OfficeMax 2010 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2010 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

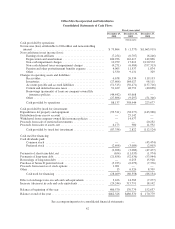

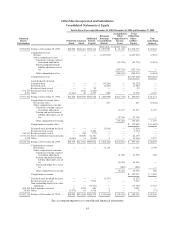

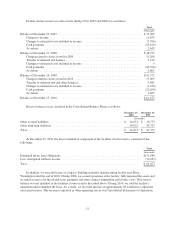

OfficeMax Incorporated and Subsidiaries

Consolidated Statements of Cash Flows

Fiscal year ended

December 25,

2010

December 26,

2009

December 27,

2008

(thousands)

Cash provided by operations:

Net income (loss) attributable to OfficeMax and noncontrolling

interest ................................................ $ 73,864 $ (1,575) $(1,665,919)

Non-cash items in net income (loss):

Earnings from affiliates ................................. (7,254) (6,707) (6,246)

Depreciation and amortization ............................ 100,936 116,417 142,896

Non-cash impairment charges ............................ 10,979 17,612 2,120,572

Non-cash deferred taxes on impairment charges .............. (4,271) (6,484) (357,313)

Pension and other postretirement benefits expense ............ 4,965 11,537 1,874

Other ................................................ 2,530 9,131 329

Changes in operating assets and liabilities:

Receivables ........................................... 6,678 26,334 119,133

Inventories ........................................... (27,606) 164,027 98,111

Accounts payable and accrued liabilities .................... (51,515) (56,471) (137,716)

Current and deferred income taxes ......................... 51,169 48,752 (40,698)

Borrowings (payments) of loans on company-owned life

insurance policies .................................... (44,442) 45,668 —

Other ................................................ (27,896) (9,297) (51,346)

Cash provided by operations ............................. 88,137 358,944 223,677

Cash provided by (used for) investment:

Expenditures for property and equipment ....................... (93,511) (38,277) (143,968)

Distribution from escrow account ............................. — 25,142 —

Withdrawal from company-owned life insurance policies ........... — 14,977 —

Proceeds from sale of restricted investments ..................... — — 20,252

Proceeds from sales of assets, net .............................. 6,173 980 11,592

Cash provided by (used for) investment ..................... (87,338) 2,822 (112,124)

Cash used for financing:

Cash dividends paid:

Common stock ........................................ — — (45,474)

Preferred stock ........................................ (2,698) (3,089) (2,003)

(2,698) (3,089) (47,477)

Payments of short-term debt, net .............................. (654) (11,035) (1,974)

Payments of long-term debt .................................. (21,858) (52,936) (53,944)

Borrowings of long-term debt ................................ — 6,255 15,928

Purchase of Series D preferred stock ........................... (5,233) (6,079) (7,376)

Proceeds from exercise of stock options ........................ 1,961 — —

Other .................................................... 13 6,326 8,709

Cash used for financing ................................. (28,469) (60,558) (86,134)

Effect of exchange rates on cash and cash equivalents ............. 3,426 14,583 (7,277)

Increase (decrease) in cash and cash equivalents .................. (24,244) 315,791 18,142

Balance at beginning of the year .............................. 486,570 170,779 152,637

Balance at end of the year .................................... $462,326 $486,570 $ 170,779

See accompanying notes to consolidated financial statements

42