OfficeMax 2010 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2010 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

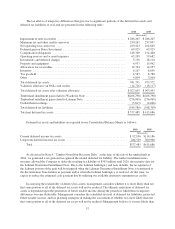

not that the Company will realize the benefits of these deductible differences, except for certain state net

operating losses and other credit carryforwards as noted below. The amount of the deferred tax assets considered

realizable, however, could be reduced if estimates of future taxable income during the carryforward period are

reduced.

The Company has a deferred tax asset related to net operating loss carryforwards for Federal income tax

purposes of $68 million which expire in 2020, and alternative minimum tax credit carryforwards of

approximately $188 million, which are available to reduce future regular Federal income taxes, if any, over an

indefinite period. The Company also has deferred tax assets related to various state net operating losses of

$31.5 million, net of the valuation allowance, that expire between 2011 and 2029.

The Company has established a valuation allowance related to net operating loss carryforwards and other

credit carryforwards in jurisdictions where the Company has substantially reduced operations because

management believes it is more likely than not that these items will expire before the Company is able to realize

their benefits. The valuation allowance was $14.7 million and $16.1 million at December 25, 2010 and

December 26, 2009, respectively. The valuation allowance is reviewed and adjusted based on management’s

assessments of realizable deferred tax assets.

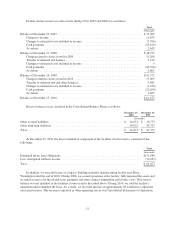

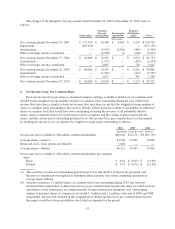

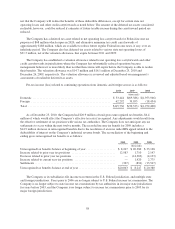

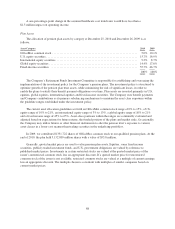

Pre-tax income (loss) related to continuing operations from domestic and foreign sources is as follows:

2010 2009 2008

(thousands)

Domestic ..................................................... $ 53,444 $(69,386) $(1,953,946)

Foreign ...................................................... 62,292 39,053 (18,454)

Total ........................................................ $115,736 $(30,333) $(1,972,400)

As of December 25, 2010, the Company had $20.9 million of total gross unrecognized tax benefits, $6.4

million of which would affect the Company’s effective tax rate if recognized. Any adjustments would result from

the effective settlement of tax positions with various tax authorities. The Company does not anticipate any tax

settlements to occur within the next twelve months. The recorded income tax benefit for 2009 includes a

$14.9 million decrease in unrecognized benefits due to the resolution of an issue under IRS appeal related to the

deductibility of interest on the Company’s industrial revenue bonds. The reconciliation of the beginning and

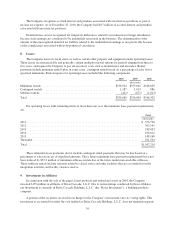

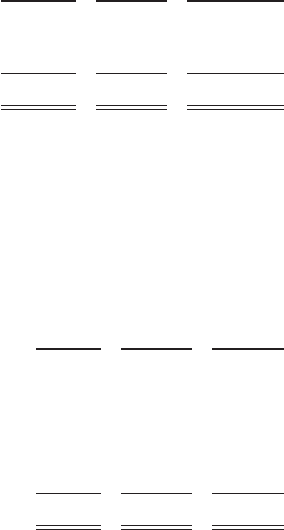

ending gross unrecognized tax benefits is as follows:

2010 2009 2008

(thousands)

Unrecognized tax benefits balance at beginning of year .................... $ 8,247 $ 20,380 $ 33,128

Increase related to prior year tax positions .............................. 12,983 1,710 2,147

Decrease related to prior year tax positions ............................. — (14,369) (4,123)

Increase related to current year tax positions ............................ — 1,420 2,775

Settlements ....................................................... (367) (894) (13,547)

Unrecognized tax benefits balance at end of year ......................... $20,863 $ 8,247 $ 20,380

The Company or its subsidiaries file income tax returns in the U.S. Federal jurisdiction, and multiple state

and foreign jurisdictions. Years prior to 2006 are no longer subject to U.S. Federal income tax examination. The

Company is no longer subject to state income tax examinations by tax authorities in its major state jurisdictions

for years before 2003, and the Company is no longer subject to income tax examinations prior to 2005 for its

major foreign jurisdictions.

58