OfficeMax 2010 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2010 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.arrangements as well as the nature of our guarantees, including the approximate terms of the guarantees, how the

guarantees arose, the events or circumstances that would require us to perform under the guarantees and the

maximum potential undiscounted amounts of future payments we could be required to make.

Seasonal Influences

Our business is seasonal, with Retail showing a more pronounced seasonal trend than Contract. Sales in the

second quarter are historically the slowest of the year. Sales are stronger during the first, third and fourth quarters

that include the important new-year office supply restocking month of January, the back-to-school period and the

holiday selling season, respectively.

Disclosures of Financial Market Risks

Financial Instruments

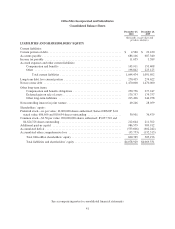

Our debt is predominantly fixed-rate. At December 25, 2010, the estimated current fair value of our debt,

based on quoted market prices when available or then-current interest rates for similar obligations with like

maturities, including the timber notes, was approximately $596.6 million less than the amount of debt reported in

the Consolidated Balance Sheets. As previously discussed, there is no recourse against OfficeMax on the

securitized timber notes payable as recourse is limited to proceeds from the applicable pledged Installment Notes

receivable and underlying guarantees. The debt and receivable related to the timber notes have fixed interest rates

and the estimated fair values of the timber notes are reflected in the table below.

The estimated fair values of our other financial instruments, including cash and cash equivalents and

receivables are the same as their carrying values. Concentration of credit risks with respect to trade receivables is

limited due to the wide variety of vendors, customers and channels to and through which our products are

sourced and sold, as well as their dispersion across many geographic areas. In the opinion of management, we do

not have any significant concentration of credit risks.

Changes in foreign currency exchange rates expose us to financial market risk. We occasionally use

derivative financial instruments, such as forward exchange contracts, to manage our exposure associated with

commercial transactions and certain liabilities that are denominated in a currency other than the currency of the

operating unit entering into the underlying transaction. We generally do not enter into derivative instruments for

any other purpose. We do not speculate using derivative instruments.

During the fourth quarter of 2010, we entered into forward exchange contracts in order to hedge our foreign

currency exchange rate exposure related to purchases of paper by our Canadian subsidiary in accordance with a

paper supply contract with Boise White Paper, L.L.C. (“Boise Paper”). Under the contract, our subsidiary is

obligated to purchase its requirements for office paper from Boise Paper or its successor until December 2012, at

prices approximating market levels. In accordance with the paper supply contract, the purchase price in Canadian

dollars is indexed to the U.S. dollar up until the first business day of the month in which the purchase is made.

We are hedging the forecasted cash flows associated with those paper purchases. These contracts qualify as

foreign currency cash flow hedges. The Company does not expect to hedge more than seventy-five percent of

forecasted paper purchases, and has determined the hedges to be effective. Recognition of the effective portion of

the gain or loss on the foreign exchange contracts is deferred until the paper associated with the hedged paper

purchases is sold, at which time it is recorded in cost of sales. The fair value associated with these hedges is not

material to our financial statements.

We were not a party to any material derivative financial instruments in 2010 or 2009.

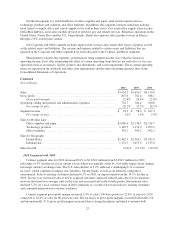

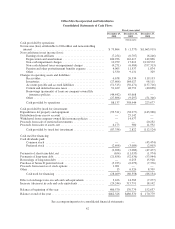

The following tables provide information about our financial instruments outstanding at December 25, 2010

that are sensitive to changes in interest rates. For debt obligations, the table presents principal cash flows and

related weighted average interest rates by expected maturity dates. For obligations with variable interest rates, the

32