accordance with the provisions of SFAS No. 71. The adjustment resulted in a regulatory asset balance at December 31, 2008.

(2) The Utility recorded approximately $44 million in 2007 as an addition to the existing pension regulatory liability in accordance with the provisions

of SFAS No. 71.