OfficeMax 2010 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2010 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

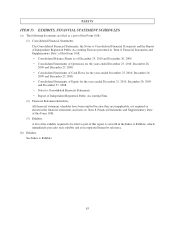

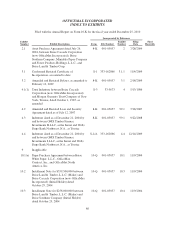

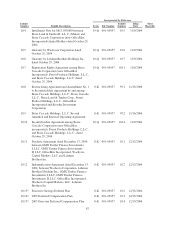

Incorporated by Reference

Exhibit

Number Exhibit Description Form File Number

Exhibit

Number

Filing

Date

Filed

Herewith

10.70† Form of Change in Control Letter Agreement

between OfficeMax Incorporated and Ravi

Saligram

8-K 001-05057 10.6 10/19/2010

10.71† Form of Nondisclosure and Fair Competition

Agreement between OfficeMax Incorporated and

Ravi Saligram

8-K 001-05057 10.7 10/19/2010

11 Inapplicable

12 Inapplicable

13 Inapplicable

14(3) Code of Ethics

16 Inapplicable

18 Inapplicable

21 Significant subsidiaries of the registrant X

22 Inapplicable

23 Consent of KPMG LLP, independent registered

public accounting firm (see page 85)

X

24 Inapplicable

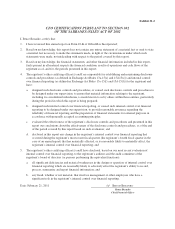

31.1 CEO Certification Pursuant to Section 302 of the

Sarbanes-Oxley Act of 2002

X

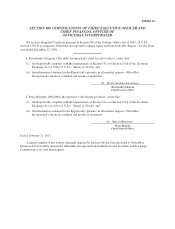

31.2 CFO Certification Pursuant to Section 302 of the

Sarbanes-Oxley Act of 2002

X

32 Section 906 Certifications of Chief Executive

Officer and Chief Financial Officer of

OfficeMax Incorporated

X

† Indicates exhibits that constitute management contracts or compensatory plans or arrangements.

(a) Certain information in this exhibit has been omitted and filed separately with the Securities and Exchange

Commission pursuant to a confidential treatment request under Rule 24b-2 of the Securities Exchange Act

of 1934, as amended.

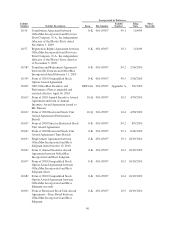

(1) The Trust Indenture between Boise Cascade Corporation (now known as OfficeMax Incorporated) and

Morgan Guaranty Trust Company of New York, Trustee, dated October 1, 1985, as amended, was filed as

exhibit 4 in the Registration Statement on Form S-3 No. 33-5673, filed May 13, 1986. The Trust Indenture

has been supplemented on seven occasions as follows: The First Supplemental Indenture, dated

December 20, 1989, was filed as exhibit 4.2 in the Pre-Effective Amendment No. 1 to the Registration

Statement on Form S-3 No. 33-32584, filed December 20, 1989. The Second Supplemental Indenture, dated

August 1, 1990, was filed as exhibit 4.1 in our Current Report on Form 8-K filed on August 10, 1990. The

Third Supplemental Indenture, dated December 5, 2001, between Boise Cascade Corporation and BNY

Western Trust Company, as trustee, to the Trust Indenture dated as of October 1, 1985, between Boise

Cascade Corporation and U.S. Bank Trust National Association (as successor in interest to Morgan

Guaranty Trust Company of New York) was filed as exhibit 99.2 in our Current Report on Form 8-K filed

on December 10, 2001. The Fourth Supplemental Indenture dated October 21, 2003, between Boise Cascade

Corporation and U.S. Bank Trust National Association was filed as exhibit 4.1 in our Current Report on

Form 8-K filed on October 20, 2003. The Fifth Supplemental Indenture dated September 16, 2004, among

91