OfficeMax 2010 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2010 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

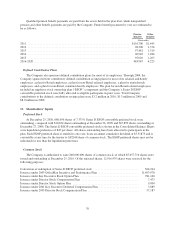

allocated to the accounts of these executive officers at December 25, 2010 and December 26, 2009, respectively.

As a result of an amendment to the plan, no additional deferrals can be allocated to the stock unit accounts.

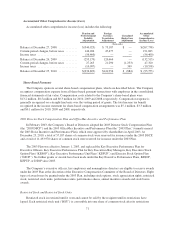

Stock Options

The Company’s stock options generally are issued at a price equal to fair market value on the grant date and

typically expire within seven years of the grant date. Stock options granted under the OfficeMax Incentive and

Performance Plan generally vest over a three year period. In 2010, 2009 and 2008, the Company recognized

$5.2 million, $2.4 million and $0.2 million, respectively, of pre-tax compensation expense and additional paid-in

capital related to stock options. The remaining compensation expense to be recognized related to outstanding

stock options, net of estimated forfeitures, is approximately $12.4 million.

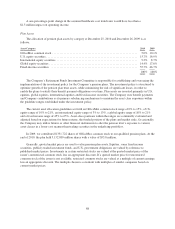

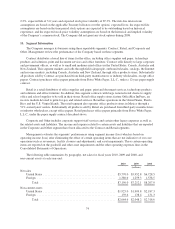

A summary of stock option activity for the years ended December 25, 2010, December 26, 2009 and

December 27, 2008 is presented in the following table:

2010 2009 2008

Shares

Wtd. Avg.

Ex. Price Shares

Wtd. Avg.

Ex. Price Shares

Wtd. Avg.

Ex. Price

Balance at beginning of year ........ 3,249,773 $15.14 1,495,795 $31.95 1,596,295 $31.84

Options granted .................. 2,060,246 16.24 2,071,360 4.77 — —

Options exercised ................ (408,519) 4.80 — — — —

Options forfeited and expired ....... (588,210) 16.02 (317,382) 26.70 (100,500) 30.08

Balance at end of year ............. 4,313,290 $16.52 3,249,773 $15.14 1,495,795 $31.95

Exercisable at end of year .......... 1,301,257 1,225,646 1,400,462

Weighted average fair value of options

granted (Black-Scholes) ......... $ 8.08 $ 2.63 $ —

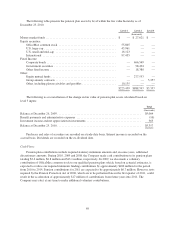

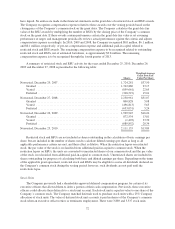

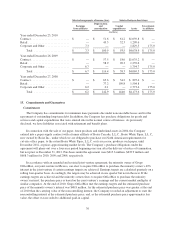

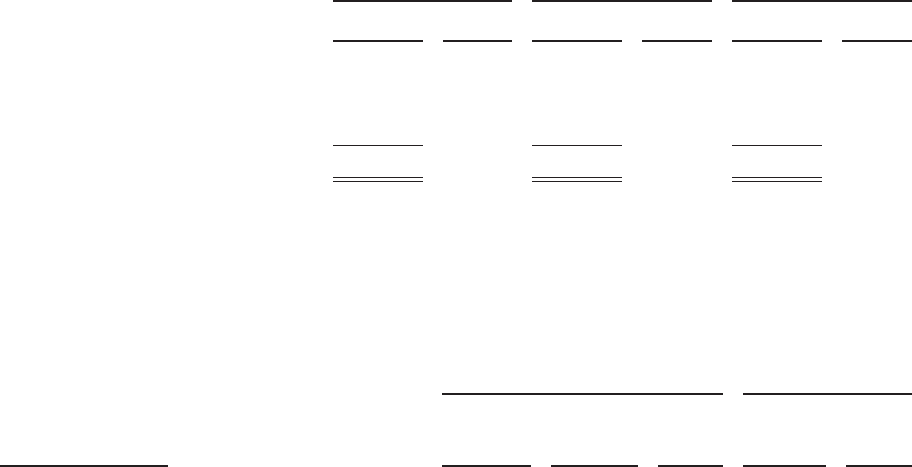

The following table provides summarized information about stock options outstanding at December 25,

2010:

Options Outstanding Options Exercisable

Range of Exercise Prices

Options

Outstanding

Weighted

Average

Contractual

Life (Years)

Weighted

Average

Exercise

Price

Options

Exercisable

Weighted

Average

Exercise

Price

$2.50 ..................................... 11,171 — $ 2.50 11,171 $ 2.50

$4.00 – $5.00 ............................... 1,355,269 5.1 4.75 233,926 4.71

$12.00 – $16.00 ............................. 915,690 6.1 14.52 — —

$18.00 – $28.00 ............................. 1,356,200 5.4 20.84 381,200 27.71

$28.01 – $39.00 ............................. 674,960 2.0 34.44 674,960 34.44

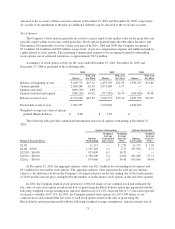

At December 25, 2010, the aggregate intrinsic value was $21.3 million for outstanding stock options and

$3.3 million for exercisable stock options. The aggregate intrinsic value represents the total pre-tax intrinsic

value (i.e. the difference between the Company’s closing stock price on the last trading day of the fourth quarter

of 2010 and the exercise price, multiplied by the number of in-the-money stock options at the end of the quarter).

In 2010, the Company granted stock options for 2,060,246 shares of our common stock and estimated the

fair value of each stock option award on the date of grant using the Black-Scholes option pricing model with the

following weighted average assumptions: risk-free interest rate of 2.12%, expected life of 3.7 years and expected

stock price volatility of 67.21%. In 2009, the Company granted stock options for 2,071,360 shares of our

common stock and estimated the fair value of each stock option award on the date of grant using the

Black-Scholes option pricing model with the following weighted average assumptions: risk-free interest rate of

73