OfficeMax 2010 Annual Report Download - page 70

Download and view the complete annual report

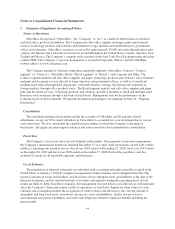

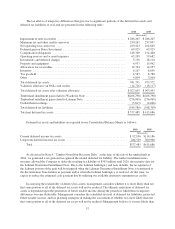

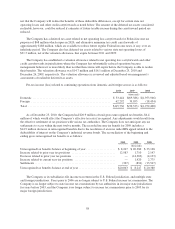

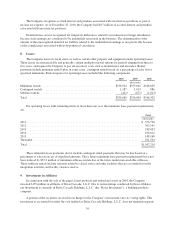

Please find page 70 of the 2010 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.minimum lease payments in the Company’s capital lease tests and in determining straight-line rent expense for

operating leases. Straight-line rent expense is also adjusted to reflect any allowances or reimbursements provided

by the lessor.

Derivative Instruments and Hedging Activities

The Company records all derivative instruments on the balance sheet at fair value. Changes in the fair value

of derivative instruments are recorded in current earnings or deferred in accumulated other comprehensive loss,

depending on whether a derivative is designated as, and is effective as, a hedge and on the type of hedging

transaction. Changes in fair value of derivatives that are designated as cash flow hedges are deferred in

accumulated other comprehensive loss until the underlying hedged transactions are recognized in earnings, at

which time any deferred hedging gains or losses are also recorded in earnings. If a derivative instrument is

designated as a fair value hedge, changes in the fair value of the instrument are reported in current earnings and

offset the change in fair value of the hedged assets, liabilities or firm commitments. The Company has no

material outstanding derivative instruments at December 25, 2010 and did not have any material hedge

transactions in 2010, 2009 or 2008.

Recently Issued or Newly Adopted Accounting Standards

There were no recently issued or newly adopted accounting standards that were applicable to the preparation

of our consolidated financial statements for 2010 or that may become applicable to the preparation of our

consolidated financial statements in the future.

Prior Period Revisions

Certain amounts included in the prior year financial statements have been revised to conform with the

current year presentation. In the current year, expenses previously reported in the consolidated statements of

operations separately as operating and selling expenses and as general and administrative expenses have been

combined and are now reported as selling, operating and general and administrative expenses.

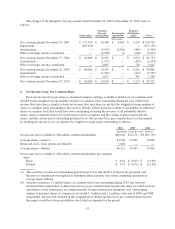

2. Facility Closure Reserves

We conduct regular reviews of our real estate portfolio to identify underperforming facilities, and close

those facilities that are no longer strategically or economically beneficial. We record a liability for the cost

associated with a facility closure at its fair value in the period in which the liability is incurred, primarily the

location’s cease-use date. Upon closure, unrecoverable costs are included in facility closure reserves and include

provisions for the present value of future lease obligations, less contractual or estimated sublease income.

Accretion expense is recognized over the life of the required payments.

During 2010, we recorded charges of $13.1 million in our Retail segment related to facility closures, of

which $11.7 million was related to the lease liability and other costs associated with closing eight domestic stores

prior to the end of their lease terms, and $1.4 million was related to other items. In 2009, we recorded charges of

$31.2 million related to the closing of 21 underperforming stores prior to the end of their lease terms, of which 16

were in the U.S. and five were in Mexico. In 2008, we recorded $3.1 million of charges related principally to the

closing of five domestic stores and reduced rent and severance accruals by $3.4 million relating to previously

closed stores. In 2008, we also recorded $8.7 million of charges related to four domestic retail stores for which

we had signed lease commitments, but decided not to open the stores due to the existing economic environment.

This charge was partially offset by reduced rent accruals of $4.0 million on other store lease obligations.

These charges were included in other operating, net in the Consolidated Statements of Operations.

50