OfficeMax 2010 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2010 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

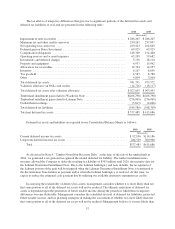

The Company recognizes accrued interest and penalties associated with uncertain tax positions as part of

income tax expense. As of December 25, 2010, the Company had $0.7 million of accrued interest and penalties

associated with uncertain tax positions.

Deferred taxes are not recognized for temporary differences related to investments in foreign subsidiaries

because such earnings are considered to be indefinitely reinvested in the business. The determination of the

amount of the unrecognized deferred tax liability related to the undistributed earnings is not practicable because

of the complexities associated with its hypothetical calculation.

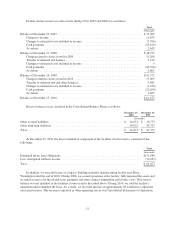

8. Leases

The Company leases its retail stores as well as certain other property and equipment under operating leases.

These leases are noncancelable and generally contain multiple renewal options for periods ranging from three to

five years, and require the Company to pay all executory costs such as maintenance and insurance. Rental

payments include minimum rentals plus, in some cases, contingent rentals based on a percentage of sales above

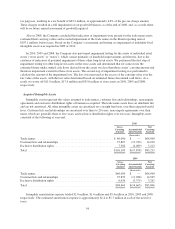

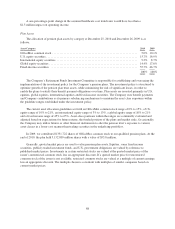

specified minimums. Rental expense for operating leases included the following components:

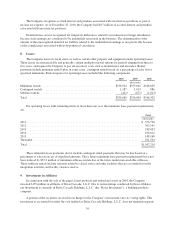

2010 2009 2008

(thousands)

Minimum rentals ................................................ $338,924 $355,662 $348,629

Contingent rentals ............................................... 1,187 1,013 886

Sublease rentals ................................................. (422) (671) (1,013)

Total .......................................................... $339,689 $356,004 $348,502

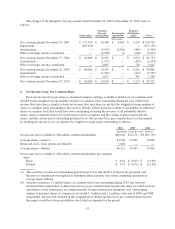

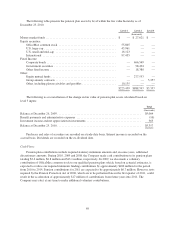

For operating leases with remaining terms of more than one year, the minimum lease payment requirements

are:

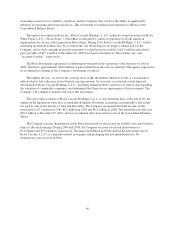

Total

(thousands)

2011 ............................................................................ $ 356,730

2012 ............................................................................ 303,141

2013 ............................................................................ 249,033

2014 ............................................................................ 198,612

2015 ............................................................................ 148,168

Thereafter ....................................................................... 291,534

Total ........................................................................... $1,547,218

These minimum lease payments do not include contingent rental payments that may be due based on a

percentage of sales in excess of stipulated amounts. These future minimum lease payment requirements have not

been reduced by $33.2 million of minimum sublease rentals due in the future under noncancelable subleases.

These sublease rentals include amounts related to closed stores and other facilities that are accounted for in the

integration activities and facility closures reserve.

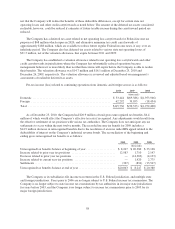

9. Investments in Affiliates

In connection with the sale of the paper, forest products and timberland assets in 2004, the Company

invested $175 million in affiliates of Boise Cascade, L.L.C. Due to restructurings conducted by those affiliates,

our investment is currently in Boise Cascade Holdings, L.L.C. (the “Boise Investment”), a building products

company.

A portion of the securities received in exchange for the Company’s investment carry no voting rights. This

investment is accounted for under the cost method as Boise Cascade Holdings, L.L.C. does not maintain separate

59