PG&E 2008 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2008 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

131

During 2007, PG&E Corporation began extending

the benchmarks of its fi xed income managers and began

using interest rate swaps for certain plans in order to better

match the interest rate sensitivity of the plans’ assets with

that of the plans’ liabilities. Changes in the value of these

investments will affect future contributions to the trust and

net periodic benefi t cost on a lagged basis.

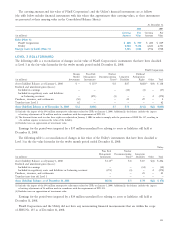

CASH FLOW INFORMATION

Employer Contributions

PG&E Corporation and the Utility contributed approxi-

mately $182 million to the pension benefi ts, including

$176 million to the qualifi ed defi ned benefi t pension plan,

and approximately $48 million to the other benefi t plans

in 2008. These contributions are consistent with PG&E

Corporation’s and the Utility’s funding policy, which is to

contribute amounts that are tax-deductible and consistent

with applicable regulatory decisions and federal minimum

funding requirements. None of these pension or other

benefi ts was subject to a minimum funding requirement

requiring a cash contribution in 2008. The Utility’s pension

benefi ts met all the funding requirements under the Employee

Retirement Income Security Act of 1974, as amended. PG&E

Corporation and the Utility expect to make total contribu-

tions of approximately $176 million annually during 2009

and 2010 to the pension plan and expect to make contribu-

tions of approximately $58 million annually for the years

2009 and 2010 to other postretirement benefi t plans.

Equity securities include a small amount (less than 0.1%

of total plan assets) of PG&E Corporation common stock.

During 2008, the duration of fi xed income assets was

extended to better align with the interest rate sensitivity

of the benefi t plan liability. The maturity of fi xed income

securities at December 31, 2008 ranged from zero to 59 years

and the average duration of the bond portfolio was approxi-

mately 12.2 years. The maturity of fi xed income securities

at December 31, 2007 ranged from zero to 60 years and the

average duration of the bond portfolio was approximately

10.5 years.

PG&E Corporation’s investment strategy for all plans is

to maintain actual asset weightings within 1.0% to 5.0% of

target asset allocations varying by asset class. A rebalancing

review is triggered whenever the actual weighting falls outside

of the specifi ed range.

A benchmark portfolio for each asset class is set

based on market capitalization and valuations of equities

and the durations and credit quality of fi xed income

securities. Investment managers for each asset class are

retained to either passively or actively manage the combined

portfolio against the benchmark. Active management covers

approximately 70% of the U.S. equity, 80% of the non-U.S.

equity, and virtually 100% of the fi xed income and global

security portfolios.

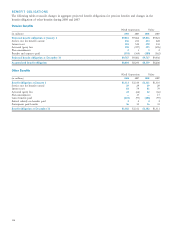

ASSET ALLOCATIONS

The asset allocation of PG&E Corporation’s and the Utility’s pension and other benefi t plans at December 31, 2008 and

2007, and target 2009 allocation, were as follows:

Pension Benefi ts Other Benefi ts

2009 2008 2007 2009 2008 2007

Equity securities

U.S. equity 32% 31% 30% 37% 35% 36%

Non-U.S. equity 18% 17% 18% 18% 16% 19%

Global equity 5% 3% 5% 3% 2% 4%

Absolute return 5% 4% 5% 3% 3% 3%

Fixed income securities 40% 42% 41% 34% 34% 37%

Cash 0% 3% 1% 5%

10% 1%

Total 100% 100% 100% 100% 100% 100%