OfficeMax 2010 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2010 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

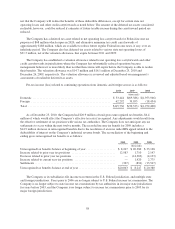

tax purposes, resulting in a tax benefit of $63.2 million, or approximately 4.6% of the pre-tax charge amount.

These charges resulted in a full impairment of our goodwill balances as of the end of 2008, and, as a result, there

will be no future annual assessment of goodwill required.

Also in 2008, the Company concluded that indicators of impairment were present for the trade name assets,

evaluated their carrying values and recorded impairment of the trade names in the Retail reporting unit of

$107.1 million, before taxes. Based on the Company’s assessment and testing, no impairment of indefinite-lived

intangible assets was required in 2009 or 2010.

In 2010, 2009 and 2008, the Company also performed impairment testing for the assets of individual retail

stores (“store assets” or “stores”), which consist primarily of leasehold improvements and fixtures, due to the

existence of indicators of potential impairment of these other long-lived assets. We performed the first step of

impairment testing for other long-lived assets on the store assets and determined that for some stores the

estimated future undiscounted cash flows derived from the assets was less than those assets’ carrying amount and

therefore impairment existed for those store assets. The second step of impairment testing was performed to

calculate the amount of the impairment loss. The loss was measured as the excess of the carrying value over the

fair value of the assets, with the fair value determined based on estimated future discounted cash flows. As a

result, we wrote off $11.0 million, $17.6 million and $55.8 million of store assets in 2010, 2009 and 2008,

respectively.

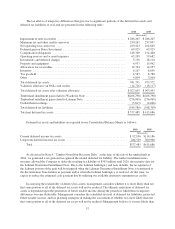

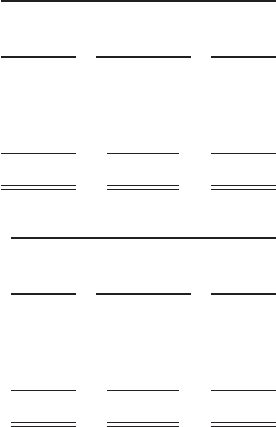

Acquired Intangible Assets

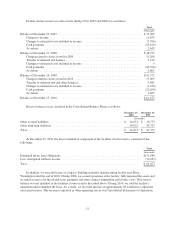

Intangible assets represent the values assigned to trade names, customer lists and relationships, noncompete

agreements and exclusive distribution rights of businesses acquired. The trade name assets have an indefinite life

and are not amortized. All other intangible assets are amortized on a straight-line basis over their expected useful

lives. Customer lists and relationships are amortized over three to 20 years, noncompete agreements over their

terms, which are generally three to five years, and exclusive distribution rights over ten years. Intangible assets

consisted of the following at year-end:

2010

Gross

Carrying

Amount

Accumulated

Amortization

Net

Carrying

Amount

(thousands)

Trade names ................................................... $ 66,000 $ — $66,000

Customer lists and relationships ................................... 27,807 (13,789) 14,018

Exclusive distribution rights ...................................... 7,302 (4,089) 3,213

Total ......................................................... $101,109 $(17,878) $83,231

2009

Gross

Carrying

Amount

Accumulated

Amortization

Net

Carrying

Amount

(thousands)

Trade names .................................................... $66,000 $ — $66,000

Customer lists and relationships .................................... 25,833 (11,288) 14,545

Exclusive distribution rights ....................................... 6,636 (3,375) 3,261

Total .......................................................... $98,469 $(14,663) $83,806

Intangible amortization expense totaled $2.0 million, $1.6 million and $5.4 million in 2010, 2009 and 2008

respectively. The estimated amortization expense is approximately $1.4 to $1.7 million in each of the next five

years.

54