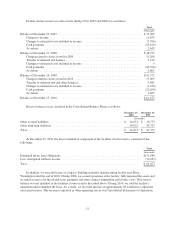

OfficeMax 2010 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2010 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Vendor Rebates and Allowances

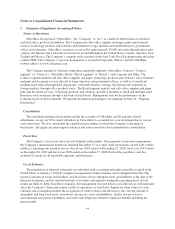

We participate in volume purchase rebate programs, some of which provide for tiered rebates based on

defined levels of purchase volume. We also participate in programs that enable us to receive additional vendor

subsidies by promoting the sale of vendor products. Vendor rebates and allowances are accrued as earned.

Rebates and allowances received as a result of attaining defined purchase levels are accrued over the incentive

period based on the terms of the vendor arrangement and estimates of qualifying purchases during the rebate

program period. These estimates are reviewed on a quarterly basis and adjusted for changes in anticipated

product sales and expected purchase levels. Vendor rebates and allowances earned are recorded as a reduction in

the cost of merchandise inventories and are included in operations (as a reduction of cost of goods sold) in the

period the related product is sold.

Merchandise Inventories

Inventories consist of office products merchandise and are stated at the lower of weighted average cost or

net realizable value. The Company estimates the realizable value of inventory using assumptions about future

demand, market conditions and product obsolescence. If the estimated realizable value is less than cost, the

inventory value is reduced to its estimated realizable value.

Throughout the year, the Company performs physical inventory counts at a significant number of our

locations. For periods subsequent to each location’s last physical inventory count, an allowance for estimated

shrinkage is provided based on historical shrinkage results and current business trends.

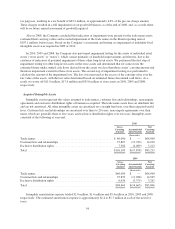

Property and Equipment

Property and equipment are recorded at cost. The Company calculates depreciation using the straight-line

method over the estimated useful lives of the assets or the terms of the related leases. The estimated useful lives

of depreciable assets are generally as follows: building and improvements, 3 to 40 years; machinery and

equipment, which also includes delivery trucks, furniture and office and computer equipment, 1.5 to 15 years.

Leasehold improvements are reported as building and improvements and are amortized over the lesser of the

term of the lease, including any option periods that management believes are probable of exercise, or the

estimated lives of the improvements, which generally range from 2 to 20 years.

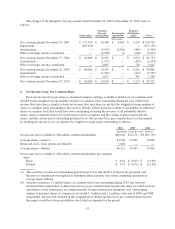

Long-Lived Asset Impairment

Long-lived assets, such as property, leasehold improvements, equipment, capitalized software costs and

purchased intangibles subject to amortization, are reviewed for impairment whenever events or changes in

circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets to be

held and used is measured by a comparison of the carrying amount of an asset to the estimated undiscounted

future cash flows expected to be generated by the asset. If the carrying amount of an asset exceeds its estimated

future cash flows, an impairment charge is recognized equal to the amount by which the carrying amount of the

asset exceeds the fair value of the asset, which is estimated based on discounted cash flows. In 2010, 2009 and

2008 the Company determined that there were indicators of impairment, completed tests for impairment and

recorded impairment of store assets. See Note 5, “Goodwill, Intangible Assets and Other Long-lived Assets,” for

further discussion regarding impairment of long-lived assets.

Goodwill and Intangible Assets

Goodwill represents the excess of purchase price and related direct costs over the value assigned to the net

tangible and identifiable intangible assets of businesses acquired. Goodwill and intangible assets with indefinite

lives are not amortized, but are tested for impairment at least annually, or more frequently if events and

circumstances indicate that the carrying amount of the asset might be impaired, using a fair-value-based

approach. An impairment loss is recognized to the extent that the carrying amount exceeds the asset’s fair value.

46