OfficeMax 2010 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2010 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

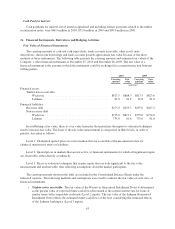

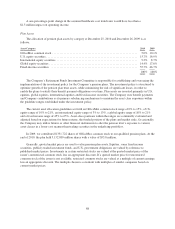

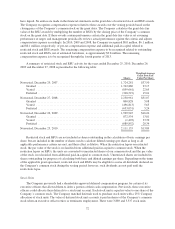

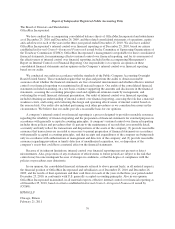

The following table presents the pension plan assets by level within the fair value hierarchy as of

December 25, 2010.

Level 1 Level 2 Level 3

(thousands)

Money market funds ................................................ $ — $ 27,621 $ —

Equity securities:

OfficeMax common stock ....................................... 55,805 — —

U.S. large-cap ................................................. 43,961 — —

U.S. small and mid-cap ......................................... 16.123 — —

International .................................................. 97,435 — —

Fixed Income:

Corporate bonds ............................................... — 466,549 —

Government securities .......................................... — 98,494 —

Other fixed income ............................................. — 18,380 —

Other:

Equity mutual funds ............................................ — 277,553 —

Group annuity contracts ......................................... — — 5,357

Other, including plan receivables and payables ....................... 10,135 — —

$223,459 $888,597 $5,357

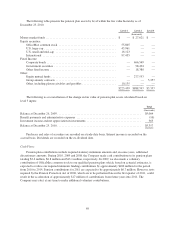

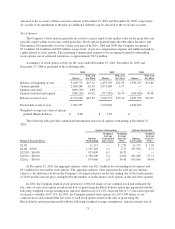

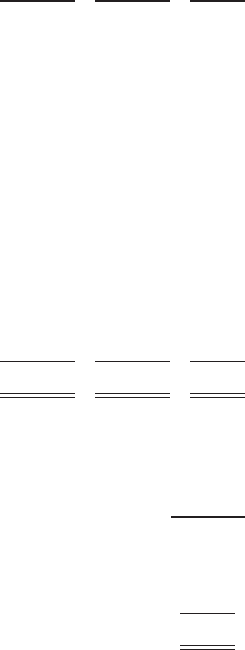

The following is a reconciliation of the change in fair value of pension plan assets calculated based on

level 3 inputs:

Total

(thousands)

Balance at December 26, 2009 ......................................................... $5,004

Benefit payments and administrative expenses ............................................ (10)

Investment income and net appreciation in investments ..................................... 363

Balance at December 25, 2010 ......................................................... $5,357

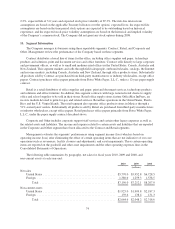

Purchases and sales of securities are recorded on a trade-date basis. Interest income is recorded on the

accrual basis. Dividends are recorded on the ex-dividend date.

Cash Flows

Pension plan contributions include required statutory minimum amounts and, in some years, additional

discretionary amounts. During 2010, 2009 and 2008, the Company made cash contributions to its pension plans

totaling $3.4 million, $6.8 million and $13.1 million, respectively. In 2009, we also made a voluntary

contribution of OfficeMax common stock to our qualified pension plans which, based on actuarial estimates, is

expected to reduce our required minimum funding contributions by approximately $100 million for the period

from 2010 to 2014. Pension contributions for 2011 are expected to be approximately $6.7 million. However, tests

required by the Pension Protection Act of 2006, which are to be performed late in the first quarter of 2011, could

result in the acceleration of approximately $17 million of contributions from future years into 2011. The

Company may elect at any time to make additional voluntary contributions.

69