PG&E 2008 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2008 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

136

As of December 31, 2008, the Utility’s net disputed

claims liability was approximately $1,750 million, consist-

ing of approximately $1,580 million of remaining disputed

claims (classifi ed on the Consolidated Balance Sheets

as Accounts payable — Disputed claims and customer

refunds) and interest accrued at the FERC-ordered rate

of $664 million (classifi ed on the Consolidated Balance

Sheets as Interest payable) offset by accounts receivable

from the CAISO and PX of approximately $494 million

(classifi ed on the Consolidated Balance Sheets as Accounts

receivable — Customers).

In connection with the Utility’s proceedings under

Chapter 11, the Utility established an escrow account for

the payment of the disputed claims, which is classifi ed on

the Consolidated Balance Sheets as Restricted cash. As of

December 31, 2008, the Utility held $1,212 million in escrow,

including interest earned, for payment of the remaining net

disputed claims.

Interest accrues on the liability for disputed claims at

the FERC-ordered rate, which is higher than the rate earned

by the Utility on the escrow balance. Although the Utility

has been collecting the difference between the accrued inter-

est and the earned interest from customers, this amount is

not held in escrow. If the amount of interest accrued at the

FERC-ordered rate is greater than the amount of interest

ultimately determined to be owed with respect to disputed

claims, the Utility would refund to customers any excess

net interest collected from customers. The amount of any

interest that the Utility may be required to pay will depend

on the fi nal amounts to be paid by the Utility with respect

to the disputed claims.

The Utility and the PX have been negotiating the terms

of a proposed agreement regarding the potential transfer of

$700 million to the PX from the Utility’s escrow account

established for disputed claims to enable the PX to fund

future settlements and pay refund claims, or amounts owed

to CAISO or PX markets, as may be authorized by the

FERC or a court of competent jurisdiction. The proposed

agreement would be subject to approval by the FERC and

by the bankruptcy courts that have jurisdiction of the

Chapter 11 proceedings of the PX and the Utility. Under

the proposed agreement, the Utility’s payment would reduce

its liability for remaining net disputed claims. To protect

the Utility against the imposition of double liability, the

proposed agreement would provide that, to the extent that

both the PX and an individual electricity supplier have fi led

claims relating to the same transaction, such claim would be

paid by the Utility only once, either to the PX or directly to

the electricity supplier, as may be ordered by the FERC or a

court of competent jurisdiction. It is uncertain when a fi nal

agreement will be executed and, if executed, when required

approvals would be obtained.

NOTE 15: RESOLUTION OF

REMAINING CHAPTER 11

DISPUTED CLAIMS

Various electricity suppliers fi led claims in the Utility’s

proceeding under Chapter 11 seeking payment for energy

supplied to the Utility’s customers through the wholesale

electricity markets operated by the CAISO and the California

Power Exchange (“PX”) between May 2000 and June 2001.

These claims, which the Utility disputes, are being addressed

in various FERC and judicial proceedings in which the State

of California, the Utility, and other electricity purchasers

are seeking refunds from electricity suppliers, including

municipal and governmental entities, for overcharges

incurred in the CAISO and the PX wholesale electricity

markets between May 2000 and June 2001.

While the FERC and judicial proceedings have been

pending, the Utility entered into a number of settlements

with various electricity suppliers to resolve some of these

disputed claims and to resolve the Utility’s refund claims

against these electricity suppliers. These settlement agree-

ments provide that the amounts payable by the parties

are, in some instances, subject to adjustment based on the

outcome of the various refund offset and interest issues

being considered by the FERC. The proceeds from these

settlements, after deductions for contingencies based on

the outcome of the various refund offset and interest issues

being considered by the FERC, will continue to be refunded

to customers in rates. Additional settlement discussions

with other electricity suppliers are ongoing. Any net refunds,

claim offsets, or other credits that the Utility receives from

energy suppliers through resolution of the remaining disputed

claims, either through settlement or the conclusion of the

various FERC and judicial proceedings, will also be credited

to customers.

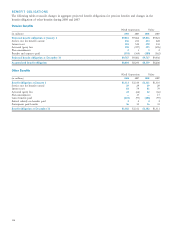

The following table presents the changes in the remain-

ing disputed claims liability and interest accrued from

December 31, 2007:

(in millions)

Balance at December 31, 2007 $ 1,719

Interest accrued 80

Less: Settlements (49)

Balance at December 31, 2008 $1,750