OfficeMax 2010 Annual Report Download - page 67

Download and view the complete annual report

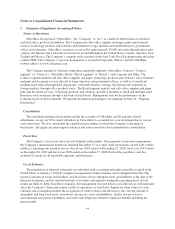

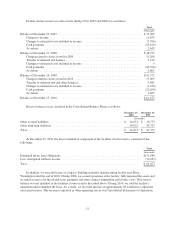

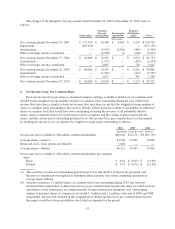

Please find page 67 of the 2010 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.This determination is made at the reporting unit level and consists of two steps. First, the Company determines

the fair value of a reporting unit and compares it to its carrying amount. Second, if the carrying amount of a

reporting unit exceeds its fair value, an impairment loss is recognized for any excess of the carrying amount of

the reporting unit’s goodwill over the implied fair value of that goodwill. The implied fair value of goodwill is

determined by allocating the fair value of the reporting unit in a manner similar to a purchase price allocation.

The residual fair value after this allocation is the implied fair value of the reporting unit goodwill. The Company

fully impaired its goodwill balances in 2008. See Note 5, “Goodwill, Intangible Assets and Other Long-lived

Assets,” for further discussion regarding impairment of goodwill.

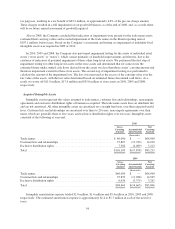

Intangible assets represent the values assigned to trade names, customer lists and relationships, noncompete

agreements and exclusive distribution rights of businesses acquired. Trade name assets have an indefinite life and

are not amortized. All other intangible assets are amortized on a straight-line basis over their expected useful

lives, which range from three to 20 years. The Company impaired its trade name assets in 2008. See Note 5,

“Goodwill, Intangible Assets and Other Long-lived Assets,” for further discussion regarding impairment of

intangible assets.

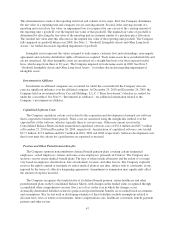

Investments in Affiliates

Investments in affiliated companies are accounted for under the cost method if the Company does not

exercise significant influence over the affiliated company. At December 25, 2010 and December 26, 2009, the

Company held an investment in Boise Cascade Holdings, L.L.C. (“Boise Investment”) which is accounted for

under the cost method. See Note 9, “Investments in Affiliates,” for additional information related to the

Company’s investments in affiliates.

Capitalized Software Costs

The Company capitalizes certain costs related to the acquisition and development of internal use software

that is expected to benefit future periods. These costs are amortized using the straight-line method over the

expected life of the software, which is typically three to (seven) years. Other non-current assets in the

Consolidated Balance Sheets include unamortized capitalized software costs of $32.4 million and $25.7 million

at December 25, 2010 and December 26, 2009, respectively. Amortization of capitalized software costs totaled

$17.5 million, $17.2 million and $18.7 million in 2010, 2009 and 2008, respectively. Software development costs

that do not meet the criteria for capitalization are expensed as incurred.

Pension and Other Postretirement Benefits

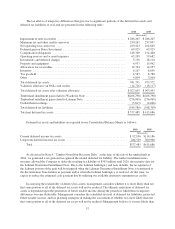

The Company sponsors noncontributory defined benefit pension plans covering certain terminated

employees, vested employees, retirees and some active employees, primarily in Contract. The Company also

sponsors various retiree medical benefit plans. The type of retiree medical benefits and the extent of coverage

vary based on employee classification, date of retirement, location, and other factors. The Company explicitly

reserves the right to amend or terminate its retiree medical plans at any time, subject only to constraints, if any,

imposed by the terms of collective bargaining agreements. Amendment or termination may significantly affect

the amount of expense incurred.

The Company recognizes the funded status of its defined benefit pension, retiree healthcare and other

postretirement plans in the Consolidated Balance Sheets, with changes in the funded status recognized through

accumulated other comprehensive income (loss), net of tax, in the year in which the changes occur.

Actuarially-determined liabilities related to pension and postretirement benefits are recorded based on estimates

and assumptions. Key factors used in developing estimates of these liabilities include assumptions related to

discount rates, rates of return on investments, future compensation costs, healthcare cost trends, benefit payment

patterns and other factors.

47