PG&E 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PG&E CORPORATION ANNUAL REPORT 2008

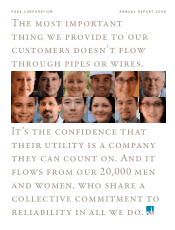

The most important

thing we provide to our

customers doesn’t flow

through pipes or wires.

It’s the confidence that

their utility is a company

they can count on. And it

flows from our 20,000 men

and women, who share a

collective commitment to

reliability in all we do.

Table of contents

-

Page 1

PG&E CORPORATION ANNUAL REPORT 2008 The most important thing we provide to our customers doesn't flow through pipes or wires. It's the confidence that their utility is a company they can count on. And it flows from our 20,000 men and women, who share a collective commitment to reliability in all ... -

Page 2

...T E NT S A Letter to Our Stakeholders PG&E Employees and Reliability Financial Statements Corporate Governance PG&E Corporation and Paciï¬c Gas and Electric Company Boards of Directors Ofï¬cers of PG&E Corporation and Paciï¬c Gas and Electric Company Shareholder Information 1 6 29 148 149 151... -

Page 3

... productivity, processing jobs more quickly and reducing cycle times for new construction work. • We won a key vote of confidence from customers in San Francisco, who rejected an attempt to take over our business. • We continued to attract investors in the capital markets, even when access... -

Page 4

... dividend growth, however, total shareholder return - stock price appreciation plus dividends - declined with the falling share price, as it did for virtually every large company. Although it may be cold comfort, we take some confidence from the fact that PG&E Corporation's shares held their value... -

Page 5

... steps in 2008 to revamp and improve processes and training, with a goal to dramatically improve the quality of field surveys to verify the integrity of PG&E's natural gas system. Other key operational highlights included the world-class power restoration following mammoth winter storms that Bay on... -

Page 6

... set a new standard for utility efficiency programs. In return, PG&E has earned $41.5 million in incentives so far, making this effort a tremendous win for customers and shareholders. Through our 2006-2008 programs, customers saved enough energy to power almost 800,000 homes and enough natural gas... -

Page 7

...-wide cap-and-trade program, which puts a price on carbon and sets limits on overall emissions. Importantly, we support a design that would also return value to our customers in order to mitigate the costs of tackling this pressing challenge. Our work on climate change, energy efficiency, renewables... -

Page 8

... they need and expect from their gas and electric company. Customers are counting on the people of PG&E to put all the right pieces in place to ensure instant access to gas and electricity, 24 hours a day, every day of the year. This is our core commitment as a reliable energy provider. But we also... -

Page 9

provide them with a simple, smooth customer experience. It's about knowing their needs and helping them ï¬nd the smartest solutions for lowering their energy use and reducing costs. bility It's about making clean energy choices that not only are right in today's environment and economy, but also ... -

Page 10

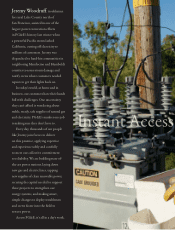

... of San Francisco, assisted in one of the largest power restoration efforts in PG&E's history last winter when a powerful Pacific storm lashed California, cutting off electricity to millions of customers. Jeremy was dispatched to hard-hit communities in neighboring Mendocino and Humboldt counties... -

Page 11

9 -

Page 12

Walt Pitson, Gas PartsGerald Replacement Stinson, Program Bay Area Power Restoration Cynthia King-Felix, North Coast Power Restoration Smart, simple changes to our operating methods are speeding up power restoration times. For example, our repair crews no longer wait for damage reports to come ... -

Page 13

... facilities will reduce California's reliance on an aging eet of power plants and decrease fuel use and greenhouse gas emissions. Alice Harron, Gateway Generating Station Dan Kaufman, Senior Consulting Electrical Engineer Walter Zenger, Transmission & Distribution 11 Sara Rathfon, Banking & Money... -

Page 14

12 -

Page 15

... relying on pge.com for critical resources and information about their energy service. Last year, he helped create an online outage mapping tool, putting the power of Google Maps to work so customers TM can view all electrical system outages. Customers can easily zero in on their zip code, city, or... -

Page 16

... on summer days when demand is highest. The Kristine Gorbet, Outage Information Akhil Katkol, Outage Information program's exibility allows them to tailor it so that any impact on their operations is minimal. In return, they benefit from the opportunity to lower their energy costs by earning... -

Page 17

... from other suppliers with only one phone call. Mark Davidson, Outage Information TM Eric Wirth, Gas Parts Replacement Program Walt Pittson, Gas Parts Replacement Program We are finding ways to offer timeand money-saving conveniences to customers. For example, during in-home service calls, we... -

Page 18

... of savings initiatives PG&E's efficiency experts help drive with customers large and small. We have created rebates and financial incentives, promoted the wider use of uorescent lighting technologies, and pioneered efficiency advances in data centers, among other efforts. We are also helping to set... -

Page 19

17 -

Page 20

... Lawson, Winter Gas Savings Program PG&E is partnering with Dell, Best Buy, Wal-Mart, and other retailers in 2009 to drive sales of the most energy-efficient televisions, desktop computers, monitors, and other devices. In conjunction with energy star®, the effort will offer financial incentives... -

Page 21

... uorescent light bulbs to customers, representing a potential energy savings equal to the energy required to power 60,000 homes for one year. The second award recognized PG&E's creation of a highly successful automated way for commercial building owners to get energy usage data into the energy star... -

Page 22

20 -

Page 23

...the use of clean energy resources. Efforts also include planning new transmission lines to connect new renewable energy supplies to areas where the power is needed. For example, PG&E, together with other companies in the Northwest, is studying a proposal for a transmission line connecting California... -

Page 24

... increase renewable energy supplies. In 2008, we added contracts for almost 1,800 megawatts of renewable power, including some of the largest solar energy commitments ever signed. We also connected our 25,000th customer-owned solar installation, making PG&E's service area home to almost half of the... -

Page 25

...Power Technology Senior Environmental Consultant Kadi Whiteside earned PG&E's Richard A. Clarke Environmental Leadership Award in 2008 for her innovative development of new practices and techniques to protect water quality, plants, and animals at construction sites. Ken Brennan, Biomethane Program... -

Page 26

...solar electric systems on every Habitat-built home in our service area. Incorporating solar energy into the design plans helps to lower the cost for homeowners while creating a standard of environmentally friendly building practices. To date, PG&E's support for this groundbreaking effort has totaled... -

Page 27

25 -

Page 28

...is reaching into our TM communities to develop qualified, diverse candidates for employment at the utility and elsewhere in the industry. The program is made possible through extensive collaboration with community colleges; labor, industry, and workforce development specialists; and community-based... -

Page 29

In 2008, PG&E's award-winning Solar Schools Program continued to teach young people about renewable energy by turning school buildings into hands-on science experiments through the installation of a free 1.3-kilowatt solar energy system. The program provides schools and teachers with a curriculum, ... -

Page 30

-

Page 31

P G & E C O R P O R AT I O N A N D PA C I F I C G A S A N D E L E C T R I C C O M PA N Y F I N A N C I A L S TAT E M E N T S 29 -

Page 32

...-Year Cumulative Total Shareholder Return Selected Financial Data Management's Discussion and Analysis PG&E Corporation and Paciï¬c Gas and Electric Company Consolidated Financial Statements Notes to the Consolidated Financial Statements Quarterly Consolidated Financial Data Management's Report on... -

Page 33

...were no items impacting comparability for 2007. (3) The common shares outstanding include 24,665,500 shares at December 31, 2007, held by a wholly owned subsidiary of PG&E Corporation and treated as treasury stock in the Consolidated Financial Statements. These shares were cancelled during 2008. 31 -

Page 34

... Index (DJUI) (1) Assumes $100 invested on December 31, 2003, in PG&E Corporation common stock, the Standard & Poor's 500 Stock Index, and the Dow Jones Utilities Index, and assumes quarterly reinvestment of dividends. The total shareholder returns shown are not necessarily indicative of future... -

Page 35

... the quarterly cash dividend to $0.39 per share. The Utility paid quarterly dividends on common stock held by PG&E Corporation and a wholly owned subsidiary aggregating to $589 million in 2008 and $547 million in 2007. See Note 7 of the Notes to the Consolidated Financial Statements. (4) Book value... -

Page 36

... the 12 months ended December 31, 2008. The Utility is regulated primarily by the California Public Utilities Commission ("CPUC") and the Federal Energy Regulatory Commission ("FERC"). The Utility generates revenues mainly through the sale and delivery of electricity and natural gas at rates set by... -

Page 37

...11.35% on the equity component of its electric and natural gas distribution and electric generation rate base. The Utility's capital structure is set until 2011, and its cost of capital components, including an 11.35% ROE, will only be changed before 2011 if the annual automatic adjustment mechanism... -

Page 38

... cash ï¬,ows, seasonal demand for electricity and natural gas, volatility in electricity and natural gas prices, and collateral requirements related to price risk management activity, among other factors. The Utility has continued to have access to the capital markets despite the recent ï¬nancial... -

Page 39

... rates, from insurance, or from other third parties; • the ability of PG&E Corporation, the Utility, and counter- electricity and natural gas businesses; • changes in customer demand for electricity and natural gas parties to access capital markets and other sources of credit in a timely... -

Page 40

... December 31, (in millions) 2008 2007 2006 Utility Electric operating revenues Natural gas operating revenues Total operating revenues Cost of electricity Cost of natural gas Operating and maintenance Depreciation, amortization, and decommissioning Total operating expenses Operating income Interest... -

Page 41

... requirements from customers to fund public purpose, demand response, and energy efï¬ciency programs, including the California Solar Initiative program and the Self-Generation Incentive program. In addition, the Utility is authorized to collect revenue requirements to recover its capital costs for... -

Page 42

...' demand ("load"). The Utility's electric operating revenues consist of amounts charged to customers for electricity generation and procurement and for electric transmission and distribution services, as well as amounts charged to customers to recover the costs of public purpose programs, energy ef... -

Page 43

...Financial Statements for further information.) The cost of electricity excludes non-fuel costs associated with the Utility's own generation facilities, which are included in Operating and maintenance expense in the Consolidated Statements of Income. The Utility's cost of purchased power and the cost... -

Page 44

... the Utility's future cost of electricity, including the market prices for electricity and natural gas, the level of hydroelectric and nuclear power that the Utility produces, the cost of procuring more renewable energy, changes in customer demand, and the amount and timing of power purchases needed... -

Page 45

... by the market price of natural gas and changes in customer demand. In addition, the Utility's future cost of gas also may be affected by federal or state legislation or rules to regulate the emissions of greenhouse gases from the Utility's natural gas transportation and distribution facilities, and... -

Page 46

... Payments for customer assistance and public purpose lion, primarily reï¬,ecting unrealized losses in the long-term disability plan trust due to the decline in the market value of trust investments as ï¬nancial markets deteriorated in the second half of 2008. • Costs increased by approximately... -

Page 47

... $12 million, due to electric plant growth, tax rate increases, and increases in assessed values in 2007. • In 2006, the Utility reduced its accrual for long-term disability beneï¬ts by approximately $11 million, reï¬,ecting changes in sick leave eligibility rules, but there was no similar... -

Page 48

... borrowings outstanding under the Utility's $2 billion revolving credit facility and lower commercial paper interest rates. These decreases were partially offset by additional interest expense of approximately $79 million in 2008, primarily related to $1.8 billion in senior notes that were issued in... -

Page 49

...to price risk management activity, the timing and amount of tax payments or refunds, and the timing and effect of regulatory decisions and ï¬nancings, among other factors. The Utility generally utilizes long-term senior unsecured debt issuances and equity contributions from PG&E Corporation to fund... -

Page 50

... Corporation and the Utility met all of these requirements. 2008 Financings Access to the capital markets is essential to the continuation of the Utility's capital expenditure program. Notwithstanding the recent disruption in the capital markets, the Utility was able to issue $1.2 billion of senior... -

Page 51

... Utility Corporate credit rating Senior unsecured debt Credit facility Pollution control bonds backed by letters of credit Pollution control bonds backed by bond insurance Pollution control bonds - nonbacked Preferred stock Commercial paper program PG&E Energy Recovery Funding LLC Energy recovery... -

Page 52

... companies based on payout ratio (the proportion of earnings paid out as dividends) and, with respect to PG&E Corporation, yield (i.e., dividend divided by share price); • Flexibility: Allow sufï¬cient cash to pay a dividend and During 2008, the Utility paid common stock dividends totaling... -

Page 53

... to customers in 2009. • Net collateral paid, primarily related to price risk manage- ment activities, increased by approximately $325 million in 2008 as a result of changes in the Utility's exposure to counterparties' credit risk, generally reï¬,ecting declining natural gas prices. Collateral... -

Page 54

... to rising natural gas costs and lower than forecasted hydroelectric generation. Effective October 1, 2008, customer rates were adjusted to allow the Utility to collect $645 million in procurement costs through December 2009. On December 30, 2008, the Utility requested that its electric rates be... -

Page 55

... from issuance of long-term debt, net of discount, premium, and issuance costs of $19 million in 2008 and $16 million in 2007 Long-term debt repurchased Rate reduction bonds matured Energy recovery bonds matured Preferred stock dividends paid Common stock dividends paid Equity contribution Other Net... -

Page 56

...district and water agencies Other power purchase agreements Natural gas supply and transportation Nuclear fuel Pension and other beneï¬ts(4) Capital lease obligations(5) Operating leases Preferred dividends(6) Other commitments PG&E Corporation Long-term debt(1): Convertible subordinated notes $17... -

Page 57

... billion for 2009. Depending on conditions in the capital markets, the Utility forecasts that it will make various capital investments in its electric and gas transmission and distribution infrastructure to maintain and improve system reliability, safety, and customer service; to extend the life of... -

Page 58

... program, for virtually all of the Utility's electric and gas customers. This infrastructure results in substantial cost savings associated with billing customers for energy usage, and enables the Utility to measure usage of electricity on a time-of-use basis and to charge time-differentiated rates... -

Page 59

.... Humboldt Bay Generating Station On September 24, 2008, the CEC issued its ï¬nal decision authorizing the construction of a 163 MW power plant to re-power the Utility's existing power plant at Humboldt Bay, which is at the end of its useful life. Demolition of existing structures on the site is... -

Page 60

... The Utility's CPUC-approved long-term electricity procurement plan, covering 2007-2016, forecasts that the Utility will need to obtain an additional 800 to 1,200 MW of new generation resources by 2015 above the Utility's planned additions of renewable resources, energy efï¬ciency, demand reduction... -

Page 61

...programs funded for the 2006-2008 and 2009-2011 program cycles. To earn incentives the utilities must (1) achieve at least 85% of the CPUC's overall energy savings goal over the three-year program cycle and (2) achieve at least 80% of the CPUC's individual kilowatt-hour (kWh), kilowatt (kW), and gas... -

Page 62

... funding of approximately $33 million per month to allow the Utility to continue existing energy efï¬ciency programs into 2009 until the CPUC issues a ï¬nal order on the 2009-2011 application. APPLICATION TO RECOVER HYDROELECTRIC GENERATION FACILITY DIVESTITURE COSTS On April 14, 2008, the Utility... -

Page 63

... by online price information from news services. When market data is not available, the Utility uses models to estimate fair value. The Utility conducts business with wholesale customers and counterparties mainly in the energy industry, including other California investor-owned electric utilities... -

Page 64

... purchases electricity from suppliers prior to the hour- and day-ahead CAISO scheduling timeframes, or in the real-time market. When the Utility's supply of electricity from its own generation resources plus net energy purchase contracts exceeds customer demand, the Utility is in a "long" position... -

Page 65

... to natural gas price risk. The Utility manages this risk in accordance with its risk management strategies included in electricity procurement plans approved by the CPUC. The CPUC did not approve the Utility's proposed electric portfolio gas hedging plan that was included in the Utility's long-term... -

Page 66

... The Utility uses value-at-risk to measure the shareholders' exposure to price and volumetric risks resulting from variability in the price of, and demand for, natural gas transportation and storage services that could impact revenues due to changes in market prices and customer demand. Value-at... -

Page 67

The Utility ties many energy contracts to master agreements that require security (referred to as "credit collateral") in the form of cash, letters of credit, corporate guarantees of acceptable credit quality, or eligible securities if current net receivables and replacement cost exposure exceed ... -

Page 68

... medical plans, and certain retired employees participate in life insurance plans (referred to collectively as "other postretirement beneï¬ts"). Amounts that PG&E Corporation and the Utility recognize as costs and obligations to provide pension beneï¬ts under SFAS No. 158, "Employers' Accounting... -

Page 69

..., the long-term nature of these obligations and the importance of the assumptions utilized, PG&E Corporation's and the Utility's estimate of these costs and obligations is a critical accounting estimate. Actuarial assumptions used in determining pension obligations include the discount rate, the... -

Page 70

... in 2008 Pension Costs Discount rate Rate of return on plan assets Rate of increase in compensation (0.5)% (0.5)% 0.5% $15 47 17 $667 - 162 Money market investments (held by PG&E Corporation) Nuclear decommissioning trusts Price risk management instruments Long-term disability trust Dividend... -

Page 71

...charges until the MRTU becomes effective. The Utility's demand response contracts with third-party aggregators of retail electricity customers contain a call option entitling the Utility to require that the aggregator reduce electric usage by the aggregators' customers at times of peak energy demand... -

Page 72

... 159 did not impact the Condensed Consolidated Financial Statements. DISCLOSURES BY PUBLIC ENTITIES (ENTERPRISES) ABOUT TRANSFERS OF FINANCIAL ASSETS AND INTERESTS IN VARIABLE INTEREST ENTITIES On December 31, 2008, PG&E Corporation and the Utility adopted the provisions of FASB Staff Position ("FSP... -

Page 73

... 15, 2009. PG&E Corporation and the Utility are currently evaluating the impact of FSP 132(R)-1. ISSUER'S ACCOUNTING FOR LIABILITIES MEASURED AT FAIR VALUE WITH A THIRD -PARTY CREDIT ENHANCEMENT - AN AMENDMENT TO FASB STATEMENT NO. 107 AND FASB STATEMENT NO. 133 In September 2008, the FASB issued... -

Page 74

...for the Utility's share of applicable expenses. Before it can distribute cash to PG&E Corporation, the Utility must use its resources to satisfy its own obligations, including its obligations to serve customers, to pay principal and interest on outstanding debt, to pay preferred stock dividends, and... -

Page 75

... environment affecting energy companies, the overall health of the energy industry, volatility in electricity or natural gas prices, and general economic and market conditions. The capital and credit markets have been experiencing extreme volatility and disruption for more than 12 months. The recent... -

Page 76

..., the Utility's control. Changes in tax laws or policies, such as those relating to production and investment tax credits for renewable energy projects, may also affect when or whether the Utility develops a potential project. In addition, reduced forecasted demand for electricity and natural gas as... -

Page 77

... to recover in rates, in a timely manner, the costs of electricity and natural gas purchased for its customers, its operating expenses, and an adequate return of and on the capital invested in its utility assets, including the costs of long-term debt and equity issued to ï¬nance their acquisition... -

Page 78

...'s supply of electricity from its own generation resources plus net energy purchase contracts exceeds customer demand, the Utility is in a "long" position. The amount of electricity the Utility needs to meet the demands of customers that is not satisï¬ed from the Utility's own generation facilities... -

Page 79

...electricity and gas meters throughout the Utility's service territory. Advanced meters will allow customer usage data to be transmitted through a communication network to a central collection point, where the data will be stored and used for billing and other commercial purposes. The CPUC authorized... -

Page 80

... costs if its customers obtain distribution and transportation services from other providers as a result of municipalization, technological change, or other forms of bypass. The Utility must achieve electricity planning reserve margin of 15% to 17% in excess of peak capacity electricity... -

Page 81

... successfully manage the risks inherent in operating the Utility's facilities. sources; • the level of production of natural gas; • the availability of nuclear fuel; • the availability of LNG supplies; • the price of fuels that are used to produce electricity, including natural gas, crude... -

Page 82

...climate change could range widely, with highly localized to worldwide effects, and under certain conditions could result in a full or partial disruption of the ability of the Utility or one or more entities on which it relies to generate, transmit, transport, or distribute electricity or natural gas... -

Page 83

... set and how the cap-and-trade market system develops, the Utility could incur signiï¬cant additional costs to ensure that it complies with the new rules as a generation owner. In addition, the price to procure electricity from other generation providers will be affected by the costs of compliance... -

Page 84

... under the Energy Policy Act of 2005, the FERC can impose penalties (up to $1 million per day per violation) for failure to comply with mandatory electric reliability standards. In the fourth quarter of 2009, the Utility will undergo its ï¬rst regularly-scheduled triennial audit for compliance with... -

Page 85

CONSOLIDATED STATEMENTS OF INCOME PG&E Corporation Year ended December 31, (in millions, except per share amounts) 2008 2007 2006 Operating Revenues Electric Natural gas Total operating revenues Operating Expenses Cost of electricity Cost of natural gas Operating and maintenance Depreciation, ... -

Page 86

... current assets Property, Plant, and Equipment Electric Gas Construction work in progress Other Total property, plant, and equipment Accumulated depreciation Net property, plant, and equipment Other Noncurrent Assets Regulatory assets Nuclear decommissioning funds Other Total other noncurrent assets... -

Page 87

...ï¬ed as current Accounts payable: Trade creditors Disputed claims and customer refunds Regulatory balancing accounts Other Interest payable Deferred income taxes Other Total current liabilities Noncurrent Liabilities Long-term debt Energy recovery bonds Regulatory liabilities Pension and other... -

Page 88

... and decommissioning Allowance for equity funds used during construction Gain on sale of assets Deferred income taxes and tax credits, net Other changes in noncurrent assets and liabilities Effect of changes in operating assets and liabilities: Accounts receivable Inventories Accounts payable Income... -

Page 89

CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY PG&E Corporation Accumulated Total Common Other Common Common Common Stock Comprehensive Share- CompreStock Stock Held by Unearned Reinvested Income holders' hensive Shares Amount Subsidiary Compensation Earnings (Loss) Equity Income 368,268,502 - $5,... -

Page 90

... Expenses Cost of electricity Cost of natural gas Operating and maintenance Depreciation, amortization, and decommissioning Total operating expenses Operating Income Interest income Interest expense Other income, net Income Before Income Taxes Income tax provision Net Income Preferred stock dividend... -

Page 91

...and other Total current assets Property, Plant, and Equipment Electric Gas Construction work in progress Total property, plant, and equipment Accumulated depreciation Net property, plant, and equipment Other Noncurrent Assets Regulatory assets Nuclear decommissioning funds Related parties receivable... -

Page 92

... payable: Trade creditors Disputed claims and customer refunds Related parties Regulatory balancing accounts Other Interest payable Income tax payable Deferred income taxes Other Total current liabilities Noncurrent Liabilities Long-term debt Energy recovery bonds Regulatory liabilities Pension... -

Page 93

... and decommissioning Allowance for equity funds used during construction Gain on sale of assets Deferred income taxes and tax credits, net Other changes in noncurrent assets and liabilities Effect of changes in operating assets and liabilities: Accounts receivable Inventories Accounts payable Income... -

Page 94

... Reinvested Earnings Total Shareholders' Equity Comprehensive Income Balance at December 31, 2005 Net income Minimum pension liability adjustment (net of income tax expense of $2 million) Comprehensive income Tax beneï¬t from employee stock plans Common stock dividend Preferred stock dividend... -

Page 95

...when purchased and then expensed or capitalized to plant, as appropriate, when consumed or installed. Natural gas stored underground represents purchases that are injected into inventory and then expensed at average cost when withdrawn and distributed to customers or used in electric generation. 93 -

Page 96

... The Utility's composite depreciation rate was 3.38% in 2008, 3.28% in 2007, and 3.09% in 2006. Estimated Useful Lives Electricity generating facilities Electricity distribution facilities Electricity transmission Natural gas distribution facilities Natural gas transportation Natural gas storage... -

Page 97

...agreement to purchase as-available electric generation output from an approximately 554-megawatt ("MW") solar trough facility in which the Utility has a signiï¬cant variable interest. Activities of this facility consist of renewable energy production from a single facility for sale to third parties... -

Page 98

... long-lived asset. In each subsequent period, the liability is accreted to its present value, and the capitalized cost is depreciated over the useful life of the longlived asset. Rate-regulated entities may recognize regulatory assets or liabilities as a result of timing differences between the... -

Page 99

... the Consolidated Financial Statements, in January 2001, the California Department of Water Resources ("DWR") began purchasing electricity to meet the portion of demand of the California investor-owned electric utilities that was not being satisï¬ed from their own generation facilities and existing... -

Page 100

... prices. Price risk management activities involve entering into contracts to procure electricity, natural gas, nuclear fuel, and ï¬rm transmission rights for electricity. The Utility uses a variety of energy and ï¬nancial instruments, such as forward contracts, futures, swaps, options, and... -

Page 101

... 159 did not impact the Condensed Consolidated Financial Statements. Disclosures by Public Entities (Enterprises) about Transfers of Financial Assets and Interests in Variable Interest Entities On December 31, 2008, PG&E Corporation and the Utility adopted the provisions of FASB Staff Position ("FSP... -

Page 102

... 15, 2009. PG&E Corporation and the Utility are currently evaluating the impact of FSP 132(R)-1. Issuer's Accounting for Liabilities Measured at Fair Value with a Third-Party Credit Enhancement - an amendment to FASB Statement No. 107 and FASB Statement No. 133 In September 2008, the FASB issued... -

Page 103

... income tax Utility-retained generation regulatory assets Environmental compliance costs Price risk management Unamortized loss, net of gain, on reacquired debt Regulatory assets associated with plan of reorganization Contract termination costs Scheduling coordinator costs Other Total regulatory... -

Page 104

... Consolidated Financial Statements.) California Solar Initiative liabilities represent revenues collected from customers to pay for costs the Utility expects to incur in the future to promote the use of solar energy in residential homes and commercial, industrial, and agricultural properties. Price... -

Page 105

... to rising natural gas costs and lower than forecasted hydroelectric generation. Effective October 1, 2008, customer rates were adjusted to allow the Utility to collect $645 million in procurement costs through December 2009. On December 30, 2008, the Utility requested that its electric rates be... -

Page 106

..., the Utility's shareholders were awarded $41.5 million for the ï¬rst interim award relating to 2006 and 2007 of the 2006-2008 energy efï¬ciency programs, which will be collected in 2009 rates. At December 31, 2007, "Other" mainly consisted of the distribution revenue adjustment mechanism account... -

Page 107

...at the option of the holder) at any time prior to maturity into 18,558,059 shares of PG&E Corporation common stock, at a conversion price of $15.09 per share. The conversion price is subject to adjustment for signiï¬cant changes in the number of outstanding shares of PG&E Corporation's common stock... -

Page 108

... the purchase and sale agreements under its Chapter 11 plan of reorganization that became effective on January 31, 2008. The Utility has no knowledge that Geysers Power Company, LLC, intends to cease using the bond-ï¬nanced facilities solely as pollution control bonds facilities within the meaning... -

Page 109

... certain conditions are met. The fees and interest rates PG&E Corporation pays under the revolving credit facility vary depending on the Utility's unsecured debt ratings issued by Standard & Poor's Ratings Service ("S&P") and Moody's Investors Service ("Moody's"). As of December 31, 2008, the... -

Page 110

..., 2012. Borrowings under the revolving credit facility and letters of credit are used primarily for liquidity and to provide credit enhancements to counterparties for natural gas and energy procurement transactions. The Utility treats the amount of its outstanding commercial paper as a reduction to... -

Page 111

..., issued $2.9 billion of rate reduction bonds ("RRBs"). The proceeds of the RRBs were used by PG&E Funding LLC to purchase from the Utility the right, known as "transition property," to be paid a speciï¬ed amount from a non-bypassable charge levied on residential and small commercial customers... -

Page 112

... awarded under the PG&E Corporation Long-Term Incentive Program and the 2006 Long-Term Incentive Plan ("2006 LTIP"), and 6,876,919 shares were issued upon the exercise of employee stock options, for the account of 401(k) plan participants, and for the Dividend Reinvestment and Stock Purchase Plan... -

Page 113

... $25 par value preferred stock is subject to redemption at the Utility's option, in whole or in part, if the Utility pays the speciï¬ed redemption price plus accumulated and unpaid dividends through the redemption date. At December 31, 2008, annual dividends ranged from $1.09 to $1.25 per share and... -

Page 114

..., rather than the actual number, of shares outstanding. PG&E Corporation stock options to purchase 11,935 and 7,285 shares were excluded from the computation of diluted EPS for 2008 and 2007, respectively, because the exercise prices of these options were greater than the average market price of PG... -

Page 115

... Corporation (in millions) 2008 2007 Utility 2008 2007 Year ended December 31, Deferred income tax assets: Customer advances for construction Reserve for damages Environmental reserve Compensation Other Total deferred income tax assets Deferred income tax liabilities: Regulatory balancing accounts... -

Page 116

... FIN 48. On June 20, 2008, PG&E Corporation reached an agreement with the IRS regarding a change in accounting method related to the capitalization of indirect service costs for PG&E tax years 2001 through 2004. This agreement resulted in (in millions) Corporation Utility Balance at January 1, 2007... -

Page 117

..., PG&E Corporation has $2.1 billion of California capital loss carry forwards based on tax returns as ï¬led, the majority of which expired in tax year 2008. N O T E 11: DERIVAT IV ES AN D H EDGIN G AC T IV IT IES The Utility enters into contracts to procure electricity, natural gas, nuclear fuel... -

Page 118

... costs of electricity and natural gas are passed through to customers. Cash inï¬,ows and outï¬,ows associated with the settlement of price risk management transactions are recognized in operating cash ï¬,ows on PG&E Corporation's and the Utility's Consolidated Statements of Cash Flows. The dividend... -

Page 119

... the Utility to record day-one gains associated with CRRs resulting in a $48 million increase in price risk management assets and the related regulatory liabilities as of January 1, 2008. in active markets for identical assets or liabilities that the reporting entity has the ability to access at... -

Page 120

... Value Measurements as of December 31, 2008 (in millions) Level 1 Level 2 Level 3 Total Assets: Money market investments (held by PG&E Corporation) Nuclear decommissioning trusts(1) Rabbi trusts Long-term disability trust Assets Total Liabilities: Dividend participation rights Price risk management... -

Page 121

...The nuclear decommissioning trusts, the rabbi trusts related to the non-qualiï¬ed deferred compensation plans, and the long-term disability trust hold primarily equities, debt securities, mutual funds, and life insurance policies. These instruments are generally valued based on unadjusted prices in... -

Page 122

... ï¬xed rate senior notes, ï¬xed rate pollution control bond loan agreements, and the ERBs issued by PG&E Energy Recovery Funding LLC, were based on quoted market prices obtained from the Bloomberg ï¬nancial information system at December 31, 2008. • The estimated fair value of PG&E Corporation... -

Page 123

... 3 in the fair value hierarchy for the twelve month period ended December 31, 2008: PG&E Corporation Money Market Investments Price Risk Management Instruments Nuclear Decommissioning Long-term Trusts(3) Disability Dividend Participation Rights (in millions) Other Total Asset (liability) Balance... -

Page 124

...funds) are recovered from customers through a non-bypassable charge that the Utility expects will continue until those costs are fully recovered. The decommissioning cost estimates are based on the plant location and cost characteristics for the Utility's nuclear power plants. Actual decommissioning... -

Page 125

... 31, 2008, the Utility had accumulated nuclear decommissioning trust funds with an estimated fair value of approximately $1.7 billion, net of deferred taxes on unrealized gains. In general, investment securities are exposed to various risks, such as interest rate, credit, and market volatility risks... -

Page 126

... Waste Policy Act of 1982, Congress environmental impacts from potential terrorist acts directed authorized the U.S. Department of Energy ("DOE") and at the Diablo Canyon storage facility. electric utilities with commercial nuclear power plants In October 2008, the NRC rejected the ï¬nal contention... -

Page 127

...pension plan for certain employees and retirees, referred to collectively as pension beneï¬ts. PG&E Corporation and the Utility also provide contributory postretirement medical plans for certain employees and retirees and their eligible dependents, and non-contributory postretirement life insurance... -

Page 128

...ï¬ts and changes in the beneï¬t obligation of other beneï¬ts during 2008 and 2007: Pension Beneï¬ts PG&E Corporation (in millions) 2008 2007 Utility 2008 2007 Projected beneï¬t obligation at January 1 Service cost for beneï¬ts earned Interest cost Actuarial (gain) loss Plan amendments Bene... -

Page 129

... Utility use publicly quoted market values and independent pricing services depending on the nature of the assets, as reported by the trustee. The following tables reconcile aggregate changes in plan assets during 2008 and 2007: Pension Beneï¬ts PG&E Corporation (in millions) 2008 2007 Utility 2008... -

Page 130

... PERIODIC BENEFIT COST Net periodic beneï¬t cost as reï¬,ected in PG&E Corporation's Consolidated Statements of Income for 2008, 2007, and 2006 is as follows: Pension Beneï¬ts December 31, (in millions) 2008 2007 2006 Service cost for beneï¬ts earned Interest cost Expected return on plan assets... -

Page 131

...' Accounting for Pensions," and SFAS No. 106. Pre-tax amounts recognized in accumulated other comprehensive income consist of: PG&E Corporation (in millions) 2008 2007 Utility 2008 2007 Pension Beneï¬ts: Beginning unrecognized prior service cost Current year unrecognized prior service cost... -

Page 132

... on service and interest cost $68 7 return of 4.6%. The rate used to discount pension and other postretirement beneï¬t plan liabilities was based on a yield curve developed from market data of over 300 Aa-grade non-callable bonds at December 31, 2008. This yield curve has discount rates that... -

Page 133

... PG&E Corporation's and the Utility's pension and other beneï¬t plans at December 31, 2008 and 2007, and target 2009 allocation, were as follows: Pension Beneï¬ts 2009 2008 2007 2009 Other Beneï¬ts 2008 2007 Equity securities U.S. equity Non-U.S. equity Global equity Absolute return Fixed income... -

Page 134

...by PG&E Corporation and the Utility in connection with the plan amounted to: (in millions) PG&E Corporation Utility 2008 2007 2006 $(7) 2 4 $(4) 1 2 LONG -TERM INCENTIVE PL AN The 2006 LTIP permits the award of various forms of incentive awards, including stock options, stock appreciation rights... -

Page 135

...2005 and still outstanding continue to be governed by the terms and conditions of the PG&E Corporation Long-Term Incentive Program. PG&E Corporation and the Utility use an estimated annual forfeiture rate of 2.5% for stock options and restricted stock and 3% for performance shares, based on historic... -

Page 136

..., certain non-employee directors of PG&E Corporation were awarded stock options. The following table summarizes stock option activity for the Utility for 2008: Weighted Average Remaining Contractual Term Options Shares Weighted Average Exercise Price Aggregate Intrinsic Value Outstanding at... -

Page 137

... for the Utility for 2008: Number of Shares of Restricted Stock Weighted Average Grant-Date Fair Value Performance Shares During 2008, PG&E Corporation awarded 581,175 performance shares to eligible participants of PG&E Corporation and its subsidiaries, of which 396,230 shares were awarded to the... -

Page 138

... and interest issues being considered by the FERC, will continue to be refunded to customers in rates. Additional settlement discussions with other electricity suppliers are ongoing. Any net refunds, claim offsets, or other credits that the Utility receives from energy suppliers through resolution... -

Page 139

... co-generation facilities and qualifying small power production facilities ("QFs"). To implement the purchase requirements of PURPA, the CPUC required California investor-owned electric utilities to enter into long-term power purchase agreements with QFs and approved the applicable terms, conditions... -

Page 140

...-approved long-term procurement plans, the Utility has entered into several power purchase agreements with third parties. The Utility's obligations under a portion of these agreements are contingent on the third party's development of a new generation facility to provide the power to be purchased by... -

Page 141

... generally based on market conditions. At December 31, 2008, the Utility's undiscounted obligations for natural gas purchases and gas transportation services were as follows: (in millions) 2009 2010 2011 2012 2013 Thereafter Total ï¬xed capacity payments Amount representing interest Present value... -

Page 142

...issue a ï¬nal decision in 2009. California Department of Water Resources Contracts Electricity purchased under the DWR-allocated power purchase contracts with various generators provided approximately 15.1% of the electricity delivered to the Utility's customers for the year ended December 31, 2008... -

Page 143

...its retail electricity rates of all costs associated with the DWR power purchase contracts to be assumed without further review. In February 2008, the CPUC opened an investigation of how the DWR can end its role in purchasing power for the customers of the California investor-owned utilities through... -

Page 144

... losssharing program among utilities owning nuclear reactors. Under the Price-Anderson Act, owner participation in this loss-sharing program is required for all owners of nuclear reactors that are licensed to operate, designed for the production of electrical energy, and have a rated capacity of 100... -

Page 145

... in future rates. The Utility also recovers its costs from insurance carriers and from other third parties whenever possible. Any amounts collected in excess of the Utility's ultimate obligations may be subject to refund to customers. Environmental remediation associated with the Hinkley natural gas... -

Page 146

QUARTERLY CONSOLIDATED FINANCIAL DATA (UNAUDITED) Quarter ended (in millions, except per share amounts) December 31 September 30 June 30 March 31 2008 PG&E Corporation Operating revenues Operating income Income from continuing operations Net income Earnings per common share from continuing ... -

Page 147

... reporting as of December 31, 2008. Deloitte & Touche LLP, an independent registered public accounting ï¬rm, has audited the Consolidated Balance Sheets of PG&E Corporation and the Utility as of December 31, 2008 and 2007, and the related Consolidated Statements of Income, Shareholders' Equity... -

Page 148

... Company San Francisco, California We have audited the accompanying consolidated balance sheets of PG&E Corporation and subsidiaries (the "Company") and of Paciï¬c Gas and Electric Company and subsidiaries (the "Utility") as of December 31, 2008 and 2007, and the related consolidated statements... -

Page 149

... - Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. As discussed in Note 2 of the Notes to the Consolidated Financial Statements, in January 2008 the Company and the Utility adopted new accounting standards addressing fair value measurement and an... -

Page 150

...Y.H. Cheng PG&E Corporation One Market, Spear Tower, Suite 2400 San Francisco, CA 94105-1126 On June 12, 2008, Peter A. Darbee, Chairman of the Board, Chief Executive Ofï¬cer, and President of PG&E Corporation submitted an Annual CEO Certiï¬cation to the New York Stock Exchange, certifying that he... -

Page 151

... CORPORATION AND PACIFIC GAS AND ELECTRIC COMPANY DAVI D R. AND REW S C. L E E C OX (1) P E TE R A . DA R B E E Senior Vice President, Government Affairs, General Counsel, and Secretary, Retired, PepsiCo, Inc. Vice Chairman, Retired, AirTouch Communications, Inc. and President and Chief Executive... -

Page 152

... all audit and non-audit services performed by the independent registered public accounting firm. Review and oversee related party transactions. Discuss guidelines and policies for assessing and managing major risks. Review processes used by Board committees to monitor and control major financial... -

Page 153

...&E CORPORATION OFFICERS PE T E R A . DA R B E E PACIFIC GAS AND ELECTRIC COMPANY OFFICERS C . LEE COX JAMES R. BECKER Chairman of the Board, Chief Executive Officer, and President KENT M. HARVEY Non-Executive Chairman of the Board P ET ER A. DAR BEE Site Vice President, Diablo Canyon Power Plant... -

Page 154

... a direct deposit authorization form by contacting BNY Mellon Shareowner Services. Replacement of Dividend Checks January 15 April 15 July 15 October 15 Paciï¬c Gas and Electric Company Preferred Stock Gabriel B. Togneri PG&E Corporation One Market, Spear Tower, Suite 2400 San Francisco, CA 94105... -

Page 155

... F SHA REHO LDERS Date: May 13, 2009 Time: 10:00 a.m. Location: San Ramon Valley Conference Center 3301 Crow Canyon Road San Ramon, California FO RM 10-K If you would like a copy, free of charge, of PG&E Corporation's and Paciï¬c Gas and Electric Company's joint Annual Report on Form 10-K for the... -

Page 156