OfficeMax 2010 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2010 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

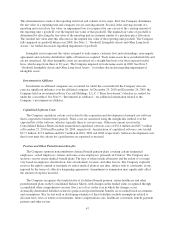

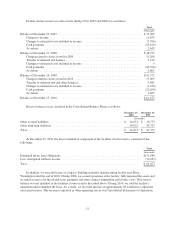

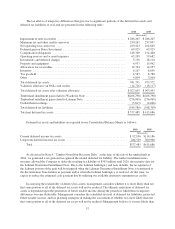

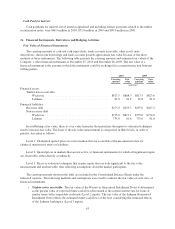

The changes in the intangible carrying amounts from December 29, 2007 to December 25, 2010, were as

follows:

Trade names

Customer

lists and

relationships

Noncompete

agreements

Exclusive

distribution

rights Total

(thousands)

Net carrying amount, December 29, 2007 .... $ 173,150 $ 20,309 $ 2,042 $ 4,219 $ 199,720

Impairment ............................ (107,150) — — — (107,150)

Amortization ........................... — (2,912) (2,041) (409) (5,362)

Effect of foreign currency translation ........ — (4,478) (1) (936) (5,415)

Net carrying amount, December 27, 2008 .... $ 66,000 $ 12,919 $ — $ 2,874 $ 81,793

Amortization ........................... — (1,271) — (363) (1,634)

Effect of foreign currency translation ........ — 2,897 — 750 3,647

Net carrying amount, December 26, 2009 .... $ 66,000 $ 14,545 $ — $ 3,261 $ 83,806

Amortization ........................... — (1,542) — (413) (1,955)

Effect of foreign currency translation ........ — 1,015 — 365 1,380

Net carrying amount, December 25, 2010 .... $ 66,000 $ 14,018 $ — $ 3,213 $ 83,231

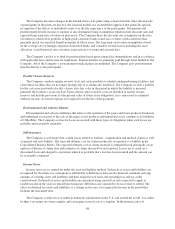

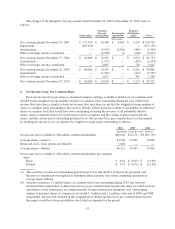

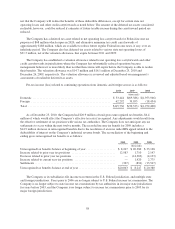

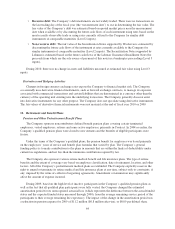

6. Net Income (Loss) Per Common Share

Basic net income (loss) per share is calculated using net earnings available to holders of our common stock

divided by the weighted average number of shares of common stock outstanding during the year. Diluted net

income (loss) per share is similar to basic net income (loss) per share except that the weighted average number of

shares of common stock outstanding is increased to include, if their inclusion is dilutive, the number of additional

shares of common stock that would have been outstanding assuming the issuance of all potentially dilutive

shares, such as common stock to be issued upon exercise of options and the vesting of non-vested restricted

shares, and the conversion of outstanding preferred stock. Net income (loss) per common share was determined

by dividing net income (loss), as adjusted, by weighted average shares outstanding as follows:

2010 2009 2008

(thousands, except per-share amounts)

Net income (loss) available to OfficeMax common shareholders ........... $68,628 $ (2,151) $(1,661,595)

Average shares—basic(a) ......................................... 84,908 77,483 75,862

Restricted stock, stock options and other(b) ........................... 1,604 — —

Average shares—diluted .......................................... 86,512 77,483 75,862

Net income (loss) available to OfficeMax common shareholders per common

share: .......................................................

Basic ...................................................... $ 0.81 $ (0.03) $ (21.90)

Diluted .................................................... $ 0.79 $ (0.03) $ (21.90)

(a) The assumed conversion of outstanding preferred stock was anti-dilutive in all periods presented, and

therefore no adjustment was required to determine diluted income (loss) from continuing operations or

average shares-diluted.

(b) Options to purchase 1.7 million shares of common stock were outstanding during 2010, but were not

included in the computation of diluted income (loss) per common share because the impact would have been

anti-dilutive as the option price was higher than the average market price during the year. Outstanding

options to purchase shares of common stock totaled 1.3 million and 1.5 million at the end of 2009 and 2008,

respectfully, but were not included in the computation of diluted income (loss) per common share because

the impact would have been anti-dilutive due to the loss reported for the period.

55