PG&E 2008 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2008 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.35

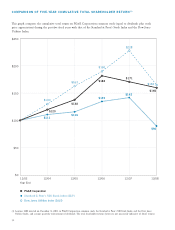

KEY FACTORS AFFECTING RESULTS OF

OPERATIONS AND FINANCIAL CONDITION

PG&E Corporation’s and the Utility’s results of operations

and fi nancial condition depend primarily on whether the

Utility is able to operate its business within authorized

revenue requirements, timely recover its authorized costs,

and earn its authorized rate of return. A number of factors

have had, or are expected to have, a signifi cant impact on

PG&E Corporation’s and the Utility’s results of operations

and fi nancial condition, including:

• The Outcome of Regulatory Proceedings and the Impact of

Ratemaking Mechanisms — Most of the Utility’s revenue

requirements are set based on its costs of service in pro-

ceedings such as the General Rate Case (“GRC”) fi led with

the CPUC and transmission owner (“TO”) rate cases fi led

with the FERC. Unlike the current GRC, which set revenue

requirements for a four-year period (2007 through 2010),

it is expected that the next GRC will set revenue require-

ments for the Utility’s electric and natural gas distribution

operations and electric generation operations for a three-

year period (2011 through 2013). From time to time, the

Utility also fi les separate applications requesting the CPUC

or the FERC to authorize additional revenue requirements

for specifi c capital expenditure projects, such as new power

plants, gas or electric transmission facilities, installation

of an advanced metering infrastructure, and reliability or

system infrastructure improvements. The Utility’s revenues

will also be affected by incentive ratemaking, including the

CPUC’s customer energy effi ciency shareholder incentive

mechanism. (See “Regulatory Matters” below.) In addition,

the CPUC has authorized the Utility to recover 100%

of its reasonable electric fuel and energy procurement costs

and has established a timely rate adjustment mechanism

to recover such costs. As a result, the Utility’s revenues

and costs can be affected by volatility in the prices

of natural gas and electricity. (See “Risk Management

Activities” below.)

• Capital Structure and Return on Common Equity —

The Utility’s current CPUC-authorized capital structure

includes a 52% common equity component. The CPUC

has authorized the Utility to earn an ROE of 11.35%

on the equity component of its electric and natural gas

distribution and electric generation rate base. The Utility’s

capital structure is set until 2011, and its cost of capital

components, including an 11.35% ROE, will only be

changed before 2011 if the annual automatic adjustment

mechanism established by the CPUC is triggered. If the

12-month October through September average yield for

the Moody’s Investors Service (“Moody’s”) utility bond

index increases or decreases by more than 1% as com-

pared to the applicable benchmark, the Utility can adjust

its authorized cost of capital effective on January 1 of

the following year. The 12-month October 2007 through

September 2008 average yield of the Moody’s utility bond

index did not trigger a change in the Utility’s authorized

cost of capital for 2009. The Utility can also apply for an

adjustment to either its capital structure or cost of capital

at any time in the event of extraordinary circumstances.

• The Ability of the Utility to Control Costs While Improving

Operational Effi ciency and Reliability — The Utility’s

revenue requirements are generally set at a level to allow

the Utility the opportunity to recover its basic forecasted

operating expenses, as well as to earn an ROE and recover

depreciation, tax, and interest expense associated with

authorized capital expenditures. Differences in the amount

or timing of forecasted and actual operating expenses and

capital expenditures can affect the Utility’s ability to earn

its authorized rate of return and the amount of PG&E

Corporation’s net income available for shareholders. When

capital expenditures are higher than authorized levels, the

Utility incurs associated depreciation, property tax, and

interest expense, but does not recover revenues to offset

these expenses or earn an ROE until the capital expen-

ditures are added to rate base in future rate cases. Items

that could cause higher expenses than provided for in

the last GRC primarily relate to the Utility’s efforts to

maintain the aging infrastructure of its electric and natural

gas systems and to improve the reliability and safety of its

electric and natural gas systems, as well as to higher debt

interest rates and to expenditures for technology infra-

structure and support. In addition, the Utility intends to

accelerate the work associated with system-wide gas leak

surveys and targets completing this work in a little more