PG&E 2008 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2008 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104

NOTE 4: DEBT

LONG-TERM DEBT

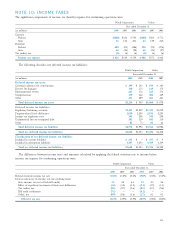

The following table summarizes PG&E Corporation’s and

the Utility’s long-term debt:

Balance at December 31,

(in millions) 2008 2007

PG&E Corporation

Convertible subordinated notes,

9.50%, due 2010 $ 280 $ 280

Utility

Senior notes:

3.60% due 2009 600 600

4.20% due 201

1 500 500

6.25% due 2013 400 —

4.80% due 2014 1,000 1,000

5.625% due 2017 700 500

8.25% due 2018 800 —

6.05% due 2034 3,000 3,000

5.80% due 2037 700 700

6.35% due 2038 400 —

Less: current portion (600) —

Unamortized discount, net of premium (22) (22)

Total senior notes 7,478 6,278

Pollution control bonds:

Series 1996 C, E, F, 1997 B, variable rates(1),

due 2026(2) 614 614

Series 1996 A, 5.35%, due 2016 200 200

Series 2004 A-D, 4.75%, due 2023 345 345

Series 2005 A-G, variable rates,

due 2016 and 2026(3) — 454

Series 2008 A-D, variable rates(4),

due 2016 and 2026(5) 309 —

Series 2008 F and G, 3.75%(6),

due 2018 and 2026 95 —

Total pollution control bonds 1,563 1,613

Total Utility long-term debt,

net of current portion 9,041 7,891

Total consolidated long-term debt,

net of current portion $9,321 $8,171

(1) At December 31, 2008, interest rates on these bonds and the related

loans ranged from 0.75% to 1.20%.

(2) Each series of these bonds is supported by a separate letter of credit, which

expires on February 24, 2012. Although the stated maturity date is 2026,

each series will remain outstanding only if the Utility extends or replaces

the letter of credit related to the series or otherwise obtains a consent

from the issuer to the continuation of the series without a credit facility.

(3) During 2008, the credit rating of the insurer of these bonds was

downgraded or put on review for possible downgrade by several credit

agencies, resulting in increased interest rates. To reduce interest expense,

the Utility repurchased $300 million of the 2005 bonds in March

2008 and the remaining $154 million in April 2008. In September and

October 2008, all of these series, except for the Series 2005 E bonds,

were refunded through the issuance of the Series 2008 A-D and F and

G bonds. See footnotes 4 and 5.

(4) At December 31, 2008, interest rates on these bonds and the related

loans ranged from 0.57% to 0.85%.

(5) Each series of these bonds is supported by a separate direct-pay letter

of credit, which expires on October 29, 2011. The Utility may choose to

provide a substitute letter of credit for any series of these bonds, subject

to a rating requirement.

(6) These bonds bear interest at 3.75% per year through September 19, 2010,

are subject to mandatory tender on September 10, 2010, and may be

remarketed in a fi xed or variable rate mode.

The utility generation balancing account is used to record

and recover the authorized revenue requirements associated

with the Utility-owned electric generation, including capital

and related non-fuel operating and maintenance expenses.

The balancing account for energy recovery bonds records

certain benefi ts and costs associated with ERBs that are

provided to, or received from, customers. In addition, this

account ensures that customers receive the benefi ts of the net

amount of energy supplier refunds, claim offsets, and other

credits received by the Utility after the second series of ERBs

were issued.

The balancing account for public purpose program

revenues tracks the recovery of authorized public purpose

program revenue requirement and the actual cost of such

programs. The public purpose programs primarily consist

of the electric energy effi ciency programs; low-income energy

effi ciency programs; research, development, and demon-

stration programs; and renewable energy programs. The

increase in the current balancing account liability balance

at December 31, 2008 compared to the December 31, 2007

is due to a refund of approximately $230 million the Utility

received from the California Energy Commission (“CEC”).

The refund amount represents unspent renewables program

funding collected in previous periods. The program was can-

celled in the beginning of 2008 and the CEC was instructed

to return any unspent program funds to utilities to allow for

customer refund. The refund will be returned to customers

in 2009 through lower rates.

The balancing account for reliability services is a FERC-

mandated balancing account to ensure that the Participating

Transmission Owner neither under-recovers nor over-recovers

from customers the Reliability Services costs it is assessed by

the California Independent System Operator (“CAISO”).

At December 31, 2008, “Other” included the customer

energy effi ciency (“CEE”) incentive account, which records

any incentive awards earned by the Utility for implement-

ing CEE programs, and to refl ect these earnings in rates.

In December 2008, the Utility’s shareholders were awarded

$41.5 million for the fi rst interim award relating to 2006

and 2007 of the 2006-2008 energy effi ciency programs,

which will be collected in 2009 rates. At December 31, 2007,

“Other” mainly consisted of the distribution revenue adjust-

ment mechanism account, which records and recovers the

authorized distribution revenue requirements and certain

other distribution-related authorized costs.