OfficeMax 2010 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2010 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

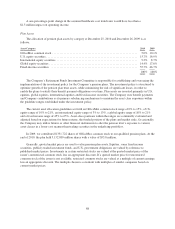

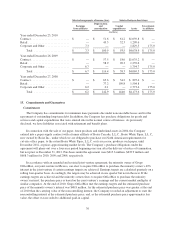

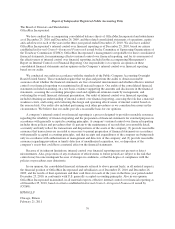

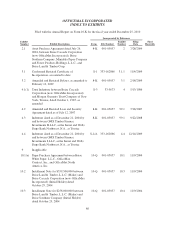

Selected components of income (loss) Selected balance sheet items

Earnings

from affiliates

Depreciation

and

amortization

Capital

expenditures Assets

Investments

in affiliates

(millions)

Year ended December 25, 2010

Contract .......................... $ — $ 51.6 $ 61.2 $1,039.8 $ —

Retail ............................ — 49.3 32.3 1,209.6 —

Corporate and Other ................ 7.3 — — 1,829.5 175.0

Total ........................ $ 7.3 $ 100.9 $ 93.5 $4,078.9 $ 175.0

Year ended December 26, 2009

Contract .......................... $ — $ 57.5 $ 18.0 $1,035.2 $ —

Retail ............................ — 58.9 20.3 1,239.6 —

Corporate and Other ................ 6.7 — — 1,794.7 175.0

Total ........................ $ 6.7 $ 116.4 $ 38.3 $4,069.5 $ 175.0

Year ended December 27, 2008

Contract .......................... $ — $ 65.6 $ 34.2 $ 895.4 $ —

Retail ............................ — 77.2 109.8 1,504.8 —

Corporate and Other ................ 6.2 0.1 — 1,773.4 175.0

Total ........................ $ 6.2 $ 142.9 $ 144.0 $4,173.6 $ 175.0

15. Commitments and Guarantees

Commitments

The Company has commitments for minimum lease payments due under noncancelable leases and for the

repayment of outstanding long-term debt. In addition, the Company has purchase obligations for goods and

services and capital expenditures that were entered into in the normal course of business. As previously

disclosed, we have liabilities associated with retirement and benefit plans.

In connection with the sale of our paper, forest products and timberland assets in 2004, the Company

entered into a paper supply contract with a former affiliate of Boise Cascade, L.L.C., Boise White Paper, L.L.C.,

now owned by Boise Inc., under which we are obligated to purchase our North American requirements for

cut-size office paper, to the extent Boise White Paper, L.L.C. or its successor, produces such paper, until

December 2012, at prices approximating market levels. The Company’s purchase obligations under the

agreement will phase-out over a four-year period beginning one year after the delivery of notice of termination,

but not prior to December 31, 2012. Purchases under the agreement were $615.6 million, $633.9 million and

$668.3 million for 2010, 2009 and 2008, respectively.

In accordance with an amended and restated joint venture agreement, the minority owner of Grupo

OfficeMax, our joint-venture in Mexico, can elect to require OfficeMax to purchase the minority owner’s 49%

interest in the joint venture if certain earnings targets are achieved. Earnings targets are calculated quarterly on a

rolling four-quarter basis. Accordingly, the targets may be achieved in one quarter but not in the next. If the

earnings targets are achieved and the minority owner elects to require OfficeMax to purchase the minority

owner’s interest, the purchase price is based on the joint venture’s earnings and the current market multiples of

similar companies. At the end of 2010, Grupo OfficeMax met the earnings targets and the estimated purchase

price of the minority owner’s interest was $48.8 million. As the estimated purchase price was greater at the end

of 2010 than the carrying value of the noncontrolling interest, the Company recorded an adjustment to state the

noncontrolling interest at the estimated purchase price, and, as the estimated purchase price approximates fair

value, the offset was recorded to additional paid-in capital.

76