OfficeMax 2010 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2010 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Through December 25, 2010, we have received all payments due under the Installment Note guaranteed by

Wachovia (the “Wachovia Guaranteed Installment Notes”), which have consisted only of interest due on the

notes, and made all payments due on the related Securitization Notes guaranteed by Wachovia, again consisting

only of interest due. As all amounts due on the Wachovia Guaranteed Installment Notes are current, and we have

no reason to believe that we will not collect all amounts due according to the contractual terms of the Wachovia

Guaranteed Installment Notes, the notes are stated in our Consolidated Balance Sheet at their original principal

amount of $817.5 million. Wachovia was acquired by Wells Fargo & Company in a stock transaction in 2008.

An additional adverse impact on our financial results presentation could occur if Wells Fargo became unable to

perform its obligations under the Wachovia Guaranteed Installment Notes, thereby resulting in a significant

impairment impact.

The pledged Installment Notes and Securitization Notes were scheduled to mature in 2020 and 2019,

respectively. The Securitization Notes have an initial term that is approximately three months shorter than the

Installment Notes. We expect that if the Securitization Notes are still outstanding in 2019, we will refinance them

with a short-term borrowing to bridge the period from initial maturity of the Securitization Notes to the maturity

of the Installment Notes.

Other

We made capital contributions to Grupo OfficeMax, commensurate with our ownership percentage in the

joint venture of $6.0 million and $6.7 million in 2009 and 2008, respectively. We made no capital contributions

to Grupo OfficeMax during 2010.

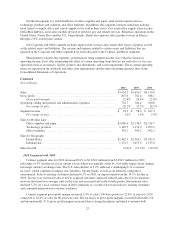

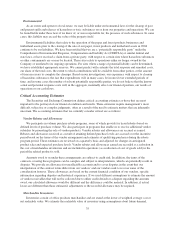

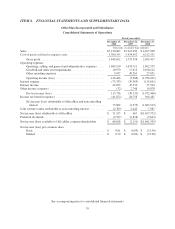

Contractual Obligations

In the following table, we set forth our contractual obligations as of December 25, 2010. Some of the figures

included in this table are based on management’s estimates and assumptions about these obligations, including

their duration, the possibility of renewal, anticipated actions by third parties and other factors. Because these

estimates and assumptions are necessarily subjective, the amounts we will actually pay in future periods may

vary from those reflected in the table.

Payments Due by Period

2011 2012-2013 2014-2015 Thereafter Total

(millions)

Recourse debt .................................... $ 4.6 $ 44.9 $ 1.9 $ 224.1 $ 275.5

Interest payments on recourse debt ................... 18.2 31.0 28.7 122.3 200.2

Non-recourse debt ................................ — — — 1,470.0 1,470.0

Interest payments on non-recourse debt ............... 39.8 79.7 79.7 152.6 351.8

Operating leases .................................. 356.7 552.2 346.8 291.5 1,547.2

Purchase obligations .............................. 30.9 6.8 0.9 — 38.6

Pension obligations (estimated payments) .............. 6.7 72.3 77.2 35.8 192.0

Total ....................................... $456.9 $786.9 $535.2 $2,296.3 $4,075.3

Debt includes amounts owed on our note agreements, revenue bonds and credit agreements assuming the

debt is held to maturity. The amounts above include both current and non-current liabilities. Not included in the

table above are contingent payments for uncertain tax positions of $20.9 million. These amounts are not included

due to our inability to predict the timing of settlement of these amounts. The “Expected Payments” table under

the caption “Financial Instruments” in this Management’s Discussion and Analysis of Financial Condition and

Results of Operations presents principal cash flows and related weighted average interest rates by expected

maturity dates. For more information, see Note 10, “Debt,” of the Notes to Consolidated Financial Statements in

“Item 8. Financial Statements and Supplementary Data” in this form 10-K.

30