OfficeMax 2010 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2010 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Foreign Currency Translation

Local currencies are considered the functional currencies for the Company’s operations outside the United

States. Assets and liabilities of foreign operations are translated into U.S. dollars at the rate of exchange in effect

at the balance sheet date with the related translation adjustments reported in shareholders’ equity as a component

of accumulated other comprehensive loss. Revenues and expenses are translated into U.S. dollars at average

monthly exchange rates prevailing during the year. Foreign currency transaction gains and losses related to assets

and liabilities that are denominated in a currency other than the functional currency are reported in the

Consolidated Statements of Operations in the periods they occur.

Revenue Recognition

Revenue from the sale of products is recognized at the time both title and the risk of ownership are

transferred to the customer, which generally occurs upon delivery to the customer or third-party delivery service

for contract, catalog and Internet sales, and at the point of sale for retail transactions. Service revenue is

recognized as the services are rendered. Revenue is reported less an appropriate provision for returns and net of

coupons, rebates and other sales incentives. The Company offers rebate programs to some of its Contract

customers. Customer rebates are recorded as a reduction in sales and are accrued as earned by the customer.

Revenue from transactions in which the Company acts as an agent or broker is reported on a commission

basis. Revenue from the sale of extended warranty contracts is reported on a commission basis at the time of sale,

except in a limited number of states where state law specifies the Company as the legal obligor. In such states,

the revenue from the sale of extended warranty contracts is recorded at the gross amount and recognized ratably

over the contract period. The performance obligations and risk of loss associated with extended warranty

contracts sold by the Company are assumed by an unrelated third party. Costs associated with these contracts are

recognized in the same period as the related revenue.

Fees for shipping and handling charged to customers in connection with sale transactions are included in

sales. Costs related to shipping and handling are included in cost of goods sold and occupancy costs. Taxes

collected from customers are accounted for on a net basis and are excluded from sales.

Cash and Cash Equivalents

Cash equivalents include short-term debt instruments that have an original maturity of three months or less

at the date of purchase. The Company’s banking arrangements allow the Company to fund outstanding checks

when presented to the financial institution for payment. This cash management practice frequently results in a net

cash overdraft position for accounting purposes, which occurs when total issued checks exceed available cash

balances at a single financial institution. The Company records its outstanding checks and the net change in

overdrafts in the accounts payable and the accounts payable and accrued liabilities line items within the

Consolidated Balance Sheets and Consolidated Statements of Cash Flows, respectively.

Accounts Receivable

Accounts receivable relate primarily to amounts owed by customers for trade sales of products and services

and amounts due from vendors under volume purchase rebate, cooperative advertising and various other

marketing programs. An allowance for doubtful accounts is recorded to provide for estimated losses resulting

from uncollectible accounts, and is the Company’s best estimate of the amount of probable credit losses in the

Company’s existing accounts receivable. Management believes that the Company’s exposure to credit risk

associated with accounts receivable is limited due to the size and diversity of its customer and vendor base,

which extends across many different industries and geographic regions.

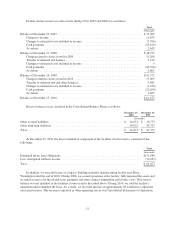

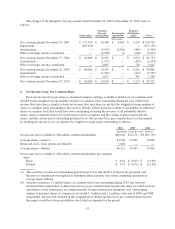

At December 25, 2010 and December 26, 2009, the Company had allowances for doubtful accounts of

$6.5 million and $8.6 million, respectively.

45