PG&E 2008 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2008 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

103

The Utility is generally authorized to recover 100% of its

electric fuel and energy procurement costs. The Utility fi les

annual forecasts of purchased power costs that it expects to

incur during the following year and rates are set to recover

such expected costs. The energy resource recovery account

tracks actual electric costs and recoveries of fuel and energy

procurement costs, excluding the DWR’s contract costs. The

CPUC has established a mechanism to adjust the Utility’s

rates whenever the forecasted aggregate over-collections or

under-collections of the Utility’s electric procurement costs

for the current year exceed 5% of the Utility’s prior year

generation revenues, excluding generation revenues for DWR

contracts. In accordance with this mechanism, on August 21,

2008, the CPUC approved the Utility’s request to collect

from customers the forecasted 2008 end-of-year under-

collection of procurement costs, due mainly to rising natural

gas costs and lower than forecasted hydroelectric generation.

Effective October 1, 2008, customer rates were adjusted to

allow the Utility to collect $645 million in procurement

costs through December 2009. On December 30, 2008, the

Utility requested that its electric rates be adjusted, effective

January 1, 2009, to refl ect the revised forecast of electricity

prices, which are expected to be lower than originally fore-

casted as a result of lower natural gas prices. The January 1,

2009 rate changes refl ect a net decrease of $101 million in

electric revenues versus revenues based on rates effective

October 1, 2008.

The modifi ed transition cost balancing account is used to

track the recovery of ongoing competition transition costs

(“CTC”), primarily consisting of above-market costs associ-

ated with power purchase contracts that were being collected

in CPUC-approved rates on or before December 20, 1995

(including costs incurred by the Utility with CPUC approval

to restructure, renegotiate, or terminate the contracts). The

recovery of ongoing CTC can continue for the term of the

contract. The amount of above-market costs associated with

the eligible power purchase contracts is determined each

year in the ERRA forecast proceeding by comparing the

ongoing CTC-eligible contract costs to a CPUC-approved

market benchmark to determine whether there are stranded

costs associated with these contracts.

The transmission revenue balancing account tracks certain

electric transmission revenues for recovery from customers.

The balance in this account represents the difference between

transmission wheeling revenues received by the Utility from

the ISO (on behalf of electric transmission wholesale cus-

tomers) and refunds to customers plus interest.

Current Regulatory Liabilities

As of December 31, 2008 and 2007, the Utility had current

regulatory liabilities of approximately $313 million and

$280 million, respectively, primarily consisting of the current

portion of electric transmission wheeling revenue refunds

and amounts that the Utility expects to refund to customers

for over-collected electric transmission rates. Current regula-

tory liabilities are included in Current Liabilities — Other

in the Consolidated Balance Sheets.

REGULATORY BALANCING ACCOUNTS

The Utility uses revenue regulatory balancing accounts

to accumulate differences between revenues and the Utility’s

authorized revenue requirements and cost regulatory

balancing accounts to accumulate differences between

incurred costs and revenues. Under-collections that are

probable of recovery through regulated rates are recorded

as regulatory balancing account assets. Over-collections

that are probable of being credited to customers are recorded

as regulatory balancing account liabilities.

The Utility’s current regulatory balancing accounts accu-

mulate balances until they are refunded to or received from

the Utility’s customers through authorized rate adjustments

within the next 12 months. Regulatory balancing accounts

that the Utility does not expect to collect or refund in the

next 12 months are included in Other Noncurrent Assets —

Regulatory assets and Noncurrent Liabilities — Regulatory

liabilities in the Consolidated Balance Sheets. The CPUC

does not allow the Utility to offset regulatory balancing

account assets against regulatory balancing account liabilities.

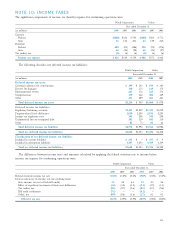

Current Regulatory Balancing Accounts

Receivable (Payable)

Balance at December 31,

(in millions) 2008 2007

Energy resource recovery $ 384 $ 149

Modifi ed transition cost 214 93

Transmission revenue 173 203

Utility generation 164 90

Energy Recovery Bonds (231) (274)

Public purpose programs (264) (16)

Reliability services 12 (96)

Other 15 (51)

Total regulatory balancing accounts, net $ 467 $ 98