OfficeMax 2010 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2010 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

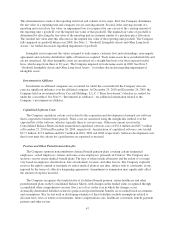

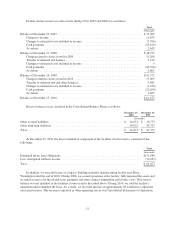

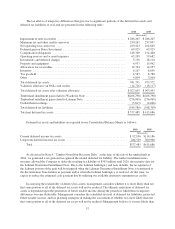

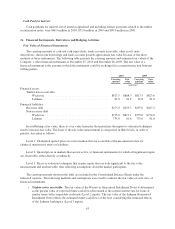

The tax effects of temporary differences that give rise to significant portions of the deferred tax assets and

deferred tax liabilities at year-end are presented in the following table:

2010 2009

(thousands)

Impairment of note receivable .............................................. $286,207 $ 286,207

Minimum tax and other credits carryover ..................................... 230,267 237,897

Net operating loss carryovers ............................................... 109,423 104,605

Deferred gain on Boise Investment .......................................... 69,925 69,925

Compensation obligations ................................................. 146,369 154,400

Operating reserves and accrued expenses ..................................... 63,205 59,682

Investments and deferred charges ........................................... 5,136 18,110

Property and equipment ................................................... 4,937 15,942

Allowances for receivables ................................................. 12,764 14,253

Inventory ............................................................... 4,167 8,699

Tax goodwill ............................................................ 4,587 6,788

Other .................................................................. 4,804 3,064

Total deferred tax assets ................................................... 941,791 979,572

Valuation allowance on NOLs and credits ..................................... (14,726) (16,117)

Total deferred tax assets after valuation allowance .............................. $927,065 $ 963,455

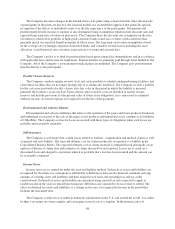

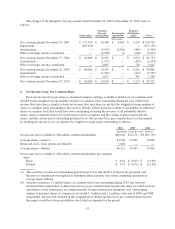

Timberland installment gain related to Wachovia Note ........................... $(266,798) $(266,798)

Timberland installment gain related to Lehman Note ............................ (276,965) (276,965)

Undistributed earnings .................................................... (5,817) (4,606)

Total deferred tax liabilities ................................................ (549,580) (548,369)

Total net deferred tax assets ................................................ $377,485 $ 415,086

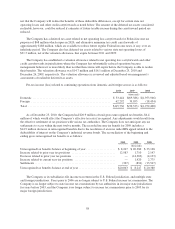

Deferred tax assets and liabilities are reported in our Consolidated Balance Sheets as follows:

2010 2009

(thousands)

Current deferred income tax assets ............................................ $ 92,956 $114,186

Long-term deferred income tax assets ......................................... 284,529 300,900

Total ............................................................... $377,485 $415,086

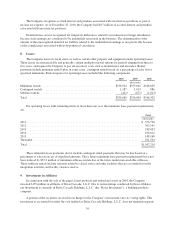

As discussed in Note 4, “Timber Notes/Non-Recourse Debt,” at the time of the sale of the timberlands in

2004, we generated a tax gain and recognized the related deferred tax liability. The timber installment notes

structure allowed the Company to defer the resulting tax liability of $543 million until 2020, the maturity date for

the Lehman Guaranteed Installment Note. Due to the Lehman bankruptcy and note defaults, the recognition of

the Lehman portion of the gain will be triggered when the Lehman Guaranteed Installment Note is transferred to

the Securitization Note holders as payment and/or when the Lehman bankruptcy is resolved. At that time, we

expect to reduce the estimated cash payment due by utilizing our available alternative minimum tax credits.

In assessing the realizability of deferred tax assets, management considers whether it is more likely than not

that some portion or all of the deferred tax assets will not be realized. The ultimate realization of deferred tax

assets is dependent upon the generation of future taxable income during the periods in which those temporary

differences become deductible. Management considers the scheduled reversal of deferred tax liabilities, projected

future taxable income, and tax planning strategies in making the assessment of whether it is more likely than not

that some portion or all of the deferred tax assets will not be realized. Management believes it is more likely than

57