PG&E 2008 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2008 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

134

Although the recipients of restricted stock can vote

their shares, they may not sell or transfer their shares

until the shares vest. For restricted stock awarded in 2005,

there were no performance criteria and the restrictions

lapsed ratably over four years. The terms of the restricted

stock awarded in 2006, 2007, and 2008 provide that 60%

of the shares will vest over a period of three years at the

rate of 20% per year. If PG&E Corporation’s annual total

shareholder return (“TSR”) is in the top quartile of its

comparator group, as measured for the three immediately

preceding calendar years, the restrictions on the remain-

ing 40% of the shares will lapse in the third year. If PG&E

Corporation’s TSR is not in the top quartile for such period,

then the restrictions on the remaining 40% of the shares

will lapse in the fi fth year. Compensation expense related

to the portion of the restricted stock award that is subject to

conditions based on TSR is recognized over the shorter of the

requisite service period and three years. Dividends declared

on restricted stock are paid to recipients only when the

restricted stock vests.

As of December 31, 2008, there was less than $1 million

of total unrecognized compensation cost related to outstand-

ing stock options. That cost is expected to be recognized

over a weighted average period of less than one year for

PG&E Corporation and the Utility.

Restricted Stock

During 2008, PG&E Corporation awarded 591,294 shares

of PG&E Corporation restricted common stock to eligible

participants of PG&E Corporation and its subsidiaries,

of which 396,854 shares were awarded to the Utility’s

eligible participants.

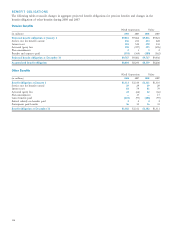

The following table summarizes stock option activity for PG&E Corporation and the Utility for 2008:

Weighted

Average

Remaining

Weighted Average Contractual Aggregate

Options Shares Exercise Price Term Intrinsic Value

Outstanding at January 1 3,882,672 $ 24.00

Granted(1) 4,032 $ 37.91

Exercised (900,732) $ 25.72

Forfeited or expired (17,711) $ 31.49

Outstanding at December 31 2,968,261 $23.45 3.75 $45,300,037

Expected to vest at December 31 254,854 $33.74 6.00 $ 1,270,206

Exercisable at December 31 2,712,725 $22.48 3.54 $44,029,831

(1) No stock options were awarded to employees in 2008; however, certain non-employee directors of PG&E Corporation were awarded stock options.

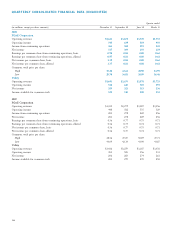

The following table summarizes stock option activity for the Utility for 2008:

Weighted

Average

Remaining

Weighted Average Contractual Aggregate

Options Shares Exercise Price Term Intrinsic Value

Outstanding at January 1(1) 2,912,552 $ 23.40

Granted — —

Exercised (588,333) $ 24.86

Forfeited or expired (14,396) $ 31.14

Outstanding at December 31(1) 2,309,823 $22.99 3.79 $36,318,945

Expected to vest at December 31 164,303 $33.09 5.80 $ 923,072

Exercisable at December 31 2,145,520 $22.21 3.64 $35,395,873

(1) Includes net employee transfers between PG&E Corporation and the Utility during 2008.